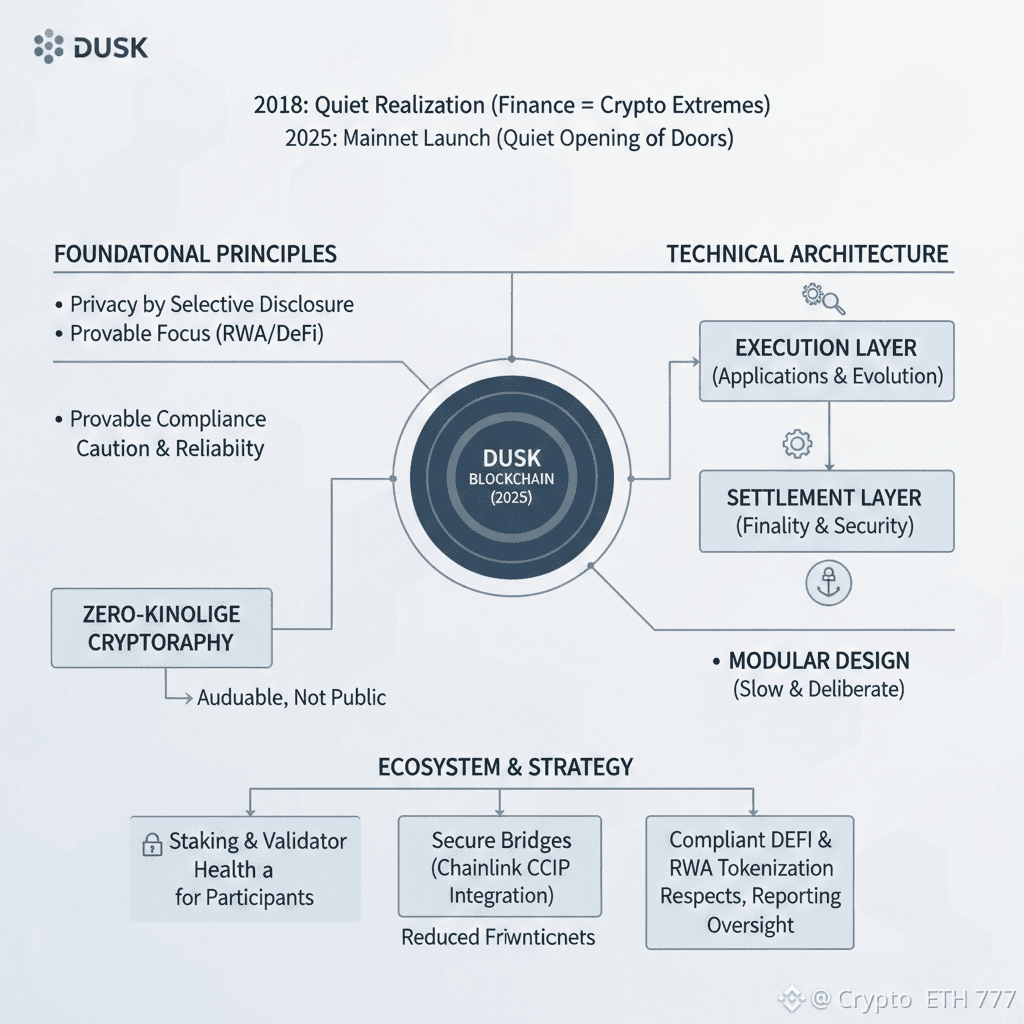

When Dusk first appeared in 2018, it didn’t arrive with loud promises or flashy slogans. It came from a quieter realization: the financial world doesn’t actually work the way most blockchains assume it does.

In real finance, transparency isn’t absolute, speed isn’t everything, and trust is built slowly. Banks don’t publish their strategies, institutions don’t expose positions in real time, and regulators don’t want chaos disguised as innovation.

Dusk was created around this reality, not in denial of it. Instead of forcing finance to adapt to crypto’s extremes, Dusk tries to meet finance where it already is and bring it on-chain without breaking the rules it lives by.

That’s why privacy sits at the heart of Dusk’s design, not as a shield for wrongdoing, but as a professional standard. In traditional markets, privacy is normal; it protects businesses, clients, and market integrity.

Dusk translates that idea into blockchain form by focusing on selective disclosure, where transactions can stay confidential to the public while still being provable to auditors and regulators.

This is where zero-knowledge cryptography becomes meaningful, not as an abstract buzzword, but as a practical tool that lets someone say “this followed the rules” without exposing everything underneath. The chain’s architecture reflects the same mindset.

Dusk doesn’t try to do everything in one rigid system. Instead, it separates settlement from execution, creating a foundation where finality and security come first, and applications can evolve on top without risking the core. This modular approach is slow by crypto standards, but it’s deliberate.

Financial infrastructure doesn’t get infinite second chances. When Dusk’s mainnet went live in early 2025, it didn’t feel like a finish line; it felt more like a quiet opening of doors. The emphasis shifted from theory to responsibility, from design to real usage.

Since then, the ecosystem narrative has been about strengthening the basics: staking participation, validator health, bridges, and interoperability, all approached with caution rather than bravado. One of the clearest signals of Dusk’s long-term intent is its focus on real-world assets and compliant DeFi.

Tokenizing assets isn’t hard in theory; doing it in a way that respects ownership rules, reporting requirements, and regulatory oversight is where most projects stumble. Dusk leans into that complexity instead of pretending it doesn’t exist.

Its vision of on-chain finance accepts that rules are part of the system, not an enemy of it.

That same thinking shows up in its interoperability choices. Moving assets across chains is necessary, but reckless bridges have proven how fragile that path can be.

By aligning with established infrastructure like Chainlink CCIP, Dusk signals that reliability matters more than novelty, especially when regulated assets are involved. Even staking on Dusk reflects this philosophy. Rather than making participation complex or exclusive, the goal is to reduce friction so more participants can contribute to network security in a sustainable way. Nothing about Dusk feels rushed, and that’s intentional.

It’s not built for viral moments or overnight dominance. It’s built for institutions that need confidentiality, for developers who want familiar tools with stronger guarantees, and for markets where trust is earned slowly through consistency.

The human truth behind Dusk is simple: not everything should be public, not everything should be permissionless, and not everything should move at maximum speed. Some things should be correct, provable, and private. Dusk isn’t trying to overthrow the financial system; it’s trying to give it a blockchain it can actually live with.