Why Decentralized Storage Matters — From an Investor’s Lens

In the last decade, blockchain innovation has shifted the focus from payments to smart contracts, decentralized finance, NFTs, and now, AI-driven applications. But as the ecosystem grows, one critical infrastructure problem has emerged: data reliability and accessibility at scale. For investors and traders, this is no longer a technical detail—it is a core determinant of the next wave of value creation.

Centralized storage systems have long been the default solution, yet they carry intrinsic risks: downtime, censorship, data loss, and misaligned incentives. As crypto projects, AI models, and DeFi protocols increasingly rely on data as a critical input, these risks translate directly into financial exposure. A trading strategy, an NFT marketplace, or an AI-powered analytics platform is only as good as the data it consumes. Enter Walrus, a decentralized storage protocol built on Sui, designed to make data provable, available, and economically composable.

From an investment perspective, Walrus is not just another storage solution. It is a foundational layer for a verifiable data economy, capable of supporting multiple industries while providing mechanisms that align economic incentives with reliability.

The Technology Behind Walrus — RedStuff and Proof of Availability

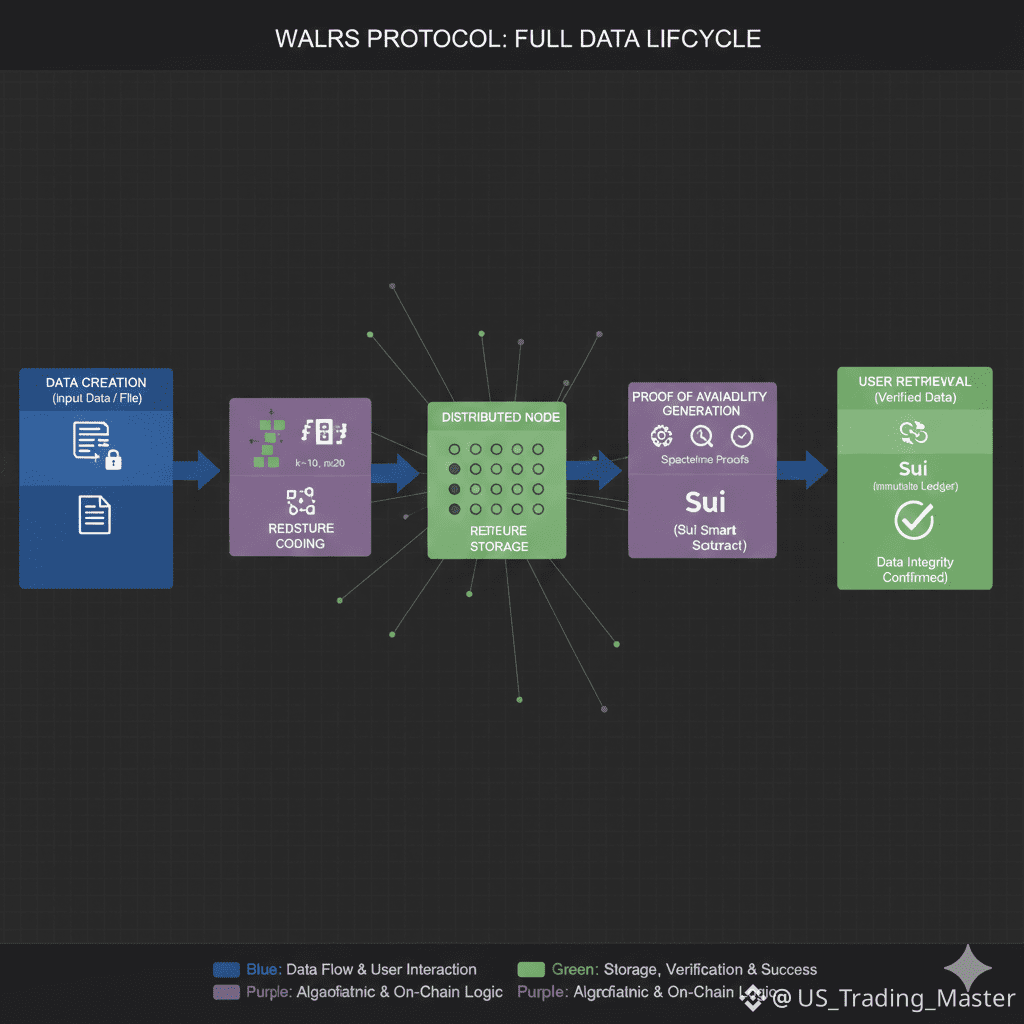

Walrus achieves its ambitious vision through two core innovations: RedStuff erasure coding and the Proof of Availability (PoA) mechanism.

