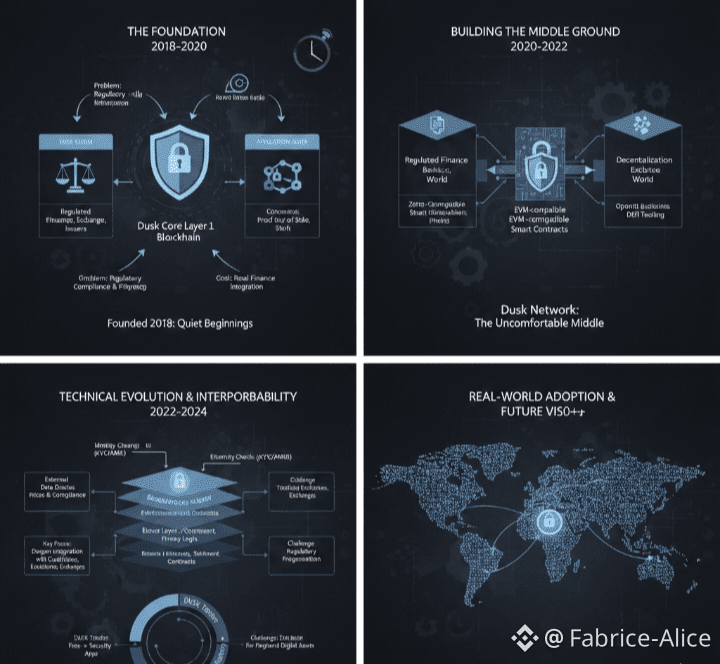

@Dusk Network is not a blockchain designed to stand out through noise or hype. Launched in 2018, the project began with a narrow but difficult problem: how can blockchain technology be applied to real financial markets without conflicting with existing legal and regulatory frameworks? Most blockchains emphasize openness and complete transparency, but traditional finance operates very differently. Financial institutions require privacy, identity verification, controlled data access, and verifiable audit processes. Dusk was created to operate precisely at this intersection, where decentralization must coexist with regulation.

