@Plasma is easiest to understand when the world isn’t calm. You don’t really meet a payments chain in a demo. You meet it when a supplier is waiting on a transfer before releasing inventory, when a family is trying to move money across borders while rumors travel faster than confirmations, when a desk is rebalancing exposure and “soon” is the same as “too late.” In those moments, a stablecoin send isn’t a “transaction.” It’s a deadline. It’s a promise someone is staking their dignity on.

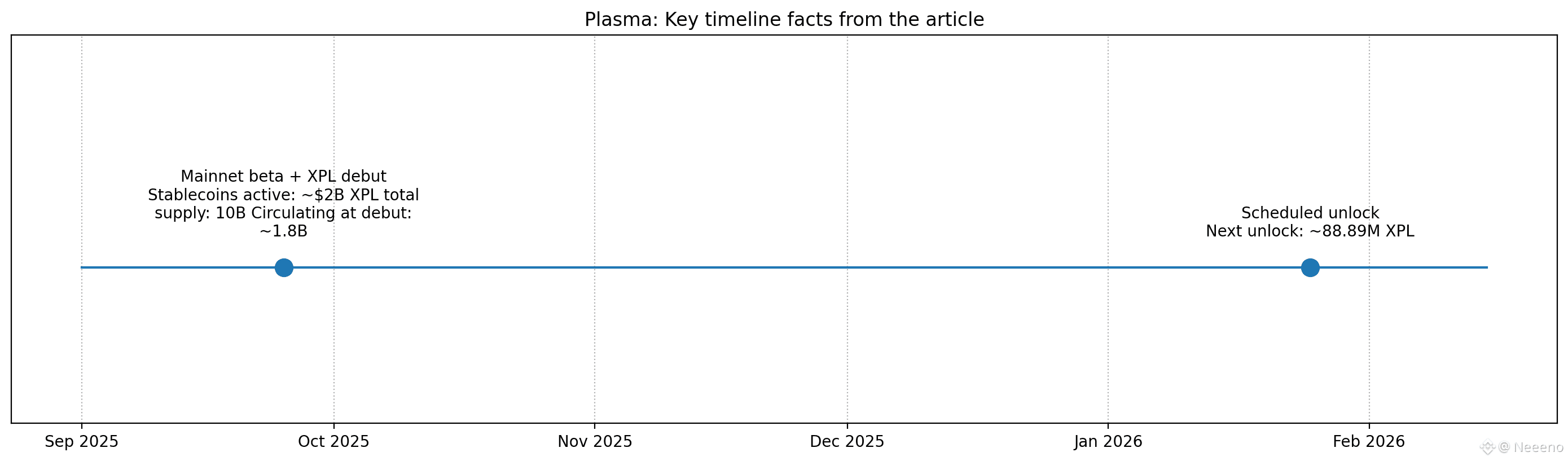

Plasma was introduced as a stablecoin-first Layer-1, but the practical claim is simpler than most crypto narratives: stablecoin movement should feel like a utility you can lean on, not an experiment you have to babysit. That intention became real when Plasma’s mainnet beta went live on September 25, 2025 (8:00 AM ET) alongside the launch of XPL. From that moment, the network stopped being judged on diagrams and started being judged on behavior: whether “sent” behaves like “arrived” even when users are rushed, uncertain, and operating with zero tolerance for ambiguity

Plasma’s own launch messaging signaled that it understood first impressions in payments are not aesthetic, they’re operational. It didn’t frame day one as a ceremonial ribbon cutting. It framed day one as a readiness test. Plasma stated that $2B in stablecoins would be active from day one, deployed across 100+ DeFi partners, specifically to make the chain immediately usable as a place where stablecoins can be staged, borrowed, and moved without waiting for liquidity to “eventually” show up. In payment systems, thinness is not a neutral condition. When a system is thin, the first wave of real usage doesn’t just test throughput—it tests whether normal users get pushed into “please wait” purgatory while the insiders stay calm.

This is also why Plasma’s stablecoin-native design choices matter more than they sound on paper. Plasma documents a mechanism for zero-fee USD₮ transfers under defined rules, so basic USD₮ sends don’t require the user to first acquire another token just to pay gas. That isn’t a gimmick. It’s an attempt to remove a class of failures that are rarely deep protocol failures and almost always human failures: the extra step that creates confusion at the exact moment someone is already stressed, rushing, or afraid of making a mistake

XPL arriving with mainnet beta also changes the social contract in a way people underestimate. A token is not just a unit of value. It becomes a unit of blame. When something goes wrong, users don’t only ask what happened. They ask who had incentives, who benefited, and whether the system was designed so reliability is the rational choice rather than a moral request. Reporting around launch described a genesis supply of 10 billion XPL, with 18% (1.8 billion) in circulation at debut. You can argue about whether that distribution is “good,” but the existence of a clearly stated supply baseline matters because payments infrastructure only feels fair when incentives don’t feel like a hidden trapdoor.

Where Plasma gets more honest—intentionally or not—is the way it forces users to confront a truth that doesn’t fit the “everything is on-chain so everything is certain” fantasy. In the real world, even on-chain value becomes mediated through dashboards, explorers, indexers, exchange accounting, and refresh rates. Different sources can present the same reality in different ways, especially during the early months of a new network. That’s not automatically scandal. It’s friction. And the lesson is psychological as much as technical: adult trust in crypto is not blind faith; it’s trust that includes verification, and verification that admits uncertainty.

This is one of the underappreciated reasons Plasma’s EVM compatibility matters. It isn’t only about developers feeling comfortable deploying Solidity. It’s about the surrounding culture of tools—wallet behaviors, explorers, monitors, integrations—already having a shared language for reading the chain. The less cognitive friction there is at the edge, the less likely a stressed operator makes a catastrophic mistake. In payments, the most expensive failures are often not “the chain broke.” They’re “the user panicked,” resent, duplicated, or assumed a delay meant failure.

Then the calendar arrives, and calendars are where narratives collide with reality. Token unlocks don’t just move supply. They move mood. They turn a planned schedule into a social stress test, because everyone starts telling themselves a different story about what fairness means this week. Multiple public trackers point to a token unlock on January 25, 2026, commonly cited as 88.89 million XPL. Whether someone sees that as dilution, maturity, opportunity, or threat isn’t the point. The point is that payment infrastructure doesn’t get to pick its timing. The network still has to feel dependable while the token becomes noisy and social feeds turn every scheduled event into a referendum.

If you stay close to Plasma long enough, you start to notice the project’s real ambition is not to make money exciting. It’s to make money boring in the specific way adults need it to be boring: fewer “did you get it?” messages, fewer duplicate sends, fewer moments where someone is staring at two dashboards trying to decide which one is lying. Plasma’s launch posture—mainnet beta tied to XPL’s debut, explicit claims about day-one stablecoin liquidity, stablecoin-native transfer mechanics, and a schedule the market can track—reads like a team that understands something many builders only learn late: reliability isn’t a slogan. It’s a discipline you practice in public.

In the end, Plasma is easiest to respect if you treat it as quiet responsibility made concrete. It’s an attempt to build a place where digital dollars can move without turning every transfer into an emotional event. The work is mostly invisible: aligning incentives so honesty is worth it, designing user flows to reduce panic and duplication, accepting that data sources will disagree and building a culture that verifies instead of spirals. If it works, it won’t look like hype. It will look like silence. And in payments, silence is often the highest form of trust.