"Hey Bro, I always wonder about Perpetual Contracts on Crypto. What's that bro? Are they Different from Futures?"

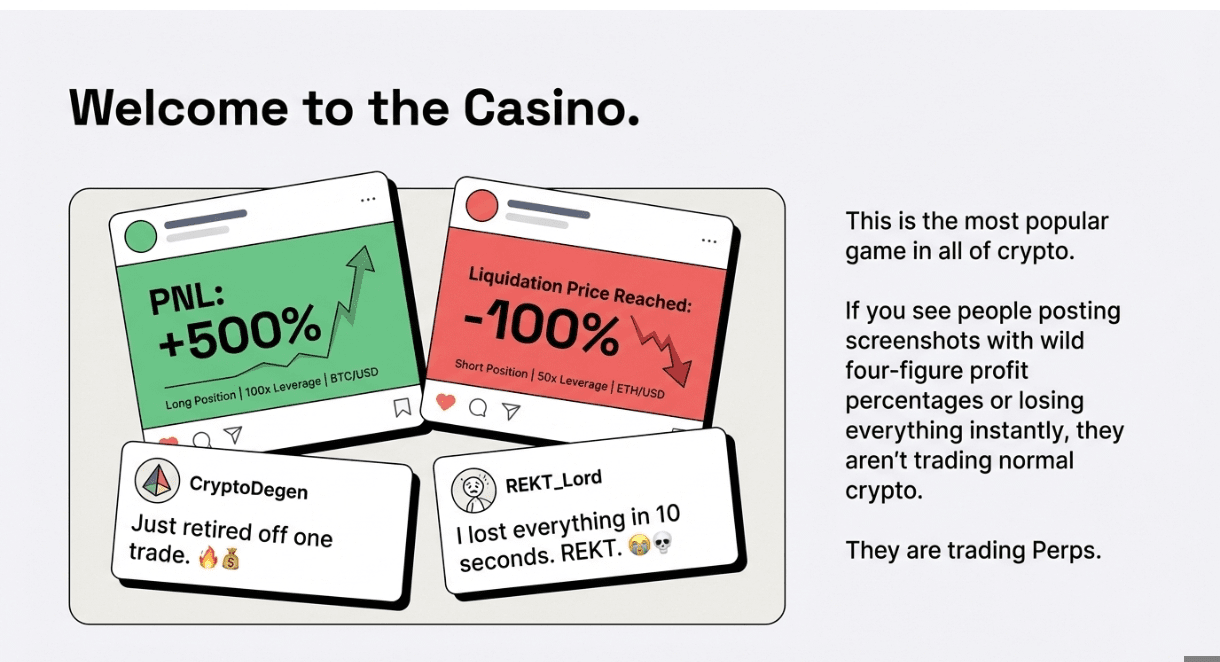

Bro, this is probably the most popular casino game in all of crypto. If you see people posting screenshots with "+500% Profit" or "REKT -69%," they are trading Perps. Noice 😜

To understand Perps, you first need to understand the difference between Buying the Asset and Betting on the Price.

Imagine you think the price of a golden watch is going to go up.

Spot Market (Buying): You go to the store, pay $10,000, and take the watch home. You own it. If the price crashes, you still have a cool watch.

Futures (Traditional): You sign a contract with a dealer that says: "I promise to buy this watch from you for $11,000 on December 31st." You don't own the watch yet. You just have a deadline. On Dec 31st, the deal must settle.

Perpetual Contract (The Crypto Special): You sign a contract that says: "I bet the price of this watch goes up."

The Twist: There is NO Date. No December 31st. No deadline.

You can hold this bet for 10 minutes, 10 years, or forever.

That is a Perpetual Contract.

It is a Futures contract that never expires.

❍ How it actually works

You might ask: "Bro, if there is no deadline, can't I just hold my position forever until I win?"

Technically, yes. But there is a catch called the Funding Rate (we will get to that).

