Dusk Network exists because finance has a problem most blockchains refuse to face. Markets need openness to function, but they also need privacy to survive. I’m not talking about hiding for the sake of hiding. I’m talking about protecting positions, balances, ownership structures, and business logic that can cause real damage if exposed. Dusk Network is built as a layer 1 where "privacy" is not decoration, it is infrastructure. They’re trying to answer a hard question: how do you run serious finance on a public chain without turning financial data into permanent public risk?

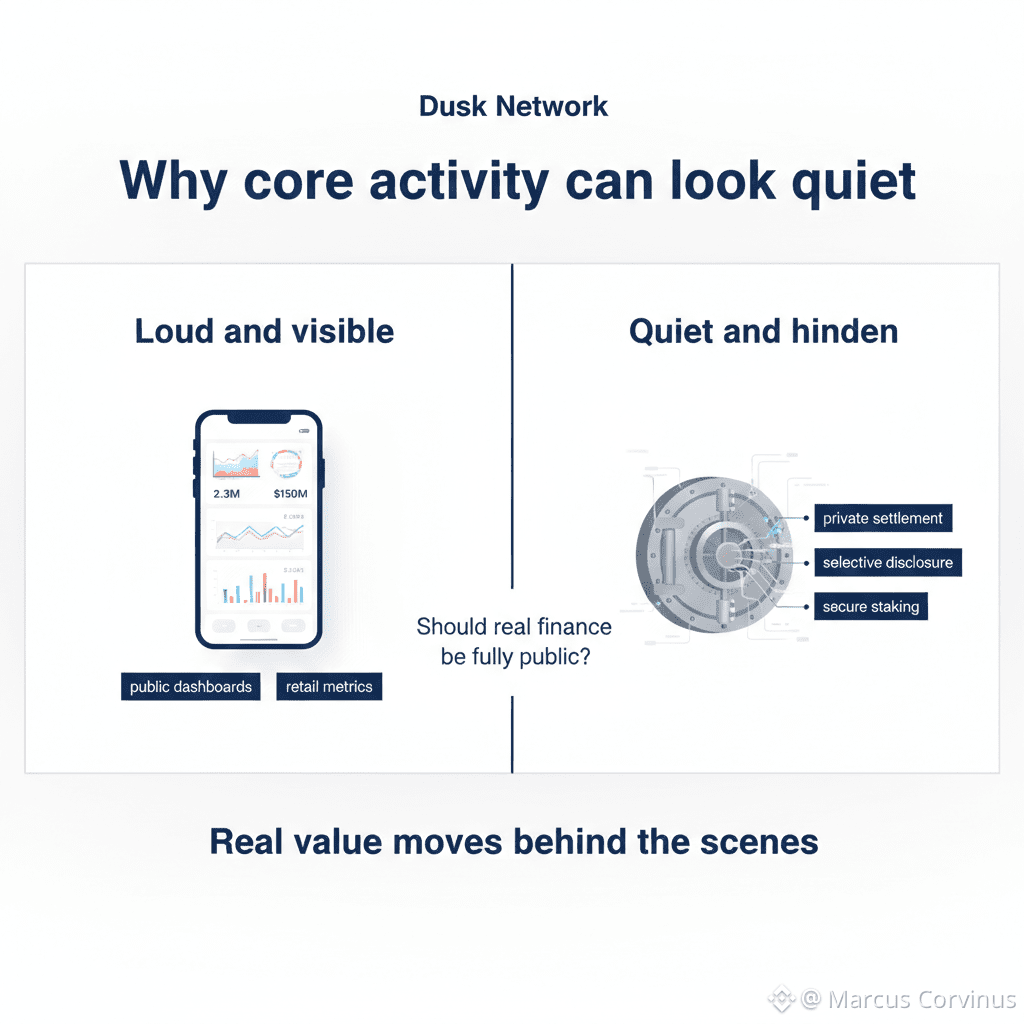

When I look at most public blockchains, I see systems designed around visibility first. Every transaction, every contract call, every balance change is recorded in the open. That makes verification simple, but it also creates a silent cost. Traders become predictable. Funds become traceable. Businesses become transparent in ways they never agreed to. If everything is visible forever, who really feels safe using the system at scale? This is the pressure Dusk Network is built under.

