I’m writing about Dusk Network because it keeps moving in a direction most projects avoid. Instead of chasing fast attention, Dusk is trying to rebuild how finance should work on a blockchain when real rules exist. That means privacy is not optional, and compliance is not an afterthought. From the start, the idea is simple but heavy: financial activity should feel normal again. Balances should not be public by default. Trading intent should not be exposed to everyone. At the same time, systems must still prove that rules were followed. That balance is what Dusk is built for.

Most blockchains were designed for openness first. That works for experiments, but it breaks once serious value shows up. In real finance, privacy is not a luxury. It’s expected. If every move is visible, markets turn into surveillance games. Strategies leak. Positions get attacked. Normal users feel watched. Dusk looks at this and asks a direct question: “Why should on chain finance be more exposed than off chain finance?” That question shapes everything they build.

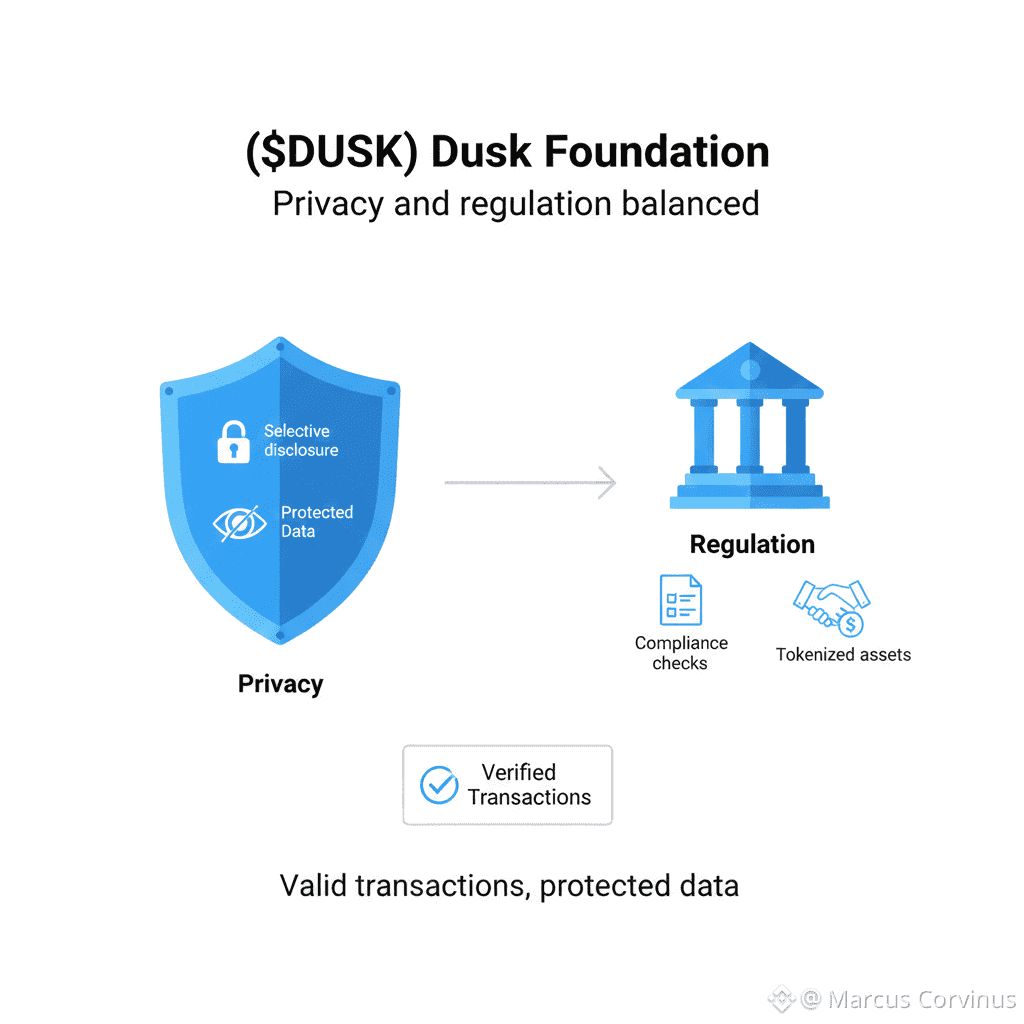

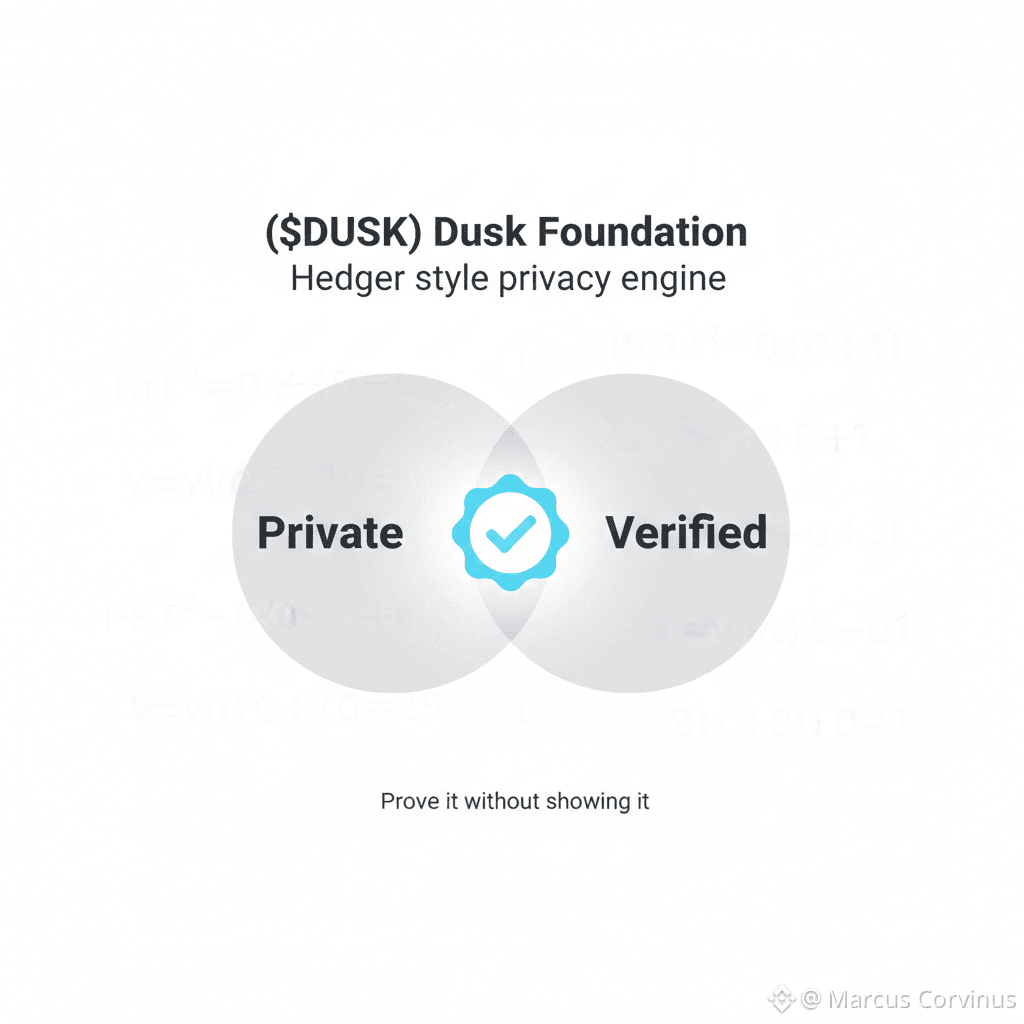

At its core, Dusk is a privacy first settlement network for regulated use cases. The network is not trying to hide activity in a dark corner. It is trying to control visibility in a smart way. Sensitive data stays protected, while proofs still exist to show that transactions are valid. That is the difference between “hiding” and “proving without revealing”. They’re not the same thing, and Dusk is built around that distinction.

