They fail when systems are almost working.

A transaction that should have been simple turns into a pause. Someone checks a balance they didn’t expect to matter. A confirmation takes longer than intuition allows. Nothing is technically broken, but something feels off. That feeling is enough to stop momentum.

That’s where money stops behaving like money.

Stablecoins are already deeply embedded in real usage. In many markets, they’re not a speculative asset. They’re a tool for moving value quickly, predictably, often under light pressure. Rent deadlines. Supplier payments. Informal transfers that still carry real weight. Yet the infrastructure underneath them often assumes patience and preparation.

Plasma seems to start from a different assumption. That payments happen in motion, not in ideal conditions. That users don’t want to manage systems while they’re trying to settle value. That the fewer questions asked mid-transaction, the better.

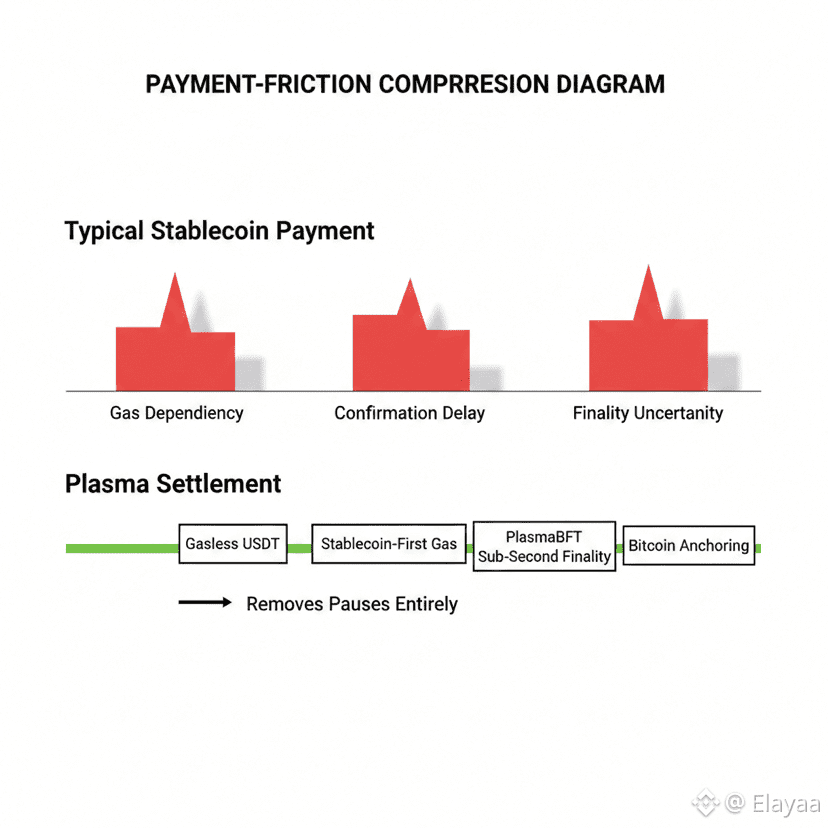

Gas is where this becomes obvious. On most chains, gas is framed as a neutral requirement. In practice, it’s a recurring failure point. People hold stablecoins but can’t move them because they lack an unrelated token. That moment isn’t dramatic, but it’s corrosive. It teaches users that their money isn’t fully theirs when they need it.

Gasless USDT transfers remove that moment entirely. Stablecoin-first gas removes another dependency. The system stops asking for setup. The payment path shortens. There are fewer reasons for a transaction to stall before it begins.

This isn’t about convenience. It’s about reducing the number of ways a payment can fail without warning.

Finality plays a similar role. PlasmaBFT offers sub-second finality, but the impact isn’t just speed. It’s psychological. The transaction completes before the user starts monitoring it. No refreshing. No wondering whether the state might change. The payment ends, and attention moves on.

Finality, in this context, is less about benchmarks and more about closure.

There’s a pattern in infrastructure that earns long-term trust. It minimizes moments where humans have to intervene. It doesn’t invite observation. It disappears quickly. Plasma’s design choices point in that direction.

Security enters quietly. Bitcoin-anchored security isn’t framed as spectacle or competition. It’s a grounding choice. A way to anchor settlement to something slower, harder to change, less reactive. For payment rails, that kind of neutrality matters more than flexibility.

Value moves across borders, systems, and cycles. A settlement layer that resists sudden shifts in rules reduces background uncertainty, even if users never consciously think about it.

Ethereum compatibility through Reth fits this same mindset. It’s not positioned as an identity statement. It’s practical. Developers can build using familiar tools without inheriting every priority of the broader Ethereum ecosystem. Execution remains known. The environment behaves differently.

What Plasma doesn’t try to do is just as telling. There’s no push to become a universal platform. No attempt to capture every narrative. Payment infrastructure that tries to be expressive tends to accumulate complexity. Complexity creates fragility.

Retail users feel this first, especially in high-adoption regions. When payments work without explanation, usage grows quietly. No onboarding guides. No repeated instructions. The system becomes background.

Institutions experience different pressure points. Delayed settlement. Ambiguous finality. Edge cases that create reconciliation problems. For them, predictability matters more than optionality. A system that resolves cleanly reduces operational noise.

Plasma seems to sit at the intersection of these needs by focusing on a shared failure mode. Payments that hesitate stop being payments.

There’s a broader shift underway in how blockchains are evaluated. Less emphasis on what they can theoretically do. More attention on how they behave during normal use. Infrastructure earns trust by being boring in the right ways.

Plasma doesn’t ask users to explore it. It doesn’t require attention during use. Value moves, and the moment passes.

Those moments are hard to showcase. They don’t create dramatic charts or viral metrics. But they accumulate. Systems that don’t interrupt get reused. Systems that don’t surprise become habits.

Most networks optimize for engagement. Plasma appears optimized for completion.

That difference doesn’t announce itself. It shows up in what doesn’t happen. In transactions that don’t become questions. In payments that end before doubt starts.

That’s not a bold claim. It’s an observation about priorities.

And in payment infrastructure, priorities show up everywhere.