@Dusk There’s a moment every team building for finance eventually runs into: you realize that “being on-chain” doesn’t magically make you safe. It makes you visible.

Visibility isn’t the same as truth. “Transparency” often means people want proof that calms fear—logs, timestamps, records everyone can check. But if that proof requires you to expose sensitive business information, then the system turns compliance into a disadvantage. The problem is, if the only way to prove you did things right is to publicly reveal business secrets, then you’re being asked to trade your privacy—and your edge—for compliance. Dusk Network exists inside that uncomfortable trade, and it doesn’t pretend the trade is clean.

If you live close to regulated money, you start noticing how much of “trust” is actually made of small, repetitive acts that nobody celebrates. A reconciliation that doesn’t break. A settlement that doesn’t need a phone call. A disclosure that answers exactly what it must, and nothing more. Dusk’s core promise is not that everything becomes private or that everything becomes open; it’s that you can prove the right things to the right people, while keeping ordinary market life from turning into a public performance. That sounds abstract until you’ve watched a counterparty hesitate because they don’t know what a shared ledger might accidentally reveal.

The hard part is that compliance is not a single rule you satisfy once. It is a relationship with scrutiny. It comes in waves, often when the system is already under stress—when markets move fast, when reporting deadlines collide, when a dispute breaks out between what one database says and what another system insists is true. In those moments, privacy isn’t about hiding wrongdoing. Privacy is about protecting innocent positions from becoming weaponized. It’s about preventing “who traded what” from turning into “who can be pressured,” “who can be front-run,” or “who can be punished for being early.”

That’s why the timeline of Dusk’s move to mainnet matters more than people think.

