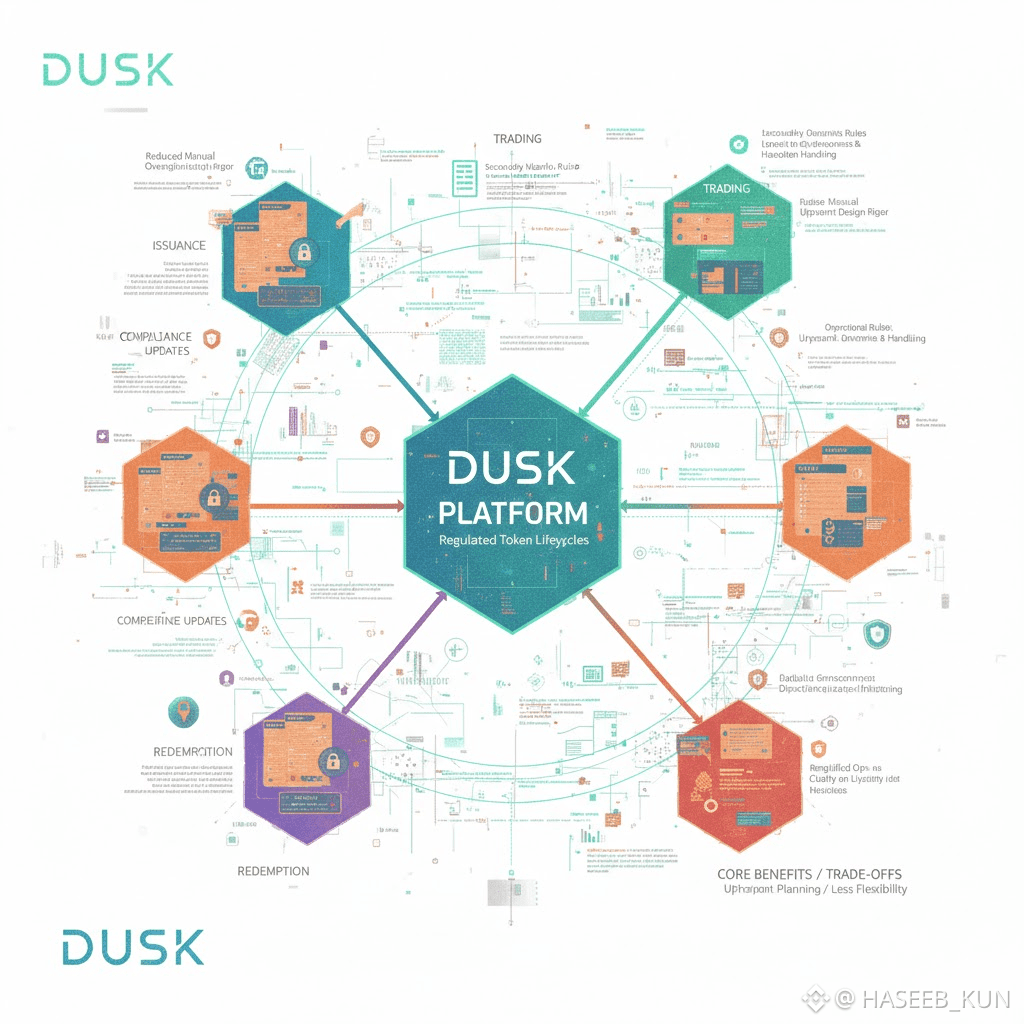

When you work with regulated tokens daily, the complexity rarely comes from moving the asset itself. The tricky part is the lifecycle: issuance, trading, compliance updates, and redemption. Most platforms handle transfers okay, but once you layer in legal and operational requirements, you end up juggling multiple systems. Each stage lives in a silo, and gaps between them are where errors accumulate. Delays, reconciliation headaches, manual overrides—these are the real operational risks. Dusk tackles this by handling the lifecycle natively. It’s not a flashy solution; it’s about keeping all the pieces on one coherent platform so that the process is visible, auditable, and predictable.

Issuance is rarely “just mint a token.” Each asset carries its own rules—who can hold it, what jurisdictions apply, what triggers a freeze or restriction. Dusk embeds these rules at the protocol level. That reduces manual oversight but introduces trade-offs. The more complex your rules, the more verification overhead each transaction carries. You get operational consistency, but it comes at the cost of upfront design rigor. If you don’t think carefully about the logic, you’ll run into bottlenecks down the line. In practice, that’s the kind of design decision teams need to make every day: do you prioritize flexibility, or do you enforce predictable behavior at scale?

Trading is where many systems fall apart. A token might be compliant on issuance, but in secondary markets, rules get messy. Dusk evaluates trades at execution. Only transactions that meet the embedded compliance criteria go through. That sounds clean, but it has implications. Builders have to account for permissions, blacklists, and regional restrictions from the outset. Edge cases matter—if a country changes regulations mid-trade, how does the system respond? The benefit is less reconciliation and fewer surprises, but the trade-off is more upfront thinking about governance and exception handling.

Compliance updates themselves can be painful in most systems. Investors change, rules evolve, and your platform has to reflect that quickly. Dusk propagates these updates on-chain, so tokens enforce rules immediately. That’s useful, but it’s not free. Misapplied updates can block legitimate transactions or introduce inconsistencies. Operational discipline is critical. Institutions still need clear procedures for validating updates and monitoring their impact. The system doesn’t remove operational risk entirely; it shifts where you manage it.

Redemption is another point where practical realities show up. Traditional setups often require multiple approvals or off-chain reconciliation. That slows settlements and creates gaps between systems. Dusk integrates redemption into the lifecycle, updating compliance, accounting, and audit logs simultaneously. It simplifies operations but demands clarity: all participants need to understand the lifecycle rules. In complex products like tokenized bonds or structured assets, exceptions and edge cases still occur. The friction doesn’t vanish—it just shows up differently.

The benefits of a full-lifecycle approach are tangible. Consolidating issuance, trading, compliance, and redemption reduces operational overhead and creates a single source of truth for audits. Scaling is easier because you aren’t patching together multiple platforms. But it’s not magic. Complexity moves upstream. The system forces you to be deliberate about token design, governance, and operational workflows. Mistakes early in design can propagate widely. For anyone running regulated products at scale, that’s a trade-off worth noting. Predictability comes at the cost of careful upfront planning.

For investors, this architecture improves visibility. They can see a token’s status across the entire lifecycle and be confident that compliance is enforced consistently. It doesn’t remove market risk, but it removes ambiguity that often causes operational losses. For builders, Dusk imposes discipline. You have to think about token logic, edge cases, and operational workflows before you deploy. The upside is fewer surprises in daily operations; the downside is less flexibility if your product or ruleset changes rapidly.

Ultimately, Dusk is not just a ledger for moving tokens. It’s infrastructure for regulated finance where the lifecycle matters as much as the transaction. Embedding compliance, auditability, and redemption into the protocol surfaces trade-offs that practitioners live with: flexibility versus enforceability, speed versus verification, and simplicity versus completeness. It doesn’t remove those trade-offs, but it gives you a platform to manage them deliberately. For anyone designing tokenized financial products, that kind of predictability—messy, constrained, and sometimes inconvenient—is more valuable than the smoothest interface or the fastest settlement times.