When you trade a Perp on Binance or anywhere:

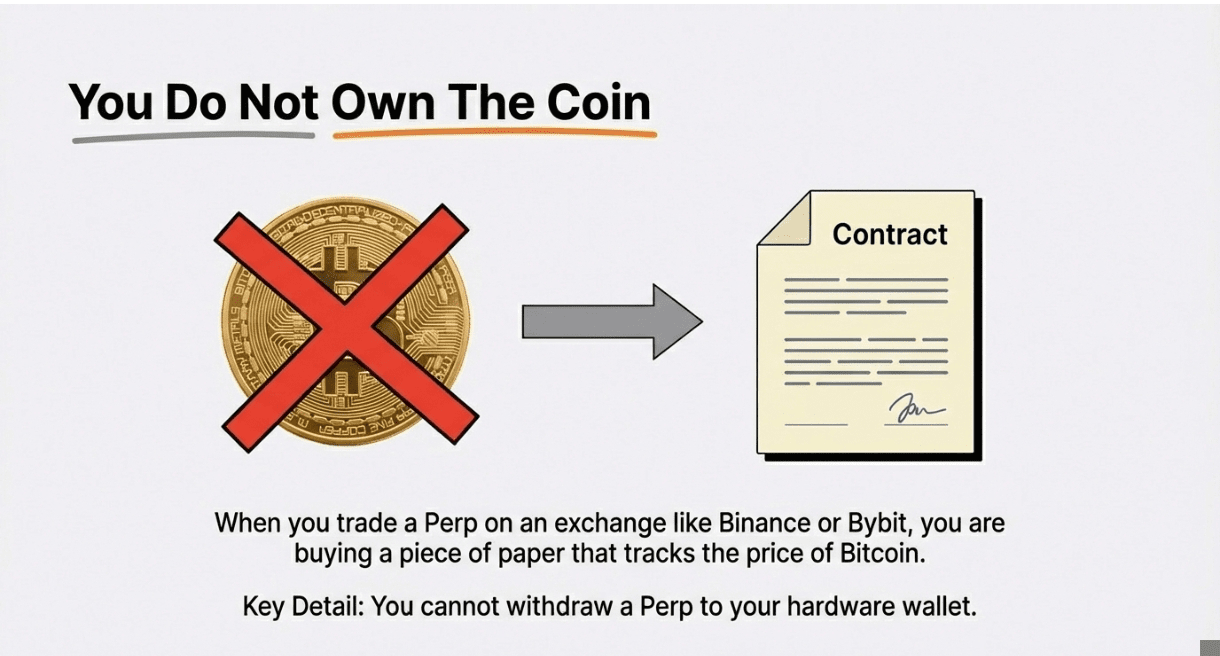

No Ownership: You are not buying Bitcoin. You are buying a piece of paper that tracks the price of Bitcoin. You can't withdraw a Perp to your hardware wallet.

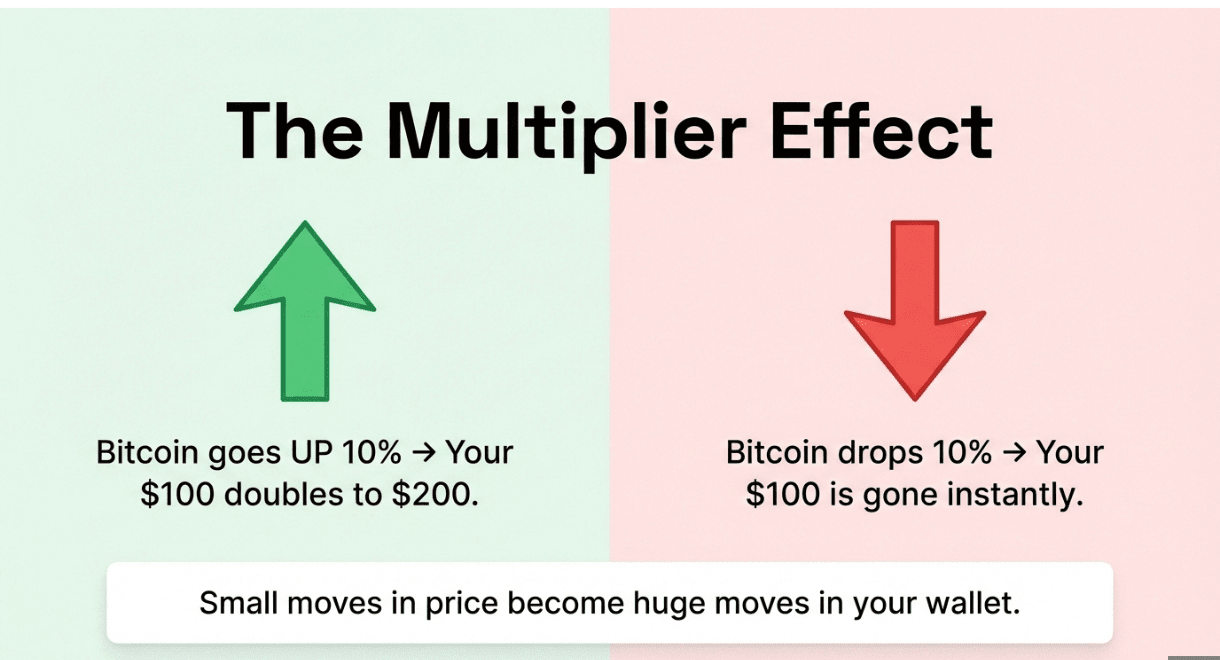

Leverage: This is the drug. Since you aren't buying the actual coin, you only need a deposit (Margin).