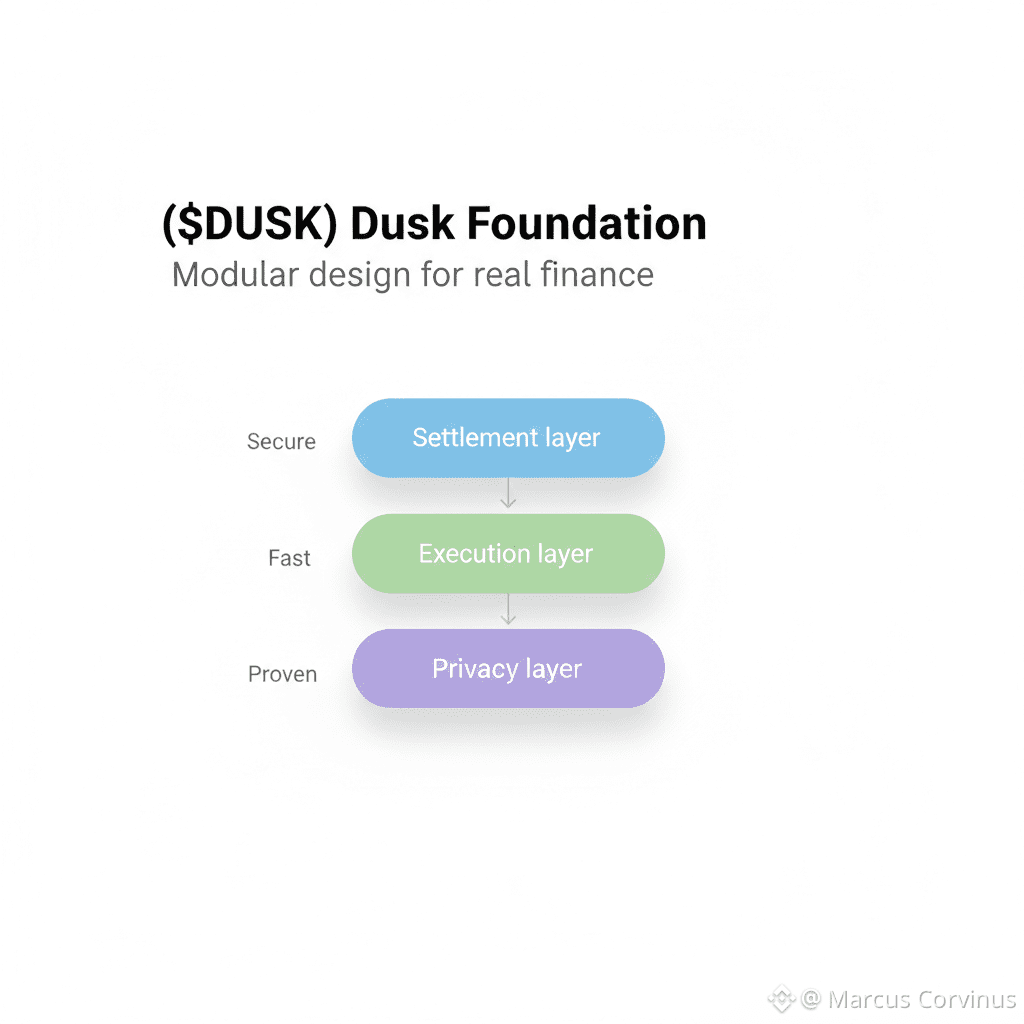

The architecture tells the story clearly. Dusk separates settlement from execution. The base layer focuses on “finality”, “security”, and “data availability”. This is where the network agrees on truth. On top of that, execution layers exist to support different needs. Some builders want familiar smart contract tools. Others need deeper privacy by design. Instead of forcing one path, Dusk allows both. This modular approach matters because finance systems fail when everything is mixed together. Stability comes from clear separation of roles.

One of the biggest challenges in privacy based finance is usability. If a system is too complex, no one builds on it. Dusk tries to avoid that by supporting an EVM compatible execution path. That choice is practical. Developers already know how to build in that environment. They can deploy faster and experiment without learning everything from scratch. At the same time, Dusk does not give up on privacy. It introduces a privacy engine designed to work with this execution layer, allowing confidential balances and transfers while still keeping proofs intact.

This is where things get interesting. Privacy on Dusk is not about making everything invisible. It’s about selective visibility. If a rule requires disclosure, the system can prove compliance. If no disclosure is required, user data stays private. That idea fits regulated finance much better than full transparency or full secrecy. It also raises an important question: “Can privacy actually improve market fairness?” If large players cannot be watched and copied in real time, manipulation becomes harder. Front running loses power. Markets become calmer. That is the promise behind controlled privacy.

Identity is another sensitive area. Many systems treat identity as a public label. Dusk goes in a different direction. The goal is to prove eligibility without exposing personal details. If someone is allowed to trade, the system should prove that fact, not publish who they are. This approach respects both user dignity and regulatory needs. It also reduces long term risk. Public identity data on a blockchain cannot be erased. Dusk tries to avoid creating permanent personal footprints.

Security is treated seriously because settlement demands it. The network uses staking to align incentives. Validators are rewarded for honest behavior and punished for harmful actions. This is not about hype rewards. It is about reliability. A settlement layer must keep working when attention drops and when markets turn rough. If the base layer fails, everything built on top fails with it. Dusk’s design reflects that reality.

