1️⃣ Asset Summary: River ($RIVER)

River ($RIVER) is an Ethereum-based token launched on 17 September 2025. Current on-chain metrics and derivatives signals suggest that RIVER has moved into a period of heightened speculative activity, shown by growing whale accumulation, upward price momentum, and a relatively concentrated holder distribution.

Key data highlights:

• Blockchain: Ethereum

• Token lifespan: ~121 days

• Data sources used: Bubble Map, Etherscan, DEX Screener, GMGN

• Audit rating: 45 / 100

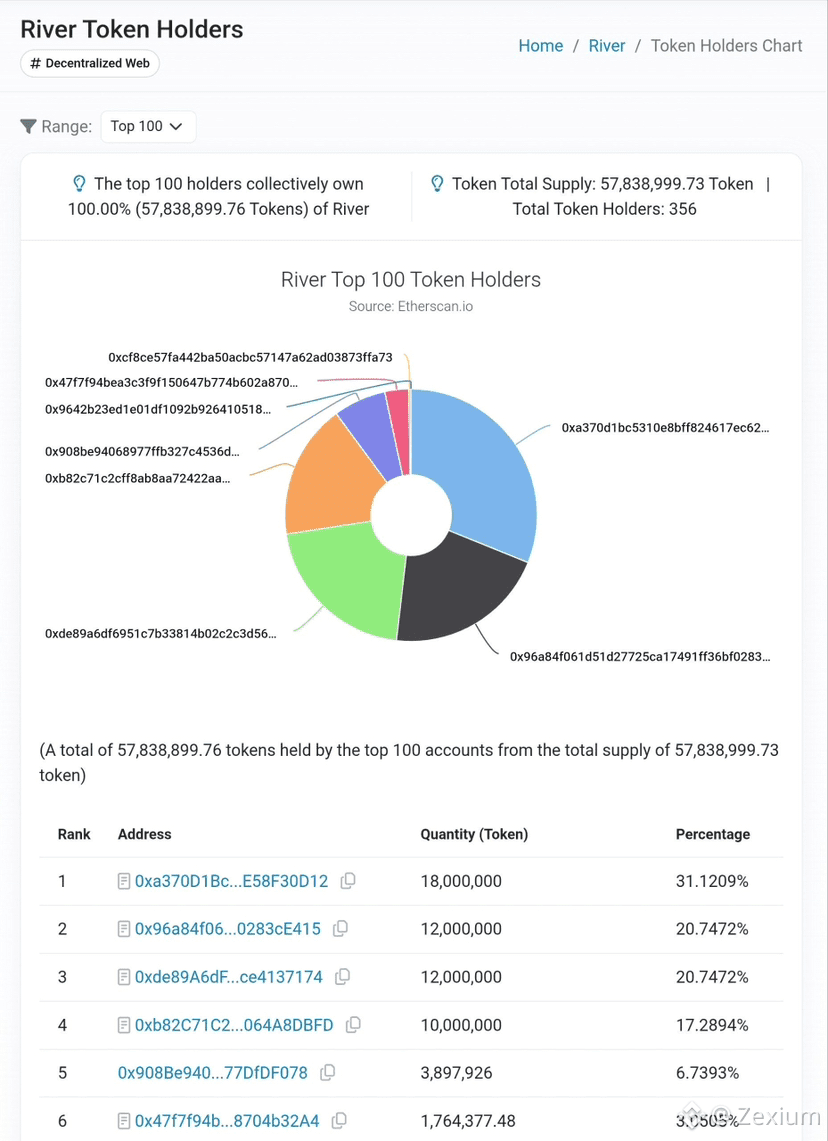

2️⃣ Holder Composition & Supply Breakdown

On-chain wallet data shows that RIVER’s token supply is extremely concentrated.

Total supply:

57,838,999.73 RIVER

Number of holders:

356 wallets

Major concentration findings:

The top 100 wallets control nearly 100% of the circulating supply

The top 4 wallets alone hold over ~70% of all tokens

Largest wallet balances:

18,000,000 RIVER (~31.1%)

12,000,000 RIVER (~20.7%)

12,000,000 RIVER (~20.7%)

10,000,000 RIVER (~17.2%)

👉 These figures indicate that RIVER is heavily centralized from a supply perspective.

As a result, price action is structurally dependent on the behavior of only a handful of wallets.