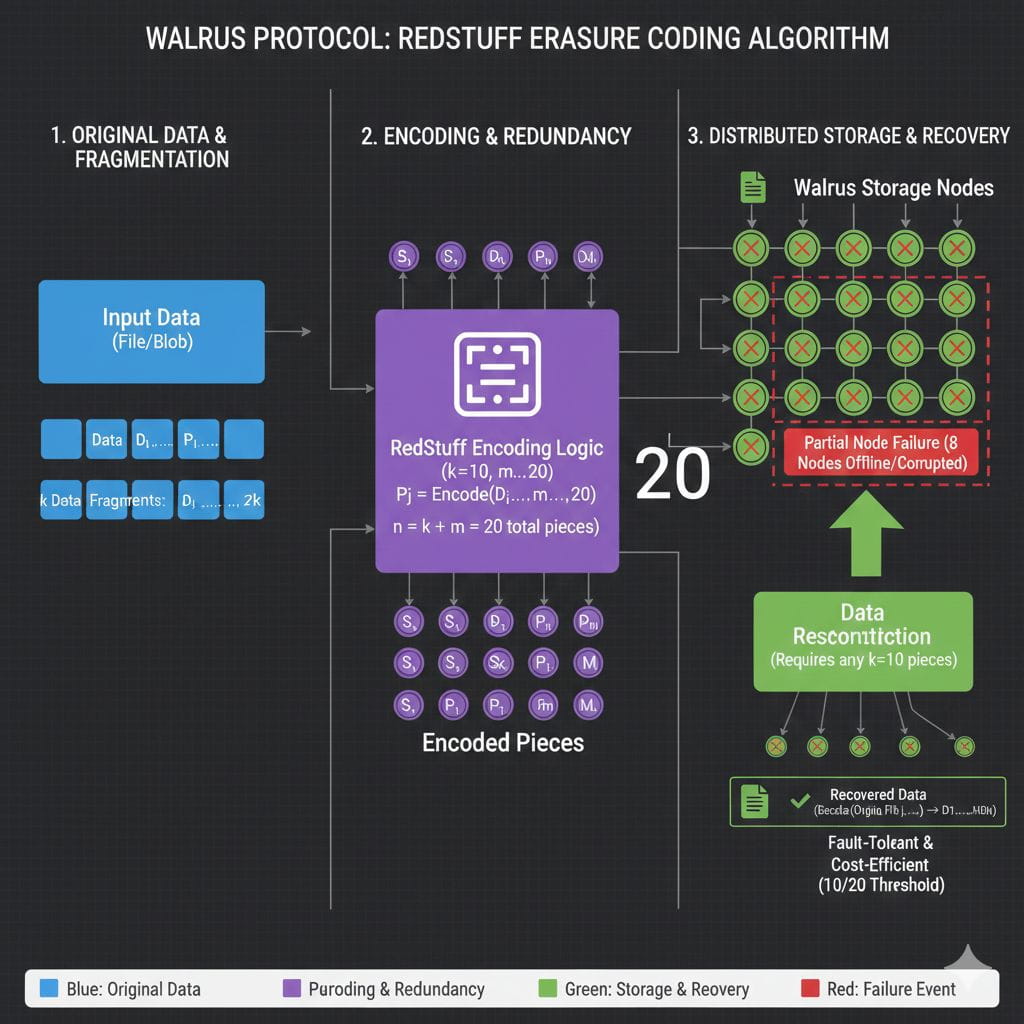

RedStuff erasure coding is Walrus’s method for distributing data efficiently across its decentralized network. Unlike traditional replication-based storage, which copies full datasets to multiple nodes, RedStuff splits data into fragments and encodes them with redundancy. Only a subset of these fragments is necessary to reconstruct the original dataset.

