There is a certain kind of project in the blockchain ecosystem that does not announce itself loudly. It does not rely on urgency, spectacle, or constant reinvention to remain relevant. Instead, it focuses on something far more difficult and enduring: dependability. Plasma belongs to this category. Its evolution has been steady and deliberate, often unnoticed by casual observers, yet beneath the surface it has been quietly accumulating strength where it matters most—payments, settlement, and real-world digital money movement.

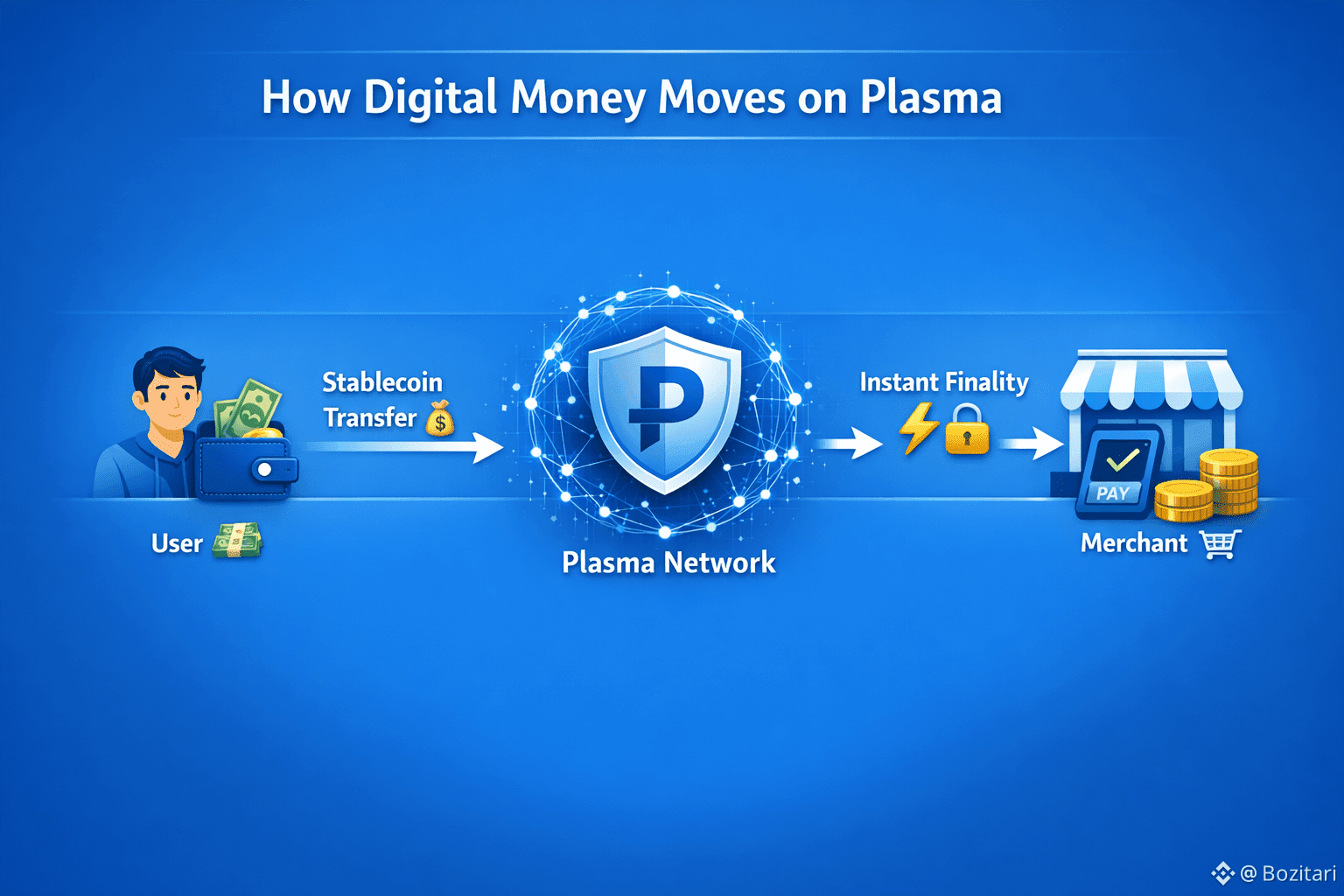

From its inception, Plasma was never designed to be everything to everyone. Rather than chasing multiple narratives at once, it narrowed its focus to a single, practical question: how can stablecoins move on-chain with the speed, clarity, and reliability required for everyday use? This framing shaped every technical and economic decision that followed. Plasma optimized for settlement certainty, operational simplicity, and long-term trust, resisting the temptation to prioritize spectacle over substance.