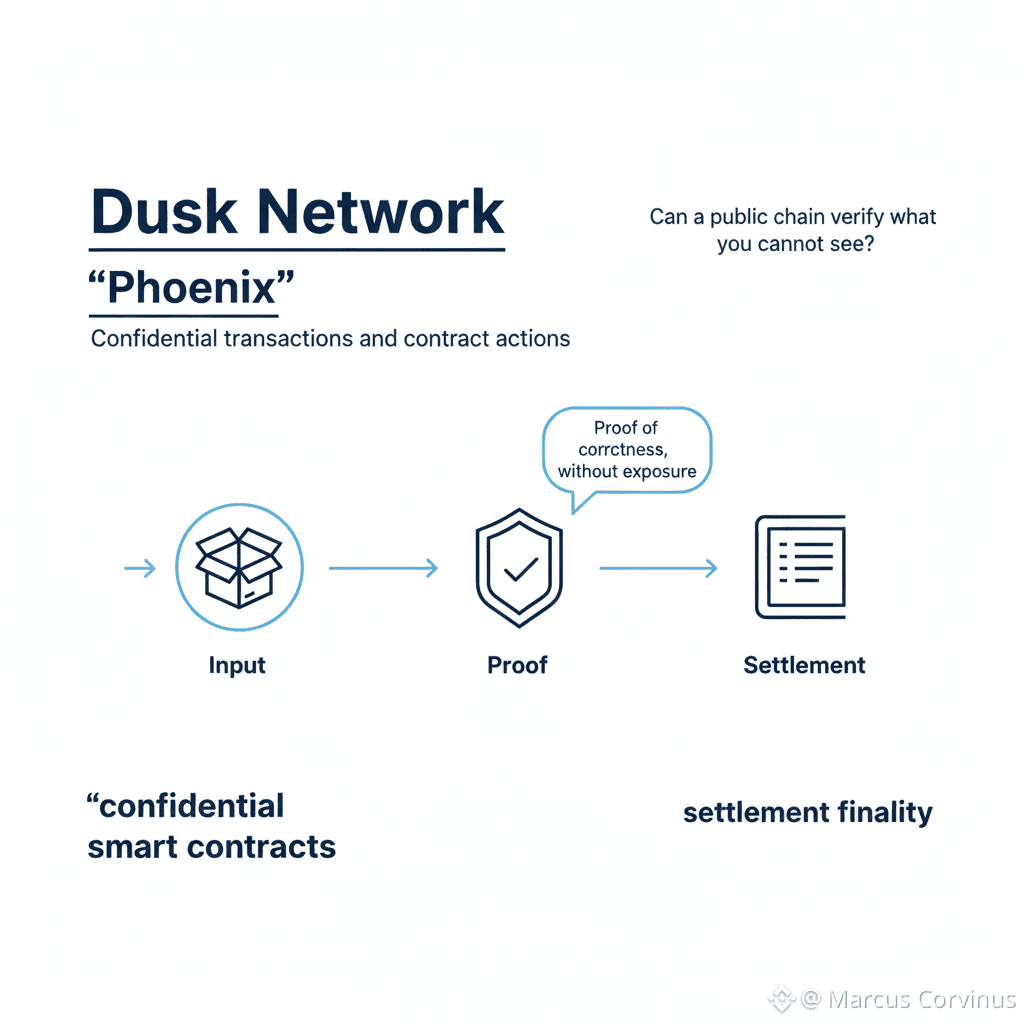

The project centers itself on "confidential smart contracts", which sounds abstract until you slow down and think about what contracts actually do. A smart contract is where decisions happen. It is where conditions are checked, balances are updated, and rules are enforced. On most chains, all of that logic runs in public. Dusk takes a different path. The idea is that a contract should be able to execute correctly while keeping sensitive inputs private, then produce proof that the rules were followed. The chain learns that something valid happened, without learning everything about how it happened. That single shift changes what is possible.

At the transaction level, this idea becomes concrete through "Phoenix". Phoenix is Dusk Network’s transaction model designed to support privacy and anonymity not only for transfers, but also for interactions with smart contracts. Why does that matter? Because privacy that exists only at the app level is fragile. If privacy is optional, users forget it. If privacy is complex, users misuse it. Phoenix tries to make confidentiality part of the normal flow of value, not a special mode you have to remember to turn on.

