I’m writing this as someone who has watched blockchains chase speed, hype, and attention for years, while real financial systems quietly waited for something more serious.Dusk did not begin with loud promises. Founded in 2018, it emerged from a simple but difficult question: how can financial markets move on public infrastructure without exposing everything to everyone, and without breaking the rules that institutions must follow?

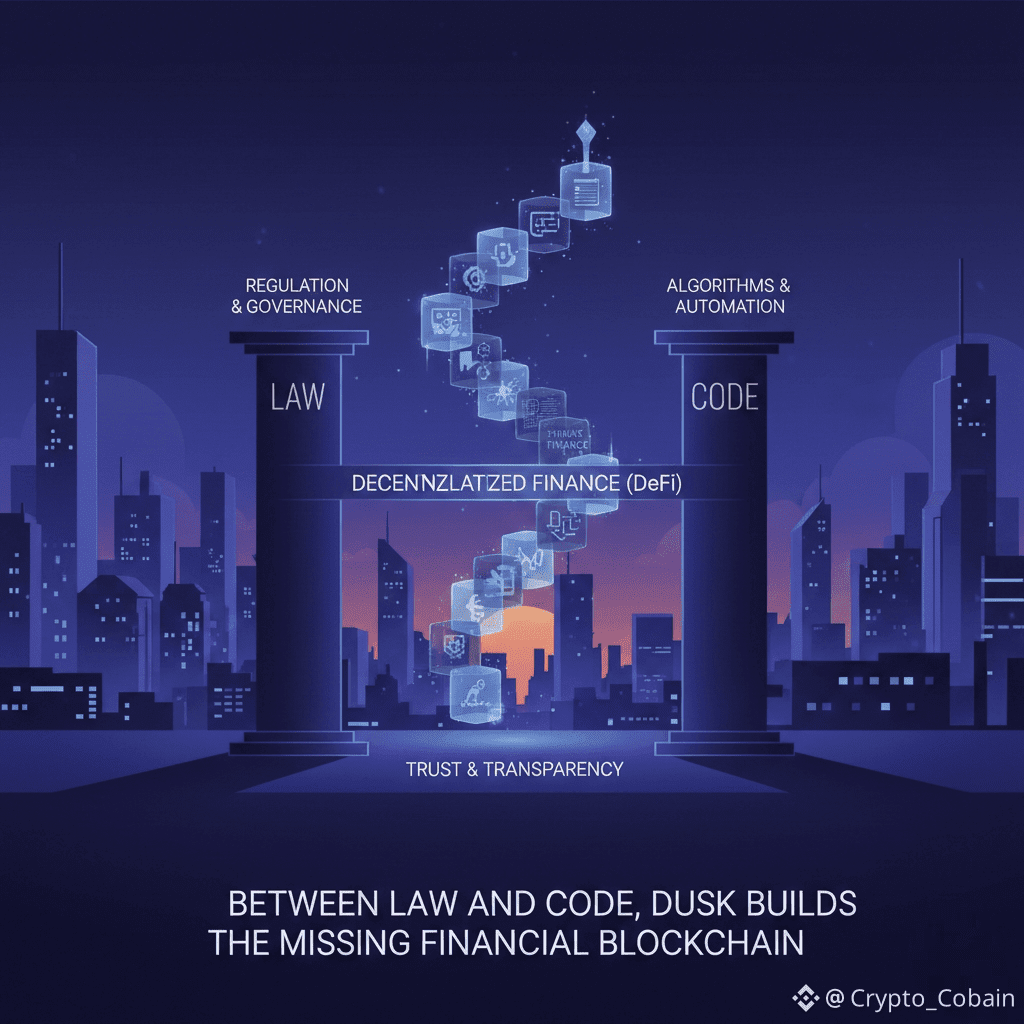

From the start,Dusk was shaped around regulated finance. Not retail speculation, not trends, but the slow, complex world of financial instruments, settlement systems, and real-world assets. Traditional markets depend on privacy, clear audit trails, and legal accountability. Most blockchains offered transparency without control. Dusk took the opposite path. It treated privacy and compliance as requirements, not obstacles.

The foundation of Dusk is its Layer 1 design. It does not rely on external chains to secure its core logic. Instead, it was built as a base layer where privacy is native and not added later. Transactions are designed so sensitive financial data stays hidden, while the system still proves that every action follows the rules. This balance allows institutions to operate with confidence while keeping regulators satisfied.

What makes Dusk different is its modular structure. Rather than forcing every application into one rigid model, the network allows financial builders to create systems that match real-world needs. Tokenized assets, compliant decentralized finance, and settlement tools can all be developed without exposing private data on a public ledger. At the same time, auditability is always available when required. Privacy is not secrecy. It is controlled visibility.

As I read deeper into Dusk’s architecture, it became clear that this is not a project built for shortcuts. Every design choice reflects the reality of regulated markets. Assets need clear ownership. Transfers need finality. Audits need accuracy. Dusk’s transaction model supports these demands while keeping sensitive information off public view. This is especially important for tokenized real-world assets, where legal rights and on-chain logic must align perfectly.

Dusk also acknowledges that institutions cannot simply abandon regulation. Instead of trying to bypass compliance, the network integrates it. Financial applications built on Dusk can meet regulatory standards without compromising confidentiality. This is a quiet but powerful shift. It allows blockchain systems to fit into existing financial frameworks rather than trying to replace them overnight.

Over time, Dusk has evolved from research into a functional infrastructure. Its growth has been deliberate. The focus has remained on building reliable tools, improving performance, and supporting long-term use cases. This is not a race for attention. It is an attempt to build something that lasts.

What stands out most to me is the discipline behind the project. Dusk does not promise to disrupt everything at once. It chooses a narrow but critical path: regulated finance that needs privacy, trust, and clarity. In a space full of noise, that restraint feels intentional and mature.

Dusk represents a different philosophy of blockchain development. One where financial systems are treated with respect, privacy is designed with purpose, and innovation works within the boundaries of reality. It is not trying to be loud. It is trying to be correct. And for the future of real financial infrastructure, that may matter more than anything else.