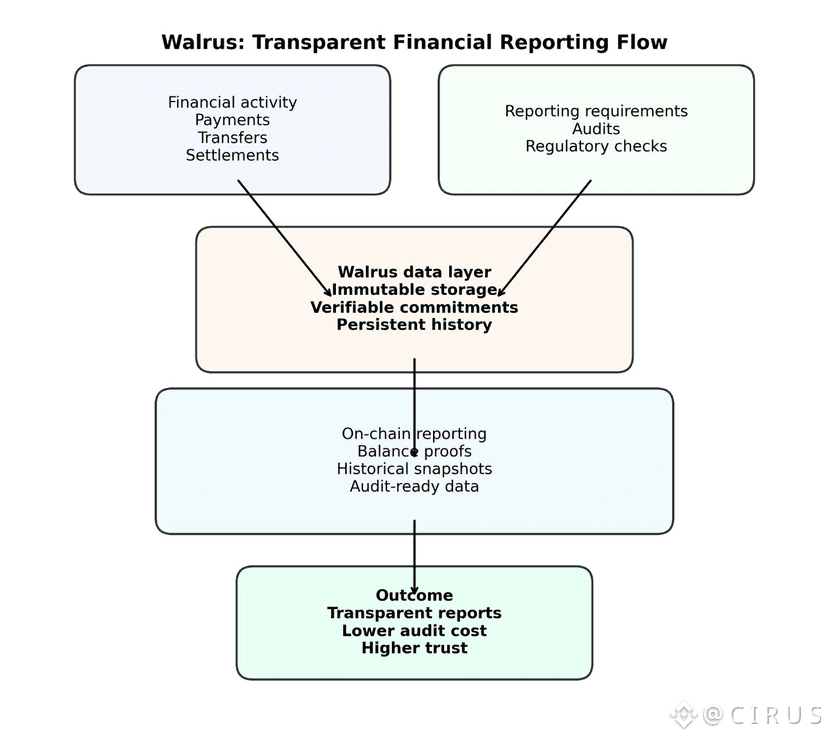

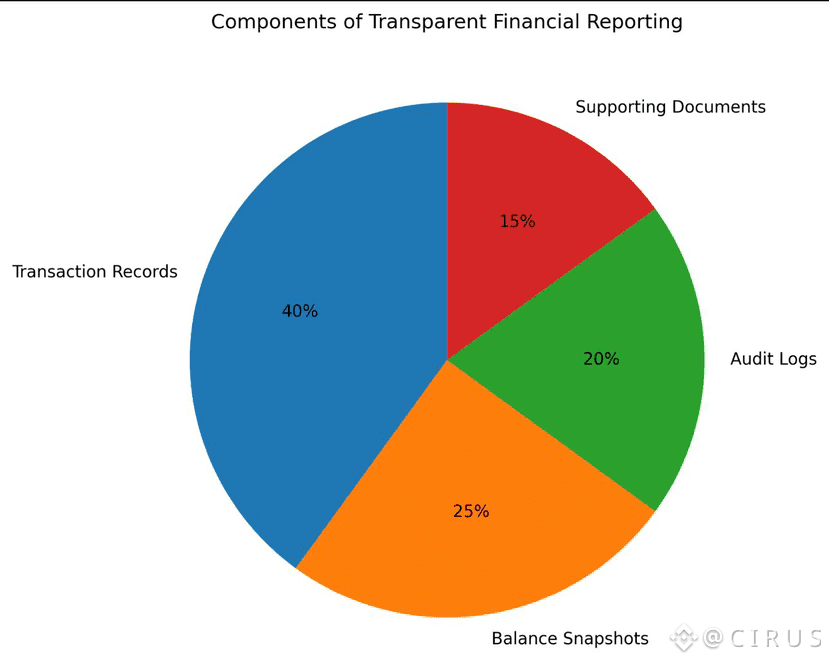

Financial reporting breaks down when data lives in too many places. Transactions sit on-chain, balances are tracked off-chain, audit logs are stored separately, and supporting documents live in internal systems. Over time, this fragmentation creates gaps, manual reconciliation, and trust issues.

This is where Walrus changes the foundation.

Walrus treats financial data as long-lived, verifiable records instead of temporary logs. Every transaction, balance snapshot, or report input can be stored as immutable data with a clear timestamp and history. Nothing is silently overwritten, and nothing disappears.

For financial teams, this means reporting is no longer about reconstructing the past. It’s about referencing data that already exists in a provable form.

From activity to reporting without manual gaps

In most systems, reporting is built after the fact. Data is pulled from multiple sources, cleaned, reconciled, and adjusted. Each step adds cost and risk.

With Walrus, financial activity can be committed as it happens. Payments, settlements, and balance changes become verifiable records. When reports are generated, they reference these commitments directly instead of relying on recreated datasets.

This reduces errors and shortens reporting cycles.

Auditability without full exposure

Transparency doesn’t mean exposing everything publicly. It means being able to prove correctness when required.

Walrus supports selective disclosure. Auditors and regulators can verify that reports match committed data without needing unrestricted access to all internal details. This mirrors how real-world audits work, but with cryptographic guarantees instead of trust-based processes.

Persistent history builds confidence

Because Walrus never overwrites data, historical financial states remain accessible. Past reports can always be tied back to the exact data used at the time. If assumptions change or disputes arise, there is a clear, immutable trail.

This persistence turns reporting from a recurring burden into a continuous process.

Transparent financial reporting isn’t about publishing more data. It’s about making financial data reliable over time.

Walrus enables this by giving financial records permanence, verifiability, and structure. When reports are built on committed data instead of reconstructed history, trust increases and overhead drops. That’s the kind of transparency institutions actually need.