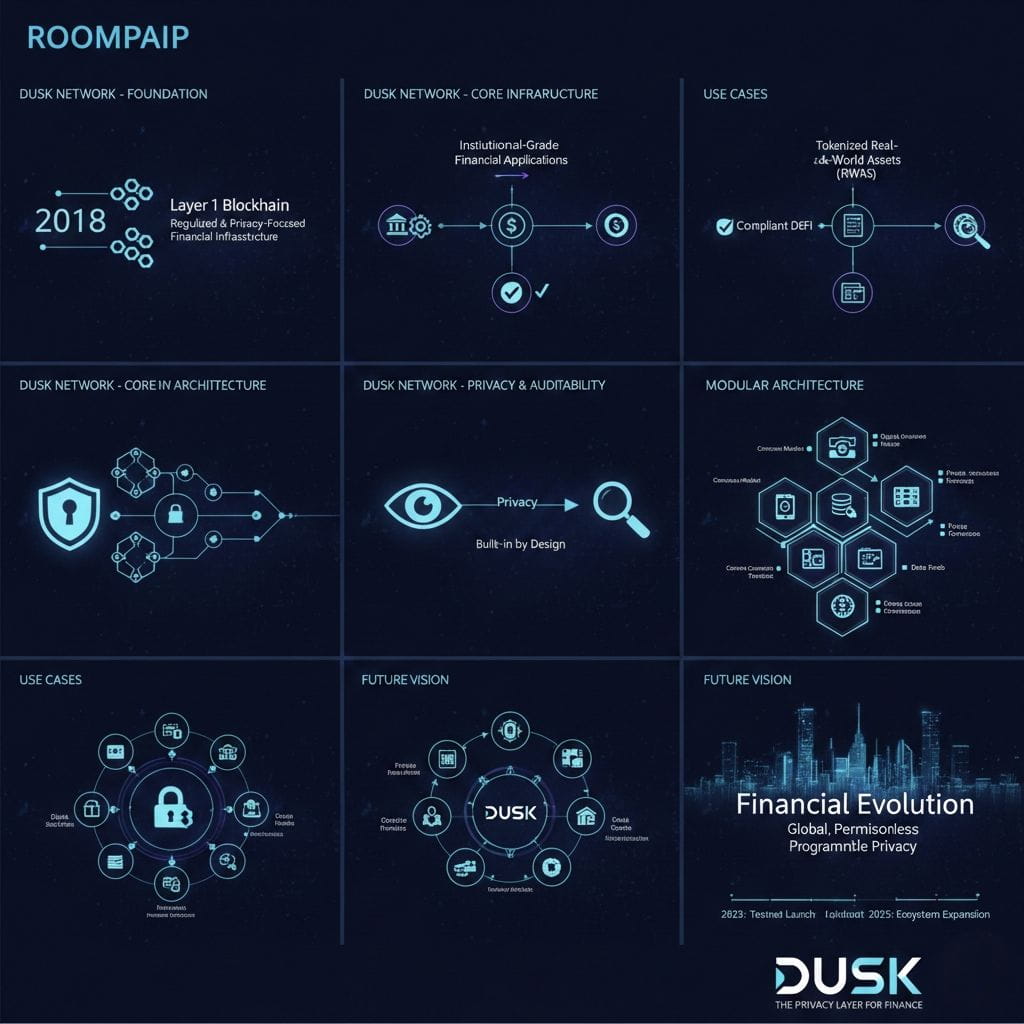

At a foundational level, Dusk is a Layer 1 blockchain purpose-built for financial assets that are subject to legal oversight. These include equities, debt instruments, investment funds, and other regulated products. On typical public blockchains, transaction data and balances are visible to anyone, which may work for experimental DeFi use cases but is unsuitable for institutions managing confidential information. Dusk’s defining approach is to treat compliance and privacy as core design principles. Transactions are designed to remain confidential to the public while still being provable and inspectable by regulators, auditors, or other authorized entities. The project’s central goal is to manage this balance more effectively than existing blockchain platforms.

From a technical perspective, Dusk adopts a modular design rather than concentrating all functionality into a single layer. The base protocol is responsible for consensus, transaction settlement, and privacy-preserving logic. Built on top of this is an execution environment compatible with Ethereum. As a result, developers can deploy smart contracts using familiar Ethereum tools and languages, while the underlying Dusk infrastructure enforces privacy and regulatory constraints. This design choice reduces friction for teams already experienced with Ethereum but seeking stronger guarantees around confidentiality and lawful operation.

Privacy within Dusk is not intended to obscure activity entirely. Instead, it focuses on selective and controlled transparency. The network relies on cryptographic proof systems that allow transactions to be verified without exposing sensitive information such as transaction values, participant identities, or asset ownership. At the same time, these transactions remain auditable. When oversight is required, specific data can be disclosed without revealing the entire transaction history to the public. This selective disclosure model aligns closely with the legal requirements financial institutions must meet.

Dusk’s consensus mechanism is based on proof of stake and is optimized for speed and certainty. Transactions reach finality quickly, and once confirmed, they are not reversed. This predictability is essential in financial environments where settlement risk can be costly. Rather than employing severe slashing penalties, Dusk uses a more moderate incentive structure. Validators who fail to perform correctly lose rewards instead of having their staked assets confiscated. This approach is intended to promote long-term stability and participation without exposing professional validators to excessive risk.

The DUSK token serves several essential functions within the ecosystem. It is used to pay network fees, execute and deploy smart contracts, and secure the network through staking. Validators lock up DUSK tokens to participate in consensus and earn rewards in return. New tokens are gradually introduced as staking incentives, following a declining issuance schedule designed to support long-term network security while limiting inflation. The economic model is relatively simple: users pay fees in DUSK, validators receive those fees and rewards, and in return they maintain the integrity of the network.

Rather than positioning itself as a competitor to the broader blockchain ecosystem, Dusk aims to complement it. Its Ethereum compatibility allows integration with existing DeFi tools and developer workflows. The DUSK token is also available across multiple chains through bridging solutions, improving liquidity and access. In addition, the network supports integration with oracle providers and external data sources, enabling real-world information such as pricing or compliance data to be safely incorporated into on-chain financial applications.

Dusk’s most compelling value proposition emerges in real-world deployments. A notable example is its collaboration with regulated financial institutions in Europe, including a fully licensed stock exchange in the Netherlands. These initiatives focus on issuing and trading tokenized securities on-chain under full regulatory supervision, with Dusk acting as the settlement and privacy infrastructure. These are not experimental pilots but live systems involving licensed entities, custodians, and legally recognized financial instruments. In these cases, Dusk operates in the background, providing compliant settlement and ownership tracking rather than serving as a consumer-facing platform.

This emphasis on regulated finance explains why Dusk’s development trajectory differs from that of many crypto projects. Progress is slower, partnerships take longer to finalize, and advancement often depends on regulatory approval rather than purely technical execution. While this cautious pace limits rapid expansion, it also creates durability. Once a blockchain system is embedded within regulated financial workflows, it becomes difficult to replace, unlike many speculative DeFi applications.

However, challenges remain. Regulatory standards differ significantly across regions, and solutions that work in Europe may not translate seamlessly to other jurisdictions. Competition is growing from both enterprise-focused blockchain platforms and public networks introducing compliance-oriented features. Observers also continue to monitor validator decentralization and token distribution. Additionally, Dusk must consistently demonstrate that its cryptographic privacy systems are secure, reliable, and sufficiently transparent for auditors and regulators.

Looking forward, Dusk’s success will depend more on execution than on market excitement. Its long-term objective is clear: to become core infrastructure for regulated digital assets. Achieving this requires deeper collaboration with exchanges, custodians, and financial institutions, alongside ongoing improvements to its privacy and compliance tooling. As global interest in tokenized real-world assets increases, there will be demand for blockchain systems that regulators are willing to approve. Dusk’s strategy assumes that caution, structure, and compliance can be competitive advantages.

In an industry often driven by speed and speculation, Dusk follows a deliberately restrained path. It focuses on building foundational infrastructure rather than consumer-facing products or narratives. If the project succeeds, it may never resemble a typical crypto success story. Instead, it could quietly underpin parts of the financial system that most people never directly encounter—fulfilling the role it was designed to play from the beginning.