You put down $100.

The exchange lets you bet with $1,000 (10x Leverage).

If Bitcoin goes up 10%, your $100 doubles to $200.

If Bitcoin drops 10%, your $100 is gone instantly (Liquidation).

❍ The Funding Rate

This is the one thing that confuses everyone, so pay attention.

In normal Futures, the price eventually matches the real price because the contract Expires (on Dec 31st, the bet ends).

But since Perps never expire, what stops the Perp price from drifting away from the Real Bitcoin price?

The Solution: The Funding Fee (The Rent)

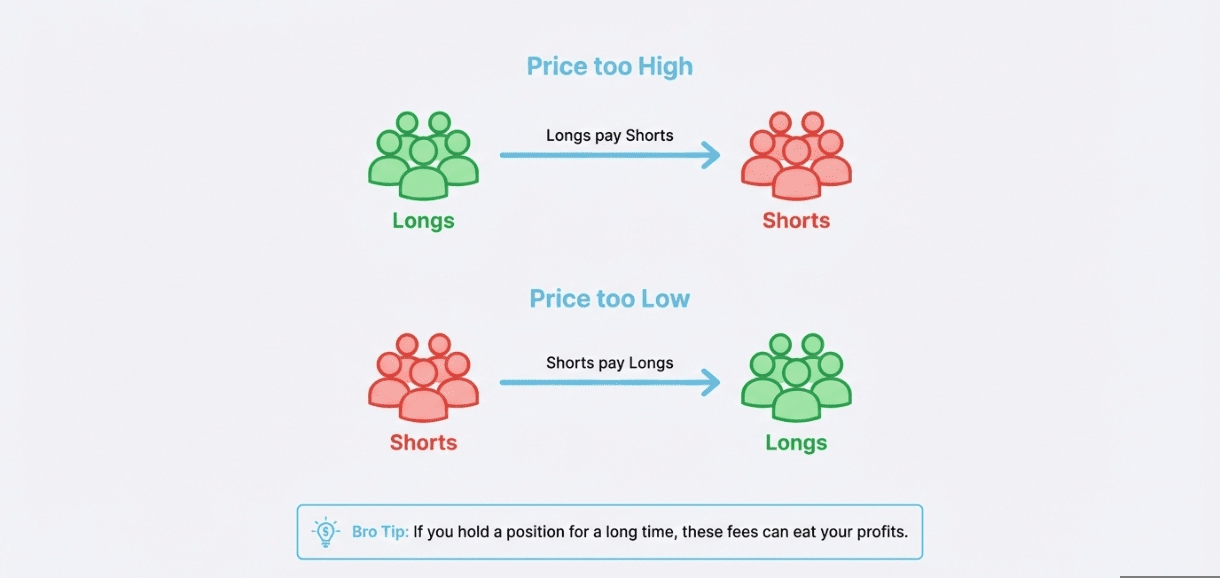

Every 8 hours, the exchange checks the price difference.

If the Perp Price is HIGHER than the Real Price: The market is too bullish. The Longs (people betting up) must pay a cash fee to the Shorts (people betting down).

If the Perp Price is LOWER than the Real Price: The market is too bearish. The Shorts must pay cash to the Longs.

This forces the price back in line.

Bro Tip: If you hold a position for a long time, these fees can eat your profits. It’s like paying rent to keep your bet open.

❍ Addressing Few Doubts (FAQ)

1. "Do I own the Bitcoin?"

No. You own a contract. If the exchange shuts down, you have nothing. If you buy Spot BTC, you have coins on the blockchain.

2. "Can I lose more than I put in?"

Usually, No. In crypto, if your loss hits your deposit limit, the exchange automatically kicks you out (Liquidation) to save themselves. You lose 100% of your bet, but you don't owe them extra debt (unlike old-school stocks).

3. "Why would I use this instead of just buying BTC?"

Two reasons:

Shorting: You can bet that Bitcoin will go DOWN. You can't do that easily in the Spot market.

Leverage: You can control 1 BTC with only $5,000 in your pocket. (High risk, high reward).