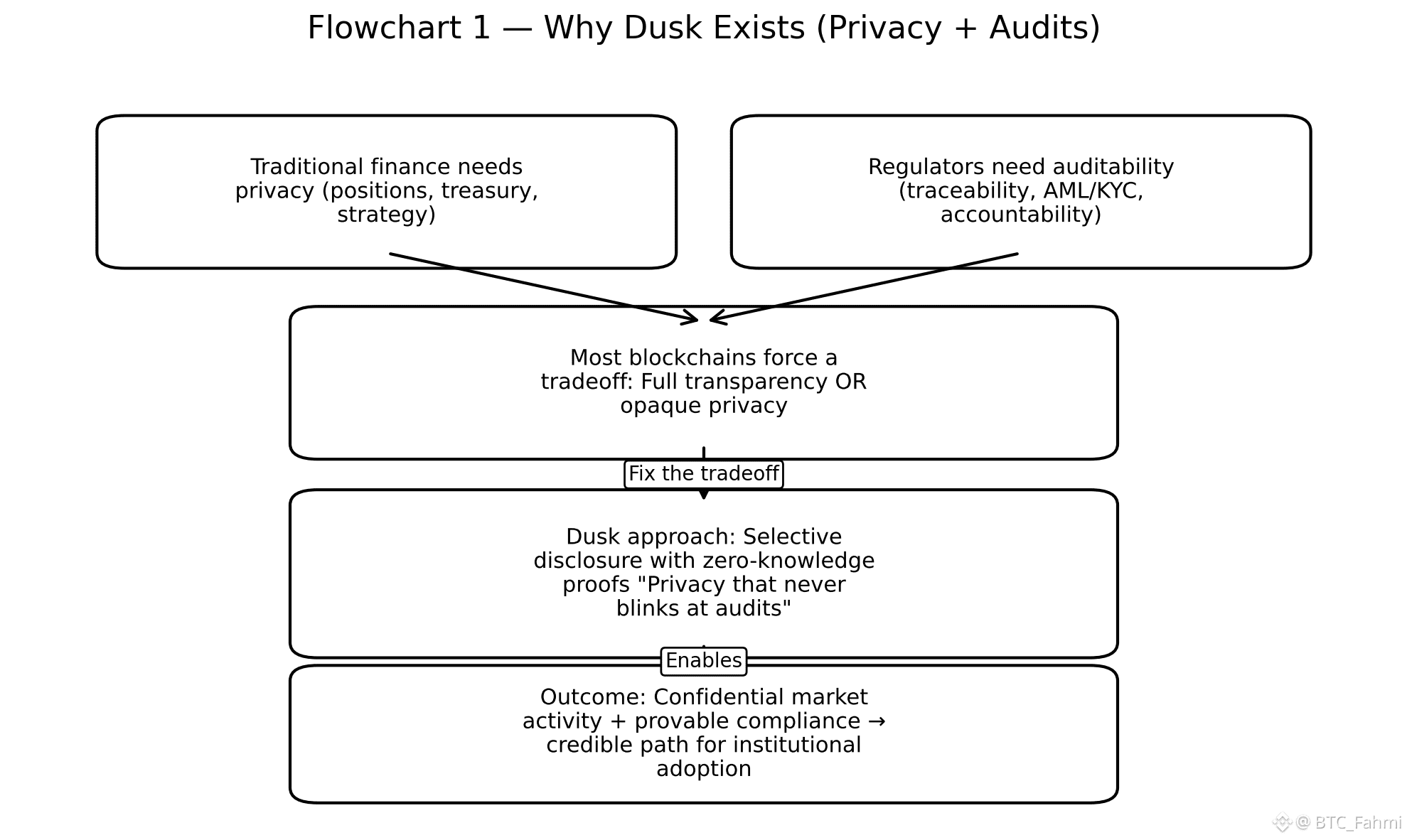

The first time I heard someone say “privacy is great until the auditor shows up,” it wasn’t in a crypto Twitter space. It was in a finance office, said casually, like it was a law of nature. And in traditional markets, it kind of is. Funds can’t run a strategy if every position is visible in real time. Companies can’t manage treasury if every move becomes a public signal. But regulators still expect traceability, accountability, and clean compliance. That tension is exactly where most blockchains feel awkward: they’re either radically transparent by default, or they hide so much that real institutions won’t touch them.