A key part of this strategy was Plasma’s commitment to full Ethereum Virtual Machine compatibility. This decision was not merely about convenience; it acknowledged that the EVM has become the shared language of decentralized applications, security tooling, and developer workflows. By aligning with this standard, Plasma removed a significant barrier to adoption. Developers can deploy contracts without rewriting logic, tooling behaves predictably, and teams can focus on building useful products rather than adapting to unfamiliar environments. Over time, execution-layer upgrades have reinforced this compatibility while improving performance and determinism.

Yet Plasma’s defining characteristic is not technical compatibility—it is intent. While many networks treat payments as just another application, Plasma treats them as its primary purpose. This distinction becomes clear when examining how the network approaches finality. Instead of relying on probabilistic confirmations that may suffice for speculation but fall short for commerce, Plasma prioritizes fast and decisive settlement. Transactions reach finality quickly and predictably, providing clarity that merchants, payment processors, and users can rely on in real-world interactions.

This focus on certainty naturally extends to Plasma’s approach to stablecoins. Plasma recognizes that stablecoins are not simply tokens; they are functional representations of value for millions of people worldwide. In many regions, stablecoins already serve as practical money. Plasma adapts to this reality by removing unnecessary friction. Gasless transfers eliminate the need for users to acquire volatile native assets just to move funds. Stablecoin-denominated fees allow costs to be understood in familiar units. While each feature may appear incremental, together they dramatically reduce the barriers that prevent blockchains from achieving everyday usability.

Security is handled with the same pragmatic mindset. Plasma does not attempt to isolate itself or reinvent trust from scratch. Instead, it anchors its settlement state to Bitcoin, leveraging the most resilient and decentralized ledger in existence. This anchoring provides an external reference point that strengthens neutrality and censorship resistance. It also sends a clear signal to institutions and integrators: Plasma’s security assumptions extend beyond a single validator set. The result is a hybrid posture that balances performance with long-term assurance.

As the protocol matured, its upgrade path remained measured and intentional. Improvements were introduced as refinements rather than disruptive overhauls. Infrastructure reliability increased, RPC availability stabilized, and developer tooling became more robust. These changes rarely generate headlines, but they are critical. A payments-focused network cannot tolerate unpredictability. Downtime or inconsistent behavior erodes trust faster than almost any technical failure. Plasma’s consistent investment in these unglamorous areas has quietly elevated the network’s reliability.

Developer growth followed the same restrained pattern. Instead of explosive expansion, Plasma attracted builders aligned with its long-term vision—developers focused on settlement, remittances, merchant tooling, and financial infrastructure rather than short-lived speculative applications. Clear documentation, predictable network behavior, and straightforward onboarding lowered the cost of building serious products. Over time, this cultivated a community that values stability and longevity over rapid experimentation.

Plasma’s native token design reflects this philosophy as well. The token exists to secure the network, incentivize validators, and enable governance. It does not dominate the user experience. Everyday users are not forced to interact with volatility simply to make payments. This separation between infrastructure economics and user-facing flows reduces cognitive load and simplifies integration for businesses that require predictable accounting and reporting.

Market expansion has been guided less by marketing narratives and more by structural fit. In regions where stablecoins already function as informal dollars, Plasma’s low-friction settlement model aligns naturally with existing behavior. For cross-border remittances, fast finality and low fees reduce both cost and uncertainty. For merchants, instant settlement simplifies reconciliation and cash flow management. Institutions benefit from programmability, auditability, and anchored security without sacrificing performance.

What makes Plasma’s trajectory particularly compelling is how closely it aligns with institutional realities. Financial infrastructure values predictability over novelty. Systems must integrate with existing workflows, meet regulatory expectations, and operate consistently over long periods. Plasma’s conservative upgrade philosophy and clear technical direction position it as infrastructure rather than experimentation.

Looking ahead, Plasma’s future is defined not by dramatic pivots but by deepening its strengths. Privacy-preserving payment features, improved decentralized bridging, and refined validator economics all build upon the same foundation. Each enhancement reinforces the original thesis rather than replacing it.

As blockchain adoption enters its next phase, the emphasis shifts from experimentation to execution. From proving what is possible to delivering what is reliable. Plasma’s focus on clarity, settlement certainty, stablecoin-native design, and restrained governance positions it well for this transition.

Plasma does not attempt to redefine money. It simply moves it better. And in a space crowded with noise and ambition, that quiet reliability may prove to be its most enduring strength. 🛠️🌐