The implications are significant:

Cost Efficiency: Less storage is required per dataset, which reduces the total economic footprint.

Fault Tolerance: Even if some nodes fail, data can still be fully reconstructed.

Scalability: Large datasets can be spread across hundreds or thousands of nodes without linear increases in storage cost.

RedStuff alone solves efficiency and resilience, but reliability requires more than redundancy—it demands verifiable availability.

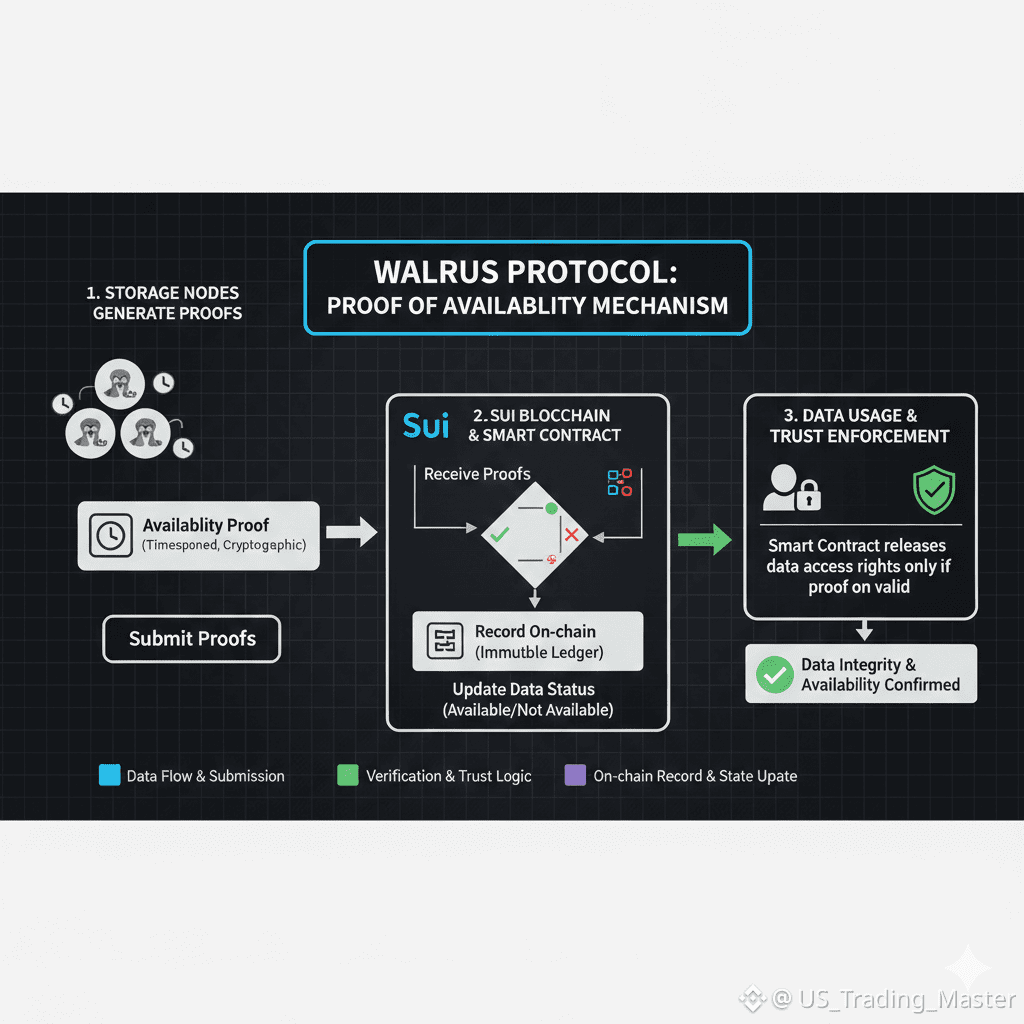

Proof of Availability (PoA) addresses this challenge. In essence, storage nodes periodically generate cryptographic proofs demonstrating that they hold the encoded data and that it can be retrieved on demand. These proofs are then submitted to the Sui blockchain, creating an auditable, tamper-proof record. Smart contracts or applications interacting with Walrus can check these proofs before consuming the data, ensuring trustless verification.