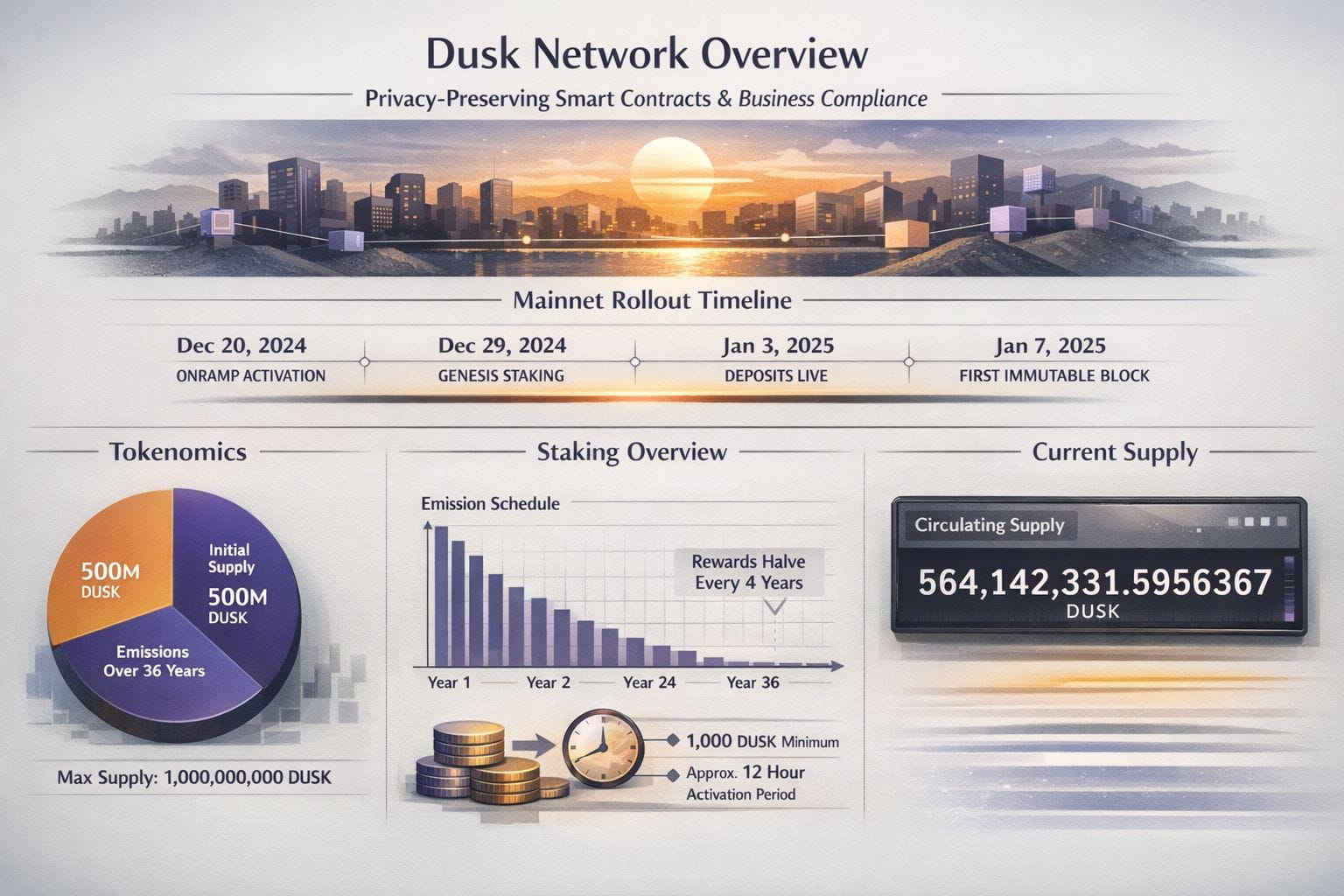

Around mid-2024, Dusk put a mainnet date out in public—and then did something most projects avoid: they admitted regulatory changes made them rebuild parts of their stack to satisfy institutions and exchanges. That’s not a marketing angle. It’s what happens when you’re serious about compliance: you treat the rulebook as alive, not as something you pretend doesn’t exist. By late December 2024, they laid out the launch in stages—onramp activation, early staking into genesis, deposits going live, and a target for the first permanent block on January 7. You can hear the seriousness in that word “immutable.” It’s not a feeling. It’s a duty.

People who haven’t had to ship systems that institutions rely on sometimes underestimate what a staged rollout is really for. It’s not just operational convenience. It’s a way of turning a chaotic moment into a series of smaller, reviewable moments. You don’t want your first day of full economic activity to also be your first day of discovering how edge cases behave. When you’re building privacy-preserving smart contracts that still have to satisfy business compliance, you’re basically designing a world where mistakes can be contained, explained, and corrected without turning into a scandal. A careful rollout is part of that emotional safety. It tells serious users: we expect reality to be messy, and we are not gambling with your reputation.

Then there’s the token, because incentives are where good intentions either become durable or collapse into theater. Dusk’s documentation is unusually direct about supply: an initial 500,000,000 DUSK, plus another 500,000,000 emitted over 36 years, for a maximum of 1,000,000,000. That number is not just a statistic. It’s a long-term promise about how the network plans to pay for honesty, participation, and uptime when transaction fees alone can’t carry the burden yet. The emission schedule is not framed as a short sprint; it’s framed as a decades-long arrangement where rewards decline in a structured way every four years.The human consequence of that design is subtle but real: it discourages the culture of “extract fast, leave faster,” because the system is explicitly paying reliability across time, not just attention in the first cycle.

Even the texture of staking in Dusk reads like it was written by people who have watched users panic. There’s a minimum of 1,000 DUSK to participate, and your stake doesn’t become active instantly—it matures after two epochs, described as about 4,320 blocks, roughly 12 hours at the documented average timing.That waiting period sounds like friction until you realize what it prevents: it reduces the “hot money” behavior where people swing in and out the moment they feel fear, and it gives the system breathing room to stabilize participation. In finance, the most dangerous systems are the ones that let everyone change their mind at the same instant.

The incentives behind block rewards are also telling. Rewards are not framed as a single winner-takes-all event; they’re divided across roles, and part of the reward can be burned if it isn’t properly earned.That kind of structure is less about punishment and more about shaping attention: it nudges participants to do the unglamorous work of including and validating what the network needs to remain coherent under load. When systems break, they usually don’t break because a single actor is evil. They break because too many actors decide the boring work is someone else’s job.

And Dusk is careful about how it discourages misbehavior.

