It finally happened.

Look at the data.

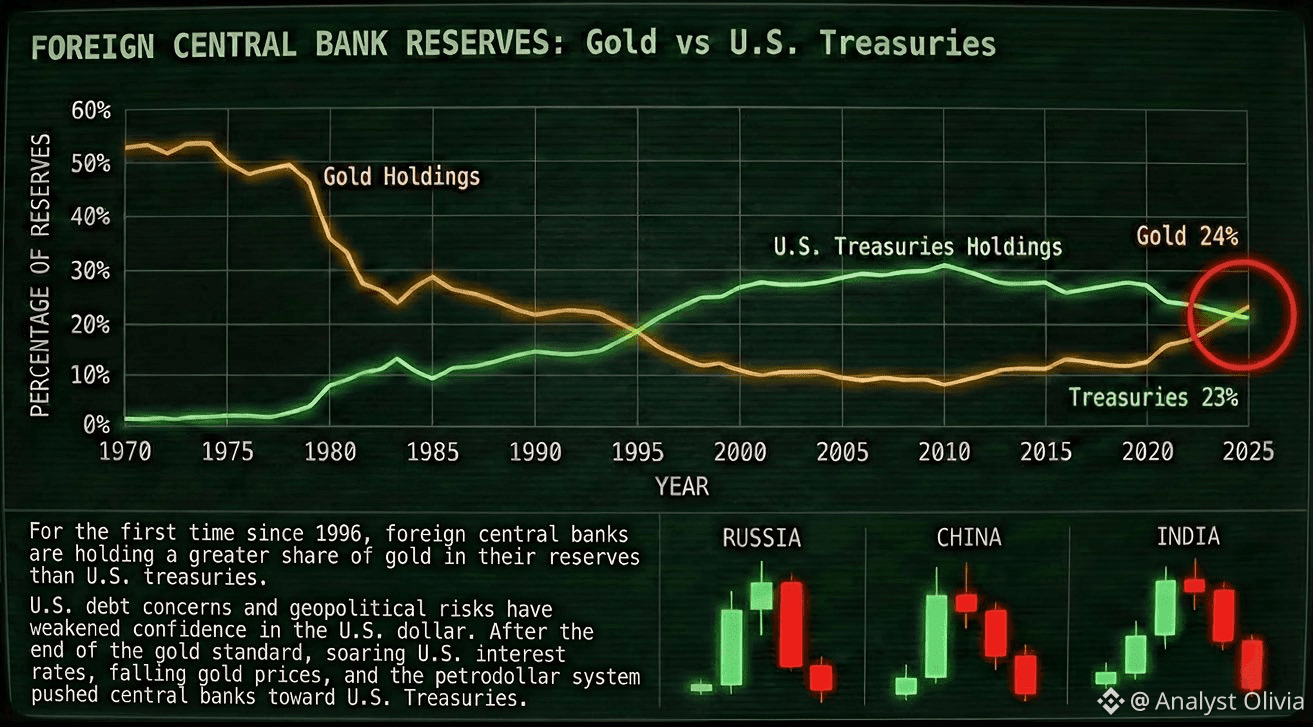

For the first time in three decades, central banks now hold more gold than U.S. Treasury debt.

That alone should stop you cold.

Because this isn’t a market trade.

It’s a sovereign signal.

And it should be especially concerning if you live in the United States.

THIS IS A LOSS OF TRUST — NOT A SEARCH FOR YIELD

Foreign governments are no longer optimizing for interest.

They are optimizing for survival of principal.

They don’t care about earning a few extra basis points anymore.

They care about whether their reserves can be:

seized

frozen

inflated away

weaponized

U.S. Treasuries can be all of the above.

Gold cannot.

Gold has zero counterparty risk.

No issuer.

No promise.

No political permission.

That’s why it’s the only truly neutral reserve asset.

AND IT GETS WORSE

U.S. debt is now rising by roughly $1 trillion every 100 days.

Annual interest payments are already passing $1 trillion per year — and accelerating.

At this point, the math is unavoidable.

The Federal Reserve has to print.

Markets see it.

Foreign governments see it.

And they are moving before the debasement becomes obvious.

This isn’t speculation.

It’s preparation.

YOU CAN SEE IT DIRECTLY IN RESERVES

Look at the buyers of gold:

China.

Russia.

India.

Poland.

Singapore.

Different systems.

Different politics.

Same conclusion.

They are dumping paper claims and accumulating hard assets.

And this is happening alongside something bigger.

THIS IS WHAT DE-DOLLARIZATION ACTUALLY LOOKS LIKE

The BRICS alliance isn’t just about trade agreements.

The goal is de-dollarization.

That means:

building independent payment rails

bypassing SWIFT

settling energy and trade in local currencies

backing settlement with commodities that cannot be printed, like gold and silver

When 40%+ of the global population decides it doesn’t need the U.S. dollar anymore, demand doesn’t weaken gradually.

It structurally disappears.

THE ERA OF “TINA” IS OVER

“There Is No Alternative” worked when the dollar was trusted.

That era is ending.

Gold is the alternative.

Not because it yields.

Not because it’s exciting.

But because it survives when trust breaks.

IS THIS THE FALL OF THE U.S. DOLLAR?

Yes. Absolutely.

Not overnight.

Not in headlines.

But through loss of reserve privilege.

If you think silver at $90 or gold at $4,600 sounds crazy,

then you are not prepared for what happens when the world reprices trust.

MY POSITION

I’ve been in macro for over 20 years.

I’ve bought and sold every major top and bottom for more than a decade.

From now on, I’m sharing my moves publicly.

If you want a hedge against 99% of retail investors,

you already know what to do.

Many people will regret not paying attention sooner.