I’m not saying this for clicks, hype, or panic. I’m saying it because I’ve been studying this stuff for years and the signals right now don’t look normal.

The Fed just released new data, and honestly… it looks worse than most people expected.

If you’re holding assets right now, you really need to pay attention.

A major global market shock is quietly building, but most retail traders don’t see it yet. There’s stress forming in the financial system underneath the surface, and very few people are actually positioned for what’s coming.

Look at what the Fed just did:

Balance sheet expanded by about $105B

Standing Repo Facility added $74.6B

Mortgage-backed securities jumped $43.1B

Treasuries only rose $31.5B

This is NOT bullish QE like people think.

This is the Fed stepping in because funding conditions got tight and banks needed emergency liquidity. When the Fed starts absorbing more mortgage securities than Treasuries, that’s a clear sign the quality of collateral is getting worse. That only happens when the system is under real pressure.

Now here’s the bigger issue almost nobody wants to talk about:

The U.S. national debt is at an all-time high — over $34 trillion and growing faster than the economy itself.

Interest payments on that debt are exploding. The government is now issuing more debt just to pay interest on old debt. That’s literally a debt spiral.

At this point, U.S. Treasuries aren’t truly “risk-free” anymore — they rely on confidence. And that confidence is starting to crack. Foreign demand for U.S. debt is weakening, domestic buyers are getting picky, and the Fed is slowly becoming the buyer of last resort.

You can’t keep running trillion-dollar deficits while funding markets tighten. You can’t pretend this is normal.

And this isn’t just a U.S. problem.

China is doing the same thing. The PBoC just injected over 1 trillion yuan in liquidity through reverse repos in a single week.

Different country — same problem: Too much debt.

Too little trust.

The entire global system is built on rolling over debt that fewer and fewer people actually want to hold. When both the U.S. and China are forced to inject liquidity at the same time, that’s not stimulus — that’s financial plumbing starting to break.

Most traders misread this phase. They see liquidity injections and think “bullish.” It’s not.

This isn’t about pumping markets — it’s about keeping funding alive. And when funding breaks, everything else becomes a trap.

The pattern is always the same:

Bonds show stress first

Funding markets crack

Stocks ignore it… until they don’t

Crypto gets hit the hardest

Now look at what gold and silver are doing — both at all-time highs. That’s not a normal “growth trade.” That’s capital fleeing paper assets and moving into hard assets. That happens when trust in the system weakens.

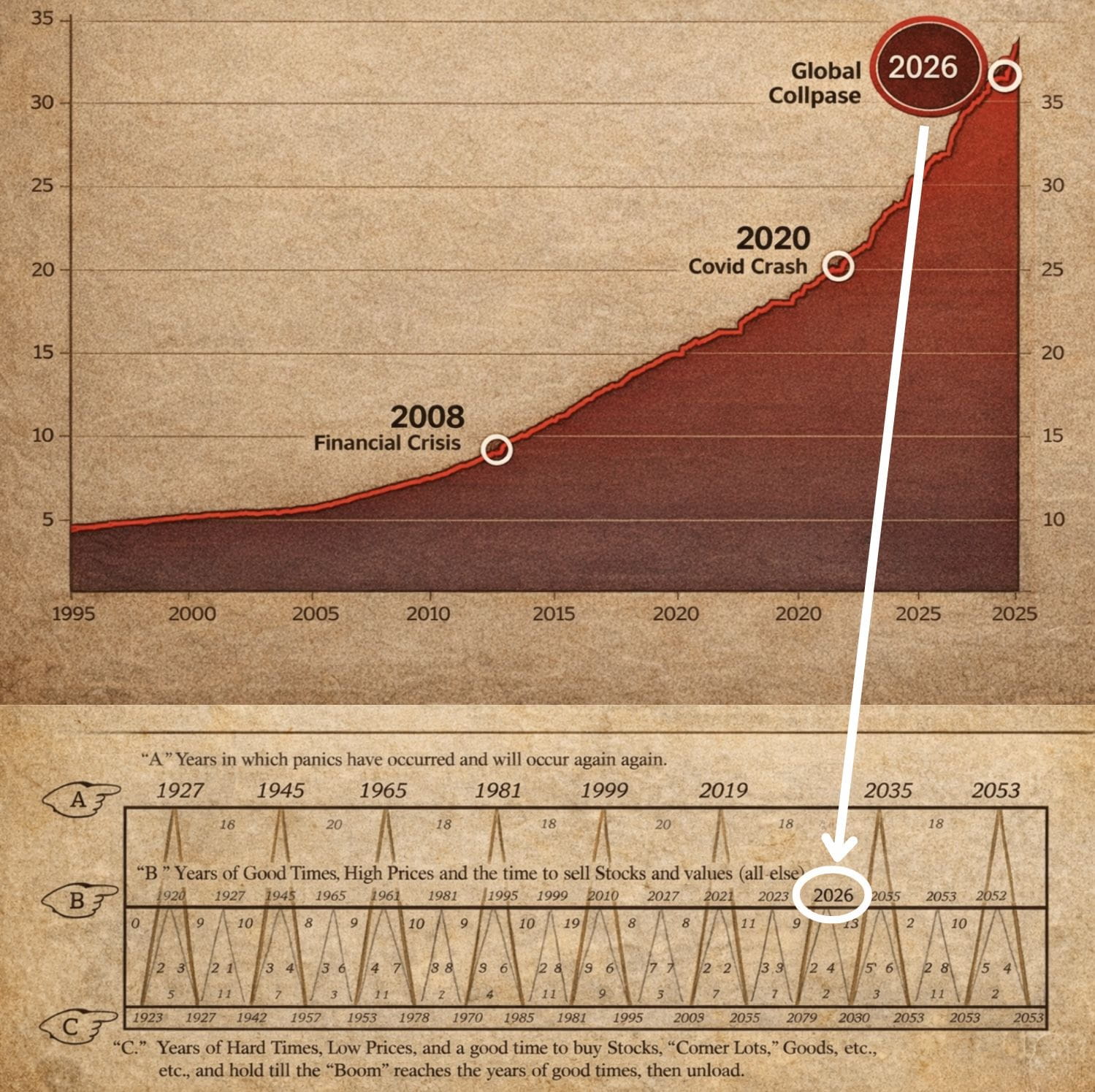

We’ve seen this movie before:

2000 → dot-com crash

2008 → financial crisis

2020 → repo market chaos

Every time, recession followed soon after.

The Fed is stuck in a trap.

If they print aggressively → metals surge and trust erodes.

If they don’t print → funding markets freeze and debt becomes unmanageable.

Risk assets can ignore this for a while — but not forever.

This isn’t just another market cycle. This is a balance-sheet, collateral, and debt crisis slowly developing in front of our eyes.

I’ve been deep into macro for nearly a decade, and I’ve called several major turning points — including the last $BTC $ATH $ETH .

If you want real, early warnings before mainstream headlines catch

on, stay tuned and keep notifications on.