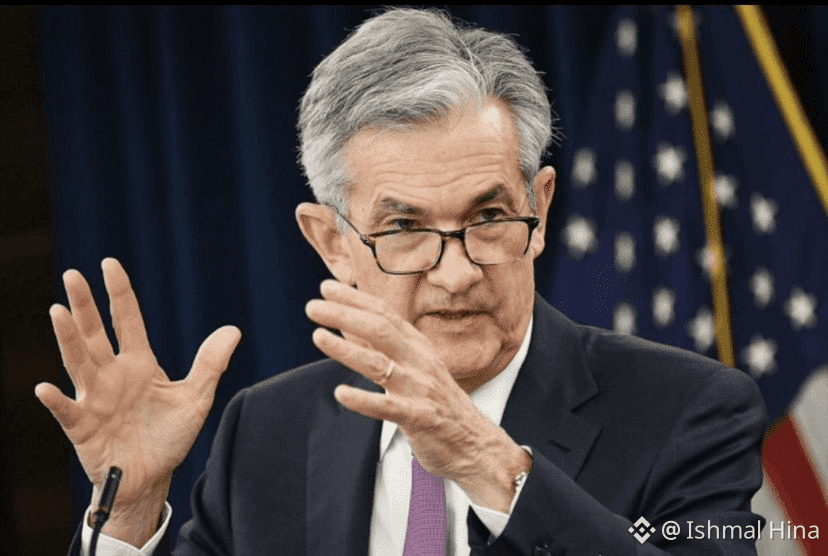

On January 28, 2026, Federal Reserve Chair Jerome Powell will speak following the FOMC January meeting and for crypto, this event carries real downside risk.

While benchmark interest rates are widely expected to remain unchanged, the decision itself isn’t the issue.

The language is. The tone is. The forward guidance is.

What Powell is expected to cover:

🔹 The economic rationale behind holding rates steady

🔹 The Fed’s latest read on inflation trends

🔹 Labor market strength vs. cooling signals

🔹 Forward guidance on when and if rate cuts are coming

🔹 How current data reshapes the Fed’s risk balance

⚠️ Why this is bearish for crypto:

• Sticky inflation keeps the Fed cautious

• A strong labor market delays rate-cut expectations

• “Higher for longer” messaging = tight liquidity

• Tight liquidity historically pressures $BTC , alts, and leverage

📉 Crypto doesn’t fall because rates stay the same

It falls when hope gets repriced.

If Powell emphasizes:

Inflation risks

Data dependency

No urgency to ease

Expect:

• Risk-off sentiment

• Funding rate volatility

• Long liquidations

• Alts underperforming BTC

🛑 This is a narrative event, not just a rate decision.

Markets are positioned for easing Powell may remind them patience isn’t over yet.

Stay defensive. Protect capital. Liquidity rules the market.