That’s why the line “Privacy that never blinks at audits” is such a sharp way to describe Dusk. It’s not a promise of invisibility. It’s a design goal: confidentiality where markets need it, with the ability to prove things when oversight demands it. And for traders and investors, that distinction matters more than most people realize, because it points directly to where adoption could realistically happen.

Dusk Network positions itself as a Layer 1 designed for regulated finance where privacy and compliance aren’t enemies. Instead of treating privacy as a bolt on feature, Dusk builds around selective disclosure using zero-knowledge proofs, aiming for a world where you can keep sensitive details private while still proving the transaction is valid, the participant is eligible, and the rules were followed. This is sometimes framed as “zero-knowledge compliance,” meaning you can satisfy AML/KYC and regulatory constraints without broadcasting personal data or business-sensitive transaction metadata to everyone watching the chain. Dusk itself describes this direction explicitly in its communications about privacy and institutions.

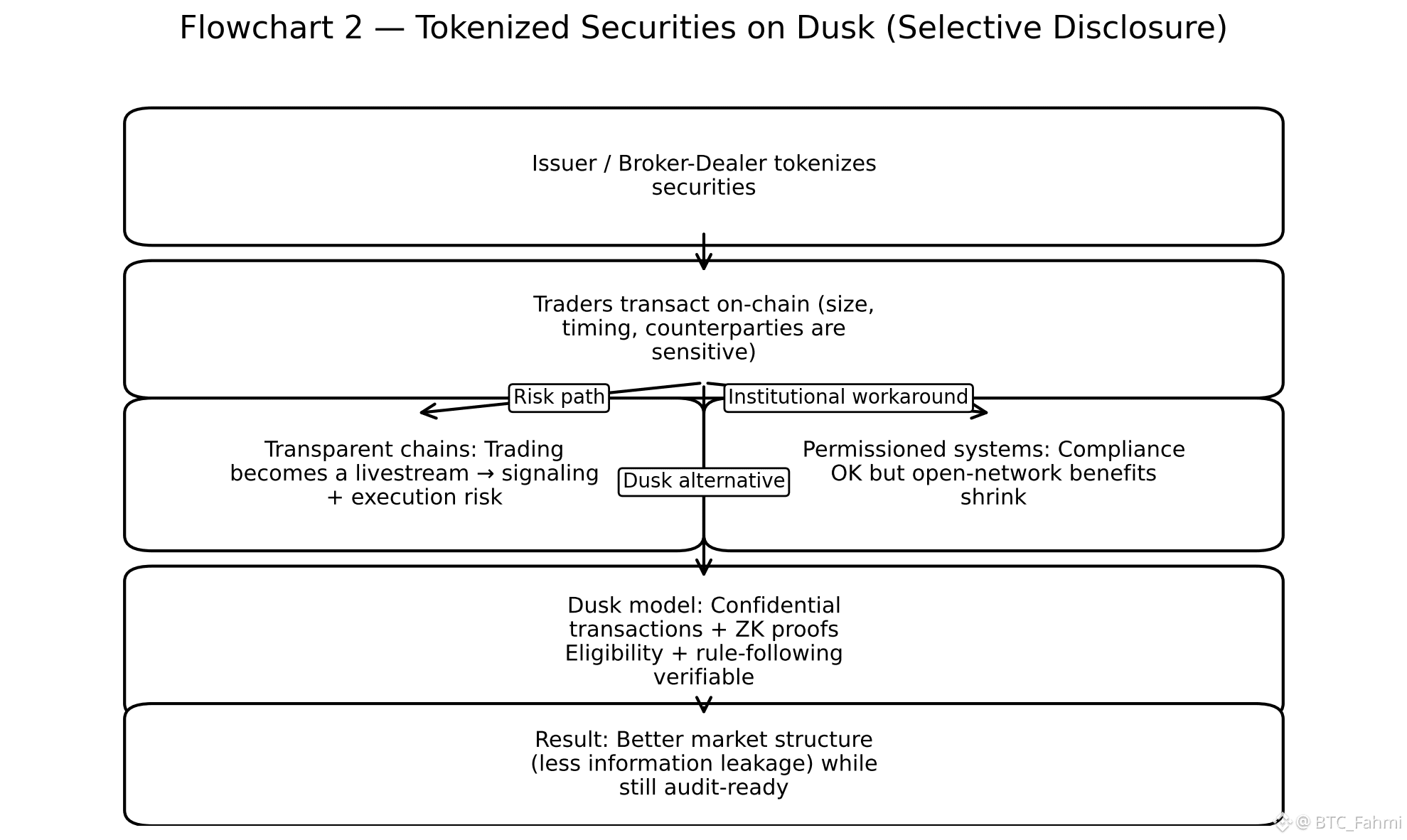

This is the subtle but important point: most traders talk about privacy like it’s only about hiding balances. Institutional finance thinks of privacy as protecting market structure. In public chains, even if you don’t publish names, wallet-level transparency creates a surveillance layer. Counterparties can infer behavior. Competitors can track flows. Market makers can see patterns. That’s not a theoretical risk. It changes execution quality and it changes incentives. If you’ve ever noticed how whales split orders, use intermediaries, or route through different venues to avoid signaling, you already understand why full transparency is not “fairness,” it’s often just forced information leakage.

Dusk’s architecture is meant to address this in a way that still remains compatible with supervision. Their whitepaper frames the protocol as having native support for privacy-preserving transactions and compute with zero-knowledge primitives, designed to provide strong finality guarantees as financial settlement requires. Their broader narrative is consistent: markets want privacy as normal behavior, not as a suspicious exception, but regulators need assurance. The only way you get both is by enabling proofs without exposure.

A simple real-world example makes this click. Imagine a broker-dealer issuing tokenized securities, and clients trading them on-chain. The trades themselves contain information: size, timing, counterparties, sometimes even strategy. In traditional markets, those details are not a public livestream. If you replicate the same security on a fully transparent chain, you basically force every participant to trade while being watched. So the institutional choice becomes obvious: either don’t use the chain, or only use it in a heavily permissioned way that kills the open-network advantage. Dusk’s bet is that selective disclosure lets regulated markets stay regulated without turning the marketplace into a glass box.