Privacy has another enemy that is easy to underestimate: "linkage". Even when amounts are hidden, behavior patterns can still connect actions over time. Timing, repetition, structure, all of these can slowly reveal identity. If privacy systems ignore linkage, they fail quietly. Phoenix is designed with the idea that privacy should reduce both direct exposure and indirect pattern leaks. If it does not, what is the point?

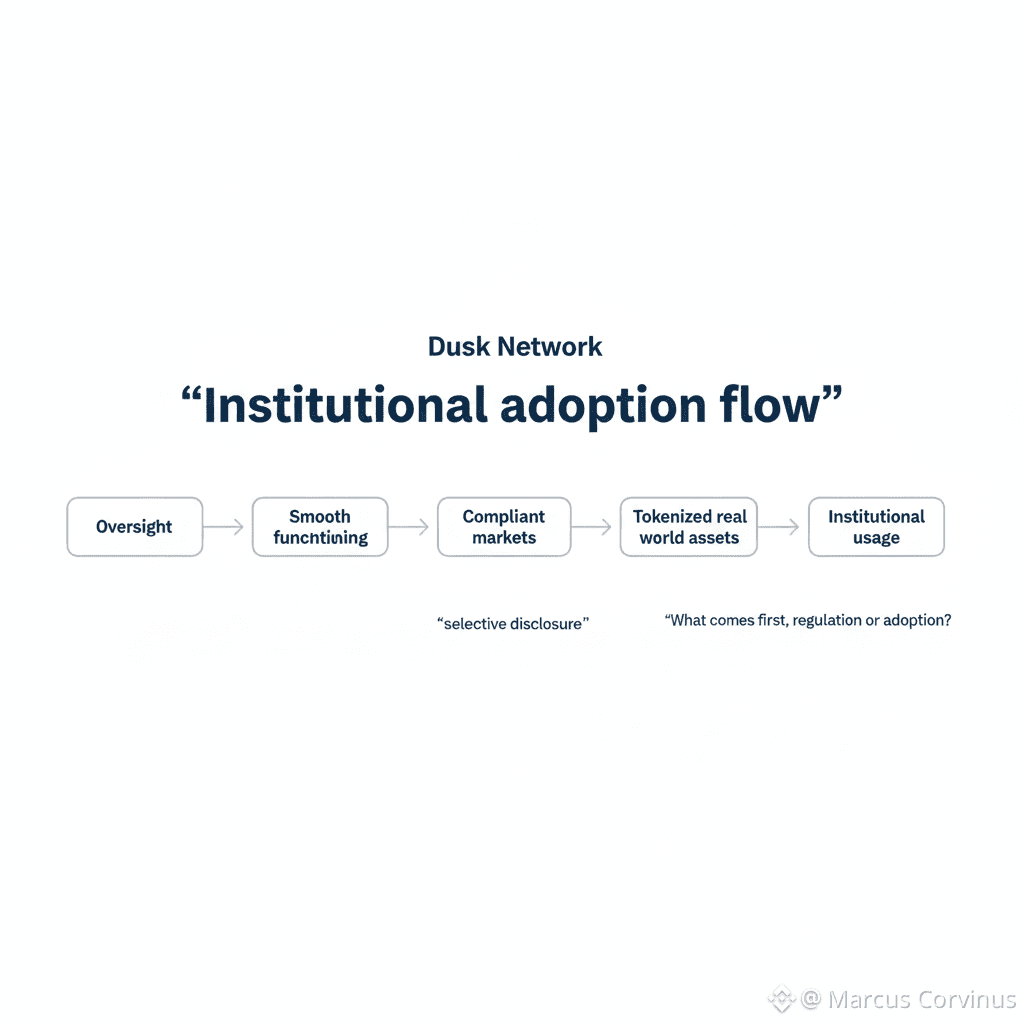

But finance is not only about moving value. It is also about assets with rules. This is where "Zedger" becomes critical. Security tokens are not cash. They come with constraints, who can hold them, who can receive them, and what happens when ownership changes. In many regulated systems, only approved participants can interact. Sometimes a receiver must explicitly accept an incoming transfer. Often, an issuer or authorized party must be able to reconstruct ownership at a specific moment in time. Why? Because dividends, voting, reporting, and audits depend on it. Without these features, tokenized securities remain theory.