From an investor’s standpoint, PoA introduces transparency and mitigates risk. Data-backed applications—AI training datasets, NFT metadata, or DeFi oracles—can now operate with cryptographic certainty that the underlying data is intact and accessible. This changes the economics of data: it becomes a verifiable, tradable asset, rather than an ephemeral resource.

Economic and Market Implications

Walrus’s approach has profound implications for multiple markets:

Cost Efficiency: By replacing full replication with erasure coding, Walrus reduces storage costs without sacrificing reliability. This makes it more viable for both enterprises and decentralized applications to store large datasets economically.

Verifiability: PoA ensures that stored data can always be audited. For investors and developers, this reduces operational risk and allows data-backed contracts and financial instruments to function with confidence.

Real Data Markets: With verifiable and monetizable storage, Walrus enables entirely new market structures:

AI: Training models on provably accurate datasets reduces the risk of corrupted or manipulated data.

DeFi: Oracles and financial contracts can rely on on-chain verified data without intermediaries.

NFTs & RWAs: Metadata and real-world asset data can be stored securely and retrieved with cryptographic assurance, supporting marketplaces and compliance needs.

Enterprise & Research: Businesses can monetize their datasets while ensuring clients or collaborators can verify availability.

Walrus doesn’t just store data—it adds economic layers to data itself. Every fragment becomes part of a system where storage, access, and verification carry measurable value.

How Walrus Could Transform the Data Economy

Walrus is positioned to turn storage into a tradable, composable infrastructure layer. Here’s how:

Tradable: Data fragments with verified availability could be bought, sold, or rented within decentralized marketplaces. $WAL incentivizes node operators and data providers, aligning economic incentives with reliability.

Composable: Developers can build applications that layer on top of Walrus storage without worrying about availability, integrating AI pipelines, DeFi contracts, or NFT marketplaces seamlessly.

Verifiable: Every access to data is backed by PoA, meaning that applications, regulators, or investors can audit usage and integrity. This opens the door to compliance-ready solutions for real-world data on-chain.

The combination of these properties transforms the perception of storage: it’s no longer a cost center; it becomes financially meaningful infrastructure.

Practical Implications for Traders, Investors, and Developers

For traders, the growth of Walrus-based data markets represents an emerging asset class. Unlike speculative tokens, WAL has intrinsic utility: it is required for participation in storage verification and for paying for access to verifiable datasets. As adoption grows, $WAL demand scales alongside the underlying data economy.

Developers gain access to a platform where storage is predictable, verifiable, and cost-effective. No longer constrained by single points of failure, they can build AI models, oracles, and NFT/RWA solutions with confidence that data integrity won’t compromise outcomes.

Investors looking for infrastructure plays should pay attention to Walrus because it sits at the intersection of AI, blockchain, and decentralized finance—three sectors with exponential growth potential.

Why Sui Blockchain Matters

Walrus leverages the Sui blockchain, which provides parallel execution, high throughput, and object-centric architecture. This allows storage verification and data proofs to scale efficiently, supporting hundreds of thousands of nodes and data-intensive applications without congestion. By aligning its protocol with a performant base layer, Walrus mitigates network-level bottlenecks—a critical factor for adoption.

Forward-Looking Perspective

The implications are profound. Imagine a future where:

AI models train on data whose authenticity is cryptographically guaranteed

DeFi contracts execute using oracles that are trustless and verifiable

NFT marketplaces store metadata that is auditable and persistent

Enterprises monetize datasets securely while retaining full verification rights

Walrus’s architecture, token economy, and verification mechanisms make this future feasible. Storage becomes not just functional, but investable, tradable, and composable.

Conclusion

Walrus represents a paradigm shift in decentralized infrastructure. By combining RedStuff erasure coding with Proof of Availability, it solves critical data reliability challenges while creating economic incentives for participation. It enables cost-efficient, verifiable, and monetizable data storage, paving the way for real-world markets for AI, DeFi, NFTs, RWAs, and more.

For traders, investors, and developers, WAL is not just a token—it’s a gateway to a new data economy, where storage becomes infrastructure, and infrastructure becomes opportunity.