What makes this more than philosophy is the timing. The broader trend in crypto right now is not purely “more DeFi,” it’s infrastructure maturing around tokenized assets, settlement, and regulated issuance. Whether someone likes it or not, regulation is not going away. The EU’s MiCA framework and experiments like the DLT Pilot Regime push the conversation toward compliant on-chain systems, not anonymous ones. And Dusk has clearly aimed its messaging at this intersection, framing privacy as a requirement for adoption rather than a political statement.

From an investor perspective, what you’re really evaluating is whether there’s a credible “category” here. Privacy chains exist. Compliance-first chains exist. But the overlap privacy and auditability, designed specifically for regulated finance is less crowded than it sounds. That doesn’t guarantee anything, but it does define a niche that isn’t just narrative, it’s tied to actual constraints in how securities, funds, and settlement rails work.

There’s also a trader’s lens that matters: market structure. If Dusk’s design succeeds, it could enable venues where participants can trade without broadcasting their entire intent to competitors, while still preserving integrity and preventing obvious abuse. That sounds like a small difference until you remember how much of trading is about information asymmetry. Most people don’t lose because they were wrong about direction. They lose because they got detected, copied, front-run, or squeezed. Transparency increases those risks. Privacy reduces them. But only if the system still produces trust, finality, and enforceable rules.

In terms of “real-time” context, DUSK is currently trading around the low $0.20 range with large daily volume relative to its market cap, suggesting heightened speculation and attention. That doesn’t tell you fundamentals, but it does tell you something about positioning: the market is treating Dusk as part of the privacy-plus-infrastructure conversation, not just as another small-cap L1.

My honest opinion is this: the most believable path for privacy in crypto is not “hide from the system.” It’s “work with the system without exposing everything.” The world doesn’t need chains that blink and panic the moment an audit request comes in. It needs networks where confidentiality is normal, and compliance is provable. If Dusk can keep building toward that balance and attract issuers who actually need it then it’s not competing for attention. It’s competing to become boring infrastructure. And in finance, boring infrastructure is often where the real money ends up living.