Rather than making “one strike and you’re finished” the standard, the docs describe a setup where serious mistakes or long outages can reduce your participation and rewards for a time, instead of instantly burning your stake. That sounds technical, but it changes how people act. If every error feels like a death sentence, operators will hide problems. If the network can apply real pressure without ending someone’s career, it creates a culture where people admit issues sooner—and that honesty makes the whole ecosystem stronger.People still have to behave, but they’re less incentivized to lie about what happened.

The phrase in your title—privacy-preserving smart contracts that satisfy business compliance—only becomes real when you imagine the kinds of arguments businesses actually have. Not the clean “did the transaction occur” arguments, but the messy ones: the invoice that was approved on one system and rejected on another, the settlement instruction that was sent twice because someone panicked, the trade that looks suspicious until you understand a legitimate hedge behind it. In those situations, the blockchain can’t just be a log. It has to be a referee that can show enough truth to resolve the dispute, without exposing everything to everyone.

This is where Dusk’s approach feels different in spirit, even if you avoid the temptation to treat it like a catalog of components. The architecture, as described in documentation, separates the parts of the system that decide what is final from the parts that execute application logic, so that upgrades and new execution paths don’t automatically threaten the base guarantees.The emotional impact of that separation is confidence. It’s the feeling that “we can build what we need” doesn’t have to mean “we are risking the foundations.” For businesses, that matters because their fear is rarely about innovation itself; it’s about unpredictable knock-on effects.

Another detail that quietly signals maturity is token migration. Dusk’s token began its life represented on other chains, and the documentation explicitly frames mainnet being live as the point where users can migrate to native DUSK through a dedicated mechanism.That matters because compliance is partly about jurisdiction and control: institutions want clarity about what ledger is the source of truth, and what asset representation is canonical. The longer a project lives with ambiguous “real” versus “wrapped” representations, the more room there is for operational mistakes that become legal problems. Migration is not just technical housekeeping; it’s the work of choosing one reality.

And if you want a single data point that captures the present tense of Dusk’s economy, there’s the circulating supply endpoint the project itself points to. As of the value currently served there, it reads 564,142,331.5956367. It’s a strangely human number—precise, not rounded, not a slogan. It reminds you that real economies are made of continuous flows, not neat charts. For anyone building applications on top, that kind of visibility into supply is part of operational trust: it’s one less thing you have to “assume,” and one more thing you can verify when people start asking uncomfortable questions.

supply.dusk.network

The real challenge for Dusk, and for anyone trying to build privacy with compliance, is that these goals collide most violently during conflict. Imagine a market event where liquidity dries up and participants are scared. In that world, private positions become targets, and rumors become weapons.

Total exposure can turn each move into a market signal and fuel anxiety. Total hiding does the opposite kind of damage: compliance and risk teams feel in the dark, and being in the dark is unacceptable when funds are moving Dusk is designed around the idea that neither extreme is acceptable if you want serious finance to show up and stay.

What I respect most about the project’s recent communications is not any single claim, but the pattern: decisions are explained in the language of requirements, rollout steps are described with dates and operational sequencing, and token economics are laid out with long-run math rather than vague optimism. The mainnet rollout plan described specific milestones—December 20 activation steps, December 29 genesis staking, January 3 deposit availability, January 7 operational mode and first immutable block.

Dusk’s tokenomics sets a hard cap of 1,000,000,000 DUSK, with rewards emitted over 36 years and reduced every four years. That level of structure is what builders look for, because planning requires rules and limits—not just motivation.

The strongest infrastructure is the kind that fades into the background because it works. Dusk wants to be that for regulated finance—showing that privacy isn’t against compliance, and compliance doesn’t have to come at the cost of dignity.Dusk Network is aiming for that steady role in a world where privacy doesn’t have to fight compliance, and compliance doesn’t have to strip away dignity. It’s a network built for the days when someone makes a mistake, when two sources disagree, when incentives tempt people to cut corners, and when a market moves fast enough to make everyone slightly afraid.

When it really counts, reliability isn’t a flex. It’s care. And with time, I’ve come to value that care—real constraints, real timelines, and fair economics—more than hype or spotlight.