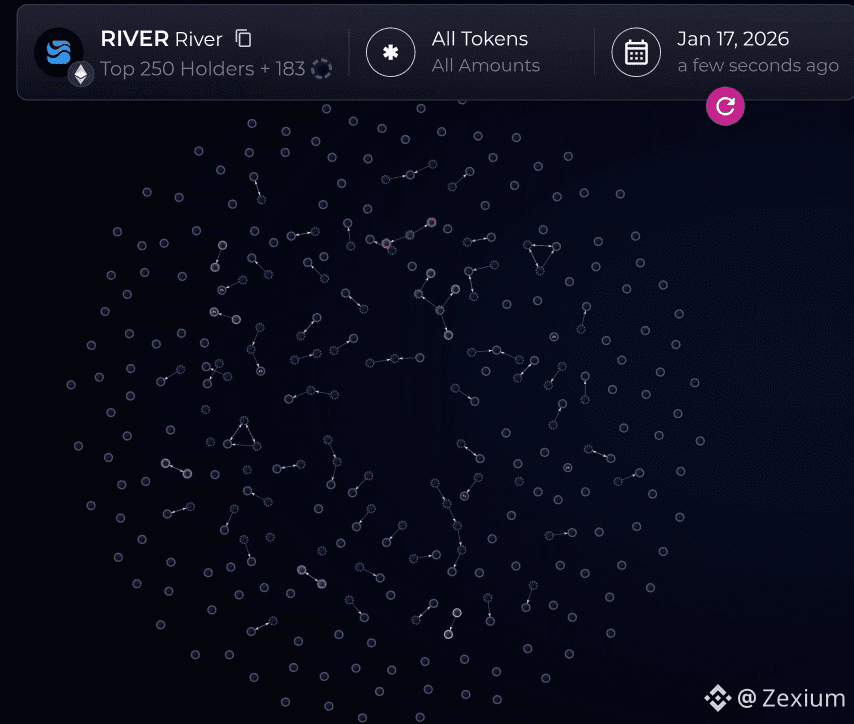

3️⃣ Wallet Network & Bubble Map Analysis

Bubble map visuals highlight:

Multiple interlinked wallet groups

Repeated micro-distribution behaviors

Several connected transaction trails

This kind of wallet structure is commonly associated with:

Coordinated wallet control

Liquidity management and routing

Internal token allocation networks

👉 These formations do not suggest misconduct, but they do point to a non-organic distribution pattern.

In setups like this, price movement is usually driven more by liquidity dynamics than by true market demand.

4️⃣ Derivatives Activity & Whale Exposure

Perpetual futures metrics on RIVERUSDT point to a clear dominance from large players.

Current price:

$29.90 (+9.20%)

Whale positioning overview:

Total whale capital: ~$32.39M

Long whales: 126 wallets — currently profitable

Short whales: 52 wallets — currently underwater

Exposure split:

Long-side exposure: ~$29.30M

Short-side exposure: ~$3.10M

Average entry prices:

Longs: $24.21

Shorts: $25.16

Unrealized performance:

Long PnL: +$5.57M

Short PnL: –$490K

👉 These figures reflect strong whale-controlled long bias, with the recent price increase being heavily supported by leveraged positions.

However, this structure also means:

⚠️ The market has become highly sensitive to liquidations.

Large price swings may increasingly result from forced position closures rather than natural trend strength.