Zedger is described as a hybrid privacy preserving model built on Phoenix and developed specifically for security tokens. The word hybrid matters. It means Dusk is not pretending regulated finance can work like anonymous cash. It accepts that some visibility is required, but only in controlled, limited ways. Users retain privacy in normal operation, while the system still supports "snapshot" reconstruction when it is legitimately needed. If privacy hides everything, regulators walk away. If transparency reveals everything, users walk away. Zedger exists because neither extreme works.

On top of this sits the "Confidential Security Contract" standard, known as "XSC". Standards are not exciting, but they are how systems survive. In finance, repetition is safety. Issuers want predictable behavior. Platforms want consistent logic. Reviewers want familiar structures. XSC is designed to standardize how privacy enabled security tokens are issued and managed on Dusk Network. It reduces the chance of fragile custom designs and makes it easier to reason about compliance and lifecycle behavior. If every security token behaves differently, risk multiplies. A standard reduces that risk.

Taken together, Phoenix, Zedger, and XSC form a coherent stack rather than isolated ideas. Phoenix handles private transaction flow. Zedger adapts that flow to regulated asset realities. XSC defines how confidential security logic should behave at the contract level. This is not about building one clever feature. It is about building an environment where financial applications can exist without leaking what should never have been public.

Privacy alone still does not make a financial system usable. Settlement matters. Finality matters. A trade that might be reversed is not a settled trade. Dusk Network places strong emphasis on transaction finality, aiming for a clear point where execution is complete and irreversible under network rules. Why does this matter? Because finance runs on certainty. Without finality, every downstream process carries risk. Can you really build serious markets without knowing when settlement is final?

There is also a quieter side to privacy at the network level. If block production or leadership patterns are easy to observe, attackers can target weak points. If validator behavior is too visible, influence can be mapped. Dusk’s design choices extend privacy beyond users and into how the network itself operates. This matters because privacy that stops at the wallet layer leaves the system exposed elsewhere. Should privacy protect only transactions, or should it protect the structure that secures them?

Then comes developer reality. Privacy technology can be correct and still fail if it is unusable. Builders need tools that let them write logic without drowning in complexity. Dusk’s approach includes execution environments designed to verify proofs efficiently, and a direction toward compatibility with familiar contract development styles. This is not about lowering standards. It is about lowering friction. If building confidential logic feels impossible, adoption never starts.

At the same time, there is a hard truth. Common contract environments assume public state. Privacy requires different assumptions. Bringing confidentiality into familiar execution models requires careful design. Dusk’s roadmap direction reflects this tension, trying to preserve privacy guarantees while making development approachable. If this balance fails, either privacy weakens or usability collapses. Can a system hold both?

Identity and compliance sit beneath everything. Privacy does not mean ignoring rules. In real finance, what matters is "selective disclosure". A participant proves they meet requirements without broadcasting personal data to the world. If a legitimate authority needs more information, there must be a controlled path to provide it. This reduces data exposure while still supporting oversight. Without selective disclosure, systems drift toward either surveillance or secrecy, and neither works for long.

When I step back, the focus of Dusk Network becomes clear. It is built for situations where transparency is not a virtue, but a liability. Tokenized securities need private ownership with enforceable rules. Institutional style financial applications need confidentiality around positions and parameters. Businesses need to operate without exposing internal flows. Markets need settlement certainty without revealing strategy. Can a public chain support all of that without breaking itself?

I’m not pretending this path is easy. It is not. If privacy proofs are too heavy, costs rise. If privacy is too light, trust breaks. If compliance controls dominate, the system feels closed. If controls are weak, serious issuers cannot participate. Dusk Network is choosing the hardest path, trying to keep privacy and order alive at the same time.

So what is Dusk Network really trying to be? I’m seeing a layer 1 designed to let finance exist on public infrastructure without forcing financial secrets into public memory. Using "Phoenix" to normalize private transaction flow, "Zedger" to respect regulated asset realities, and "XSC" to standardize confidential security behavior, the project is chasing a narrow balance. Privacy that does not reject rules. Rules that do not destroy privacy. If that balance holds, the result is not just another blockchain, it is a place where trust and confidentiality can coexist without canceling each other out.