The blockchain industry spent years obsessing over transactions per second as the ultimate metric of superiority. Every new chain marketed itself through TPS benchmarks, competing to display the largest numbers while ignoring a fundamental truth about how stablecoins actually achieve real world adoption. Plasma recognized something the market missed entirely. Speed means nothing if money cannot flow freely between the places people already keep it and the places they need to spend it.

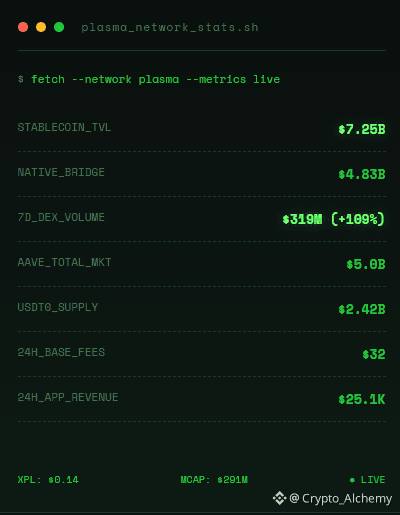

When Plasma launched its mainnet in September 2025, the focus was never purely on raw throughput despite PlasmaBFT delivering over one thousand transactions per second with sub second finality. The strategic priority centered on building dense connectivity with centralized exchanges where the majority of stablecoin holders actually custody their assets. This approach has proven remarkably effective. Binance enabled direct USDT deposits and withdrawals on Plasma network from day one. Kraken followed by activating USDT0 deposits and withdrawals specifically through Plasma rails. HashKey Global went further by launching zero gas fee promotions for USDT withdrawals via Plasma. Coinbase listed XPL in December 2025. The exchange integration list now spans across major platforms including Bitget, Bybit, KuCoin, Upbit, Gate.io, OKX, and eToro among dozens of others.

This exchange network effect creates something far more valuable than impressive benchmark numbers. When users can deposit USDT directly from their preferred exchange into Plasma without intermediate steps, wrapped tokens, or complex bridging procedures, actual usage follows naturally. The friction that kills mainstream adoption simply disappears. Consider what this means practically. Someone holding USDT on Binance can withdraw directly to Plasma, utilize zero fee transfers within the network, access DeFi yields through integrated protocols like Aave, and withdraw back to any connected exchange without ever touching gas tokens or navigating confusing bridge interfaces.

Plasma CEO Paul Faecks articulated the strategic insight clearly. The three major scenarios of stablecoin usage being savings, consumption, and global transfers each have completely different product requirements. Savings users want yield generation. Consumption users demand zero friction payment experiences. Cross border transfer users prioritize compliance and reliable inflow outflow channels above all else. Plasma architecture addresses all three simultaneously through its dual validator system and protocol level paymaster while building the exchange connectivity that makes each use case accessible to normal users.

The network achieved five and a half billion dollars in total value locked within its first week precisely because liquidity could flow efficiently through established channels. Bridge aggregators like Stargate Finance and Rhino.fi optimized specific routes for moving stablecoins onto Plasma. Institutional custody provider Cobo integrated Plasma as a preferred stablecoin payment chain. Payment partners like Yellow Card covering twenty African countries and WalaPay connecting remittance networks in labor exporting nations like Philippines and Indonesia extended reach into markets where stablecoin access creates genuine financial inclusion.

XPL secures this entire infrastructure through proof of stake consensus while remaining invisible to users who simply want to move stablecoins. The paymaster system sponsors gas costs for basic USDT transfers meaning someone can send money without ever acquiring or understanding the native token. This design choice reflects deep understanding that mainstream adoption requires removing every possible obstacle between intention and action.

The stablecoin public chain competition is no longer about who processes transactions fastest. Victory belongs to whoever builds the densest network of on ramps and off ramps connecting digital dollars to the real economy. Plasma understood this before anyone else and executed accordingly.