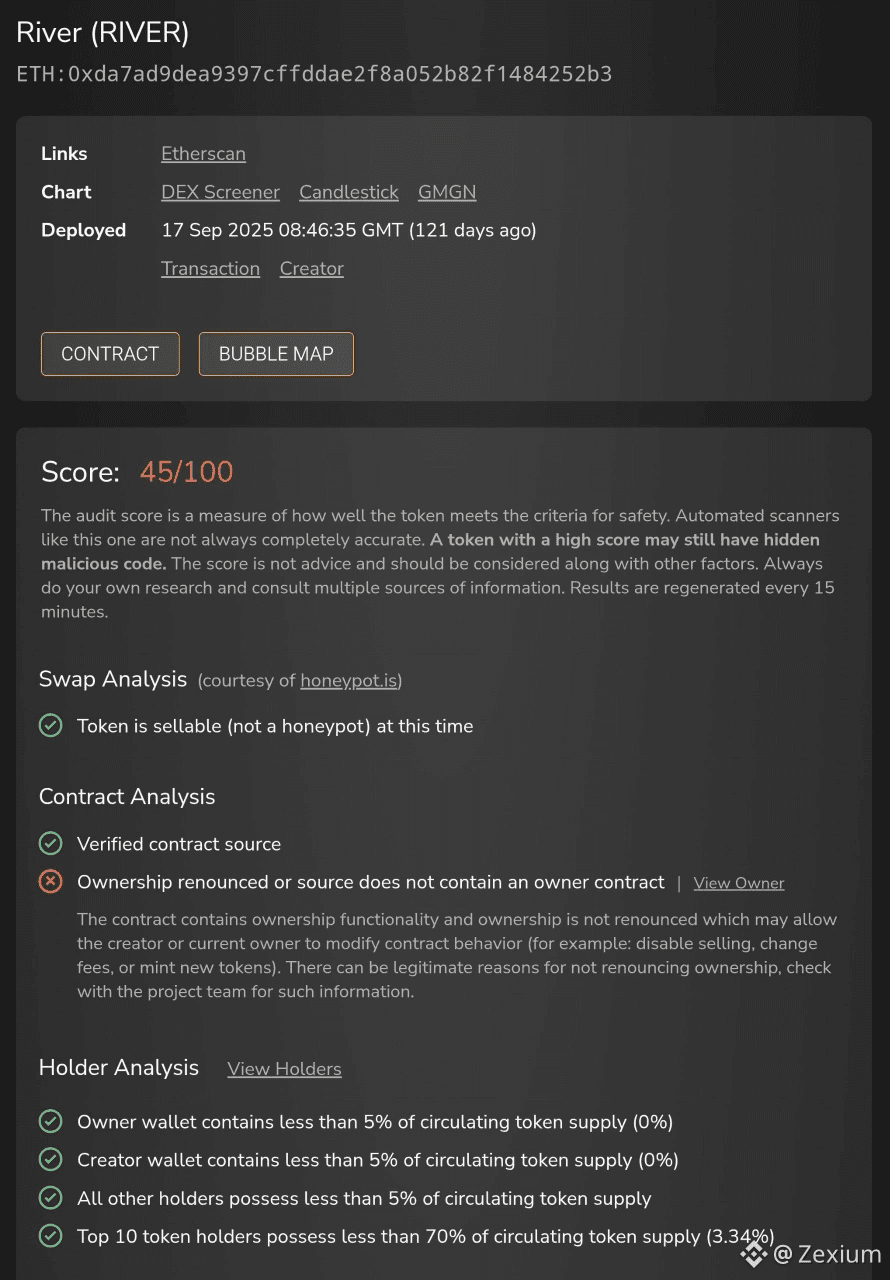

5️⃣ Contract Review & Safety Signals

Smart contract analysis shows a mixed risk profile.

Positive indicators:

✅ Source code is verified

✅ Token is currently transferable/sellable

✅ No honeypot behavior detected

✅ Deployer and owner wallets hold 0% of the supply

⚠️ Risk Indicators

⚠️ Ownership has not been renounced

⚠️ The contract still includes modifiable control functions

⚠️ Audit rating remains 45 / 100

This implies the smart contract may still technically permit changes such as:

Adjustment of fee parameters

Limiting or altering certain functions

Updates to internal contract logic

👉 From a governance and control standpoint, this places RIVER in a medium-to-high operational risk bracket.

6️⃣ Market Structure Assessment

When all data points are viewed together:

Token supply is heavily concentrated

Wallet behavior reflects coordinated network patterns

Whale accounts control the majority of leveraged positions

Contract control remains active and centralized

This produces a market setup where:

• Price behavior is wallet-influenced

• Volatility is trigger-driven

• Risk is embedded in structure, not only in code

👉 Markets with this configuration often move in distinct, aggressive cycles — rapid expansion, tight consolidation, and sudden repricing.

They typically reward:

Strong liquidity awareness

Precise execution and timing

Disciplined risk management

While penalizing:

Emotion-based entries

Excessive leverage

Slow or delayed responses

7️⃣ Strategic Risk Perspective

$RIVER currently operates within a high-control, high-volatility market framework.

Primary strengths:

Heavy whale involvement

Elevated speculative activity

Strong participation in derivatives markets

Primary risk factors:

Severe concentration of token holders

Contract ownership has not been relinquished

Liquidity remains centrally influenced

Increased vulnerability to liquidation events

👉 This is not a conventional supply-and-demand-driven asset.

👉 It functions instead as a liquidity-managed trading ecosystem.

8️⃣ Strategic Summary

RIVER fits the profile of a structure-dominated speculative instrument, where price movement is driven less by usage or adoption and more by capital flows, wallet influence, and leverage dynamics.

In markets like this, sustainability is not determined by chart patterns alone —

it is shaped by who holds the supply, who commands leverage, and when incentive structures change.