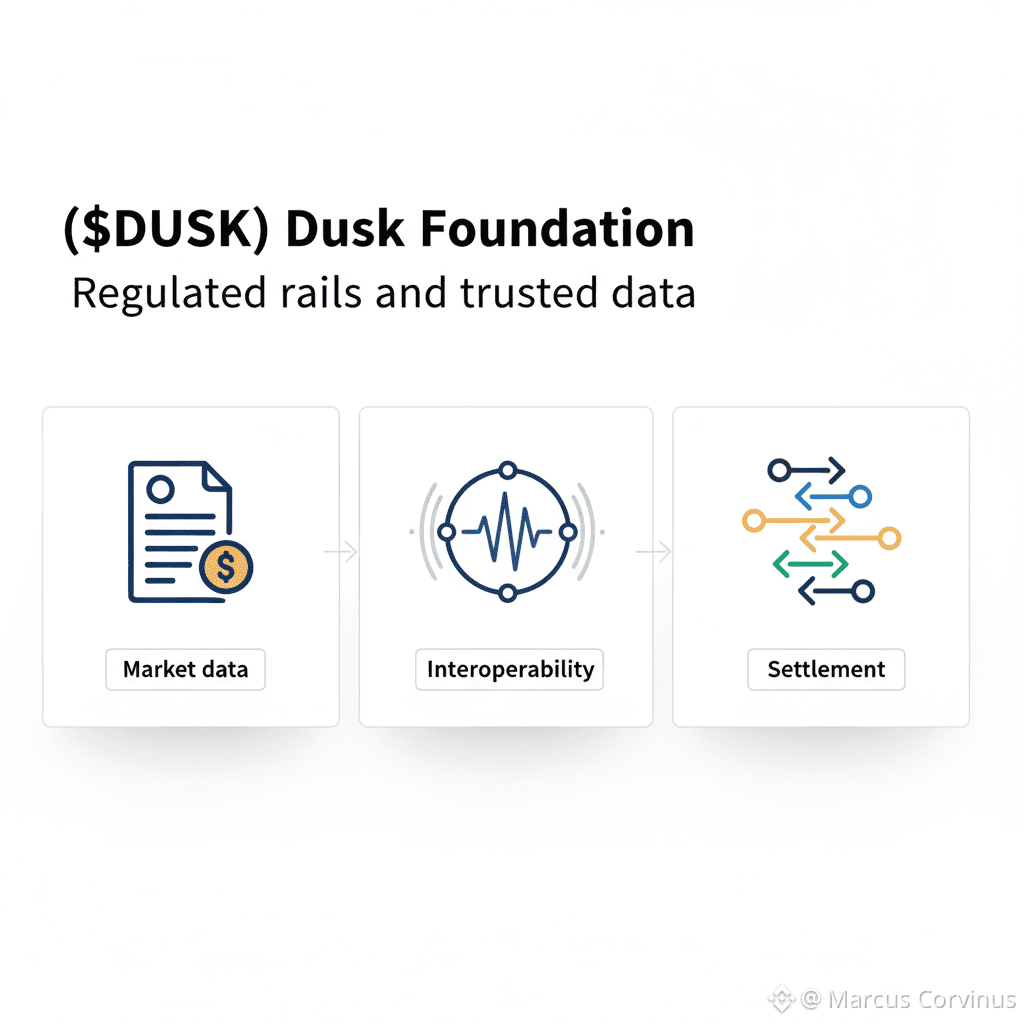

Interoperability is handled carefully. Finance does not exist in isolation, but bridges are also where many systems break. Dusk integrates outward while keeping the base layer as the source of truth. The idea is to allow value to move without weakening security or privacy guarantees. That balance is hard, but it’s necessary if the network wants real usage.

Token design also follows a long view. Supply is capped, emissions are spread over decades, and rewards decline over time. This supports network security early on while limiting long term inflation. It’s not designed for fast pumps. It’s designed to support validators and stability across market cycles. That fits the broader theme of Dusk building for endurance rather than excitement.

What I find most important is the mindset behind the project. Dusk does not assume regulation will disappear. It assumes regulation will become clearer. It does not assume users want radical transparency. It assumes users want normal financial privacy. It does not assume institutions will change their standards. It assumes blockchains must rise to those standards. That way of thinking changes how you design everything.

So the real becomes: “What happens if Dusk succeeds?” If this model works, it opens the door to on chain markets that look more like real markets. Assets can be issued and traded with rules. Users can interact without exposing their financial lives. Builders can create serious applications without fighting the base layer. That would be a shift, not just another chain.

Of course, this path is not easy. Privacy adds complexity. Modular systems add coordination challenges. Regulated environments move slowly. But slow does not mean weak. Sometimes it means careful. Dusk is choosing the hard road because the easy one does not lead to real finance. If they execute well, they may not just build a network, they may reset expectations around what private and compliant on chain finance should look like.