Crypto markets move fast. New tokens launch daily, trades settle in seconds, and innovation never stops. But speed alone doesn’t create a real financial system. For large investors, institutions, and regulators, markets must also offer privacy, legal clarity, and strong structure. Without these, blockchain finance stays experimental instead of becoming truly global.

This is exactly the problem Dusk was designed to solve.

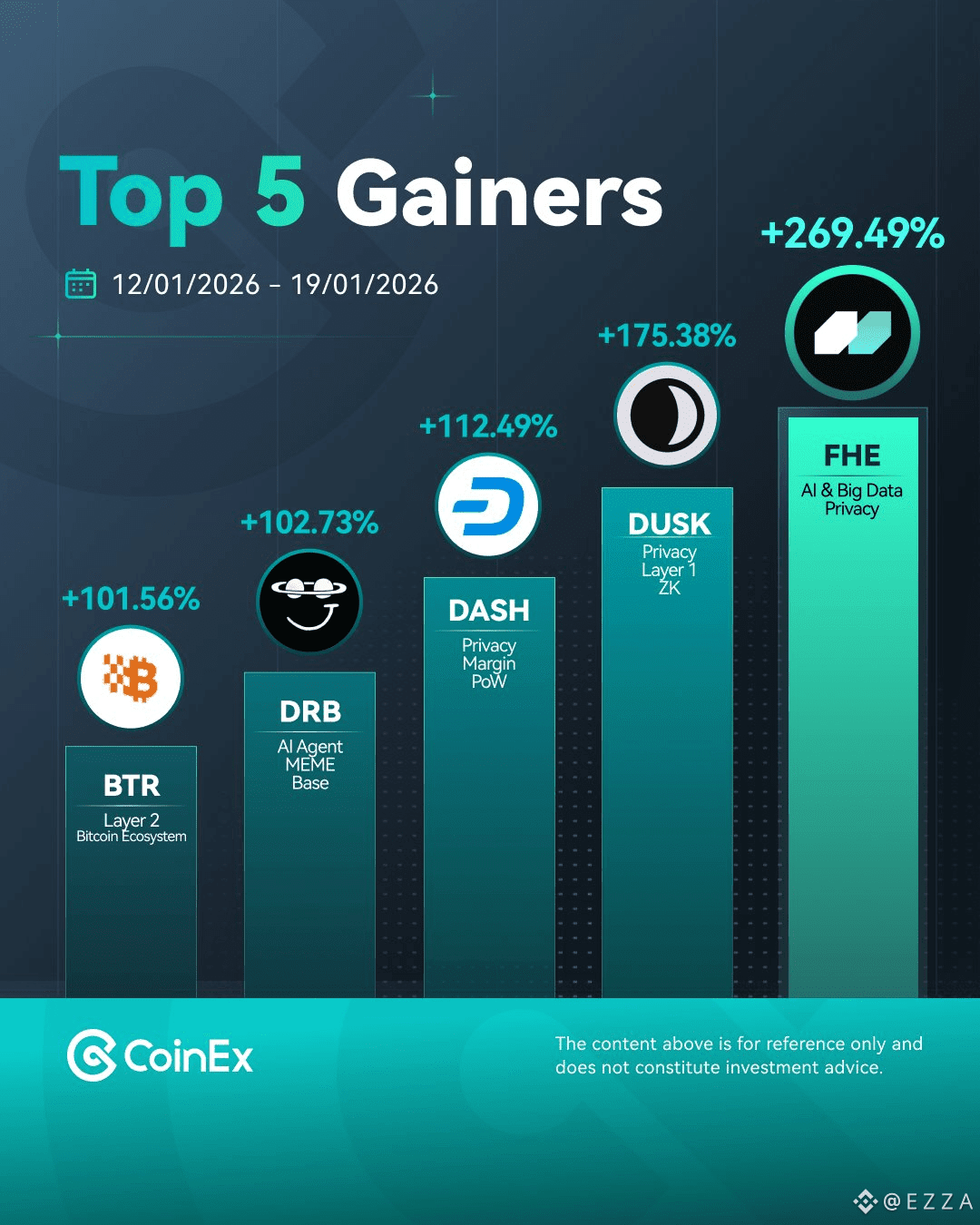

Founded in 2018, Dusk is a privacy-focused Layer-1 blockchain created for regulated financial markets. Instead of chasing trends like meme coins or short-term DeFi hype, Dusk focuses on something far more important: bringing real-world financial assets safely and legally on-chain.

Why Privacy Matters in Real Finance

In most blockchains, everything is public. Wallet balances, transactions, and trading behavior can be seen by anyone. While this openness supports transparency, it creates serious problems for real financial markets. Banks, funds, and corporations cannot operate if every transaction is exposed to the public.

Dusk approaches privacy differently. Transactions are confidential by default, meaning sensitive data like trade size, counterparties, and contract details remain hidden. At the same time, the network allows authorized audits when required. Regulators and institutions can verify activity without exposing private data to the entire world.

This balance between privacy and accountability reflects how traditional finance works and is one of Dusk’s strongest advantages.

Bringing Real-World Assets On-Chain

One of Dusk’s core missions is real-world asset (RWA) tokenization. This means turning assets like stocks, bonds, real estate, and commodities into digital tokens that can be traded on blockchain infrastructure.

This is not a theoretical idea. Dusk is already preparing real securities for on-chain trading. Through initiatives like NPEX, the network aims to tokenize over €300 million worth of regulated assets. This shows that Dusk is building real financial infrastructure, not just running experiments.

Tokenized assets on Dusk can be traded faster, settled instantly, and managed with smart contracts — while still meeting legal and regulatory requirements.

Designed to Adapt to Regulation

Financial regulations constantly evolve. Frameworks like the EU’s MiCA rules are reshaping how digital assets are managed. Many blockchains struggle here because they were never designed with regulation in mind.

Dusk solves this through a modular architecture. Core blockchain functions are separated from regulatory layers, allowing the network to adapt to new laws without breaking functionality or security. This flexibility gives institutions confidence that Dusk will remain compliant long-term.

Built for Institutions, Not Hype

Dusk is not focused on viral growth or speculation. Its priorities are stability, compliance, and usability for professional markets. This slower, more deliberate approach is exactly what banks, exchanges, and regulated entities need.

With milestones like mainnet expansion, DuskEVM compatibility, and increasing RWA adoption planned for 2025–2026, the network is positioning itself as a serious bridge between traditional finance and blockchain technology. DuskEVM allows Ethereum-based applications to run on Dusk, opening doors for developers while maintaining regulatory standards.

Real Use Cases, Real Value

Dusk supports practical, high-value applications such as:

Tokenized securities for compliant share trading

Real estate tokenization, enabling fractional ownership

Commodity trading through digital asset representation

On-chain bonds with faster settlement and better transparency

These use cases represent real markets with real demand — not temporary trends.

Why Dusk Stands Out

As crypto matures, the market is splitting into two paths. One focuses on speculation and unregulated platforms. The other focuses on building secure, compliant systems that institutions can trust.

Dusk clearly belongs to the second path. It combines privacy, regulatory readiness, and blockchain efficiency into a single network designed for long-term financial use. It proves that blockchain does not need to sacrifice trust, legality, or confidentiality to be powerful.

Final Thoughts

Dusk is not just another blockchain project. It is infrastructure for the future of finance. By enabling regulated, private, and efficient token markets, Dusk is setting a foundation where serious financial activity can move on-chain safely.

For institutions, investors, and regulators looking beyond hype, Dusk offers a clear direction forward — where real finance and blockchain finally meet.