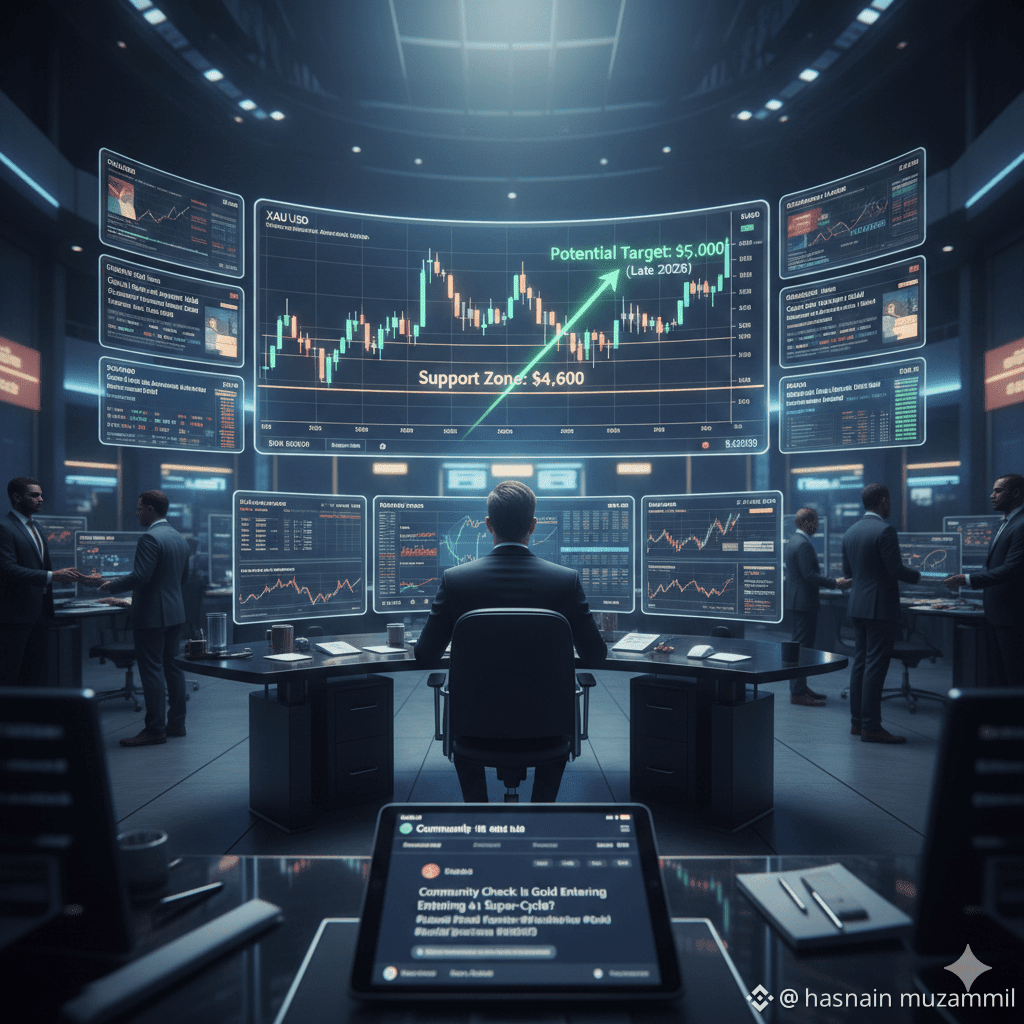

Gold is no longer just trending — it’s redefining price discovery in early 2026. After confidently reclaiming and holding above the $XAU 4,600 zone, XAU/USD is behaving like a market that’s being accumulated, not distributed.

This isn’t a random spike. It’s a structured, macro-driven move.

🔍 Price Structure & Key Zones

Current Price Area: $4,590 – $4,610

Immediate Supply Zone: $4,640

Acceptance above this level could trigger momentum expansion toward $4,750–$4,800

Bullish Defense Line: $XAU 4,520

As long as price respects this zone, pullbacks remain corrective, not bearish

🌎 The Bigger Picture (Why Gold Is Winning)

📉 Confidence Erosion in Fiat Systems

Growing uncertainty around monetary policy credibility is quietly pushing capital away from paper assets.

🏦 Central Banks Are Not Waiting

Gold accumulation by institutions and sovereign entities continues aggressively — this is long-term positioning, not short-term speculation.

⚔️ Global Risk Premium Rising

Geopolitical stress and economic fragmentation are keeping safe-haven demand elevated, and gold remains the first beneficiary.

🧠 Smart Trader Perspective

In strong trends, patience beats prediction.

Dips toward the $XAU 4,540–$4,560 range are increasingly seen as reloading zones, not exit signals.

With current conditions intact, a $5,000 target by late 2026 is now being discussed seriously — not as hype, but as a macro extension scenario.

⚠️ Risk Management Reminder

At all-time highs:

Volatility expands

Fake breakouts happen

Discipline matters more than bias

Protect capital. Let winners run — but only with structure.

💬 Community Check Is gold entering a super-cycle, or is this the final acceleration phase?

Bullish or cautious for 2026 — what’s your view? 👇

#GOLD_UPDATE #XAUUSD❤️ #MacroMarkets #SafeHaven #TradingMindse #Write2Earn