Solana ($SOL ) continues to be one of the top altcoin narratives in crypto — driven by real-world utility, fast transactions, and growing developer adoption. Analysts and market forecasts suggest Solana is positioned for significant growth in 2026 if key support levels hold and macro conditions improve.

📈 Why Solana Still Matters?

🔹 Smart contract alternative to Ethereum

Solana is widely viewed as one of the fastest blockchains with low fees and strong throughput — making it attractive for DeFi, NFT, and Web3 projects.

🔹 Institutional and ecosystem growth

With increasing institutional activity in DeFi and broad ecosystem expansion, Solana’s total value locked and usage metrics keep strengthening its case.

🔹 Market narrative & altcoin rotation

As Bitcoin stabilizes post-halving and regulatory clarity improves, capital often rotates into higher-beta altcoins — Solana being a front-runner due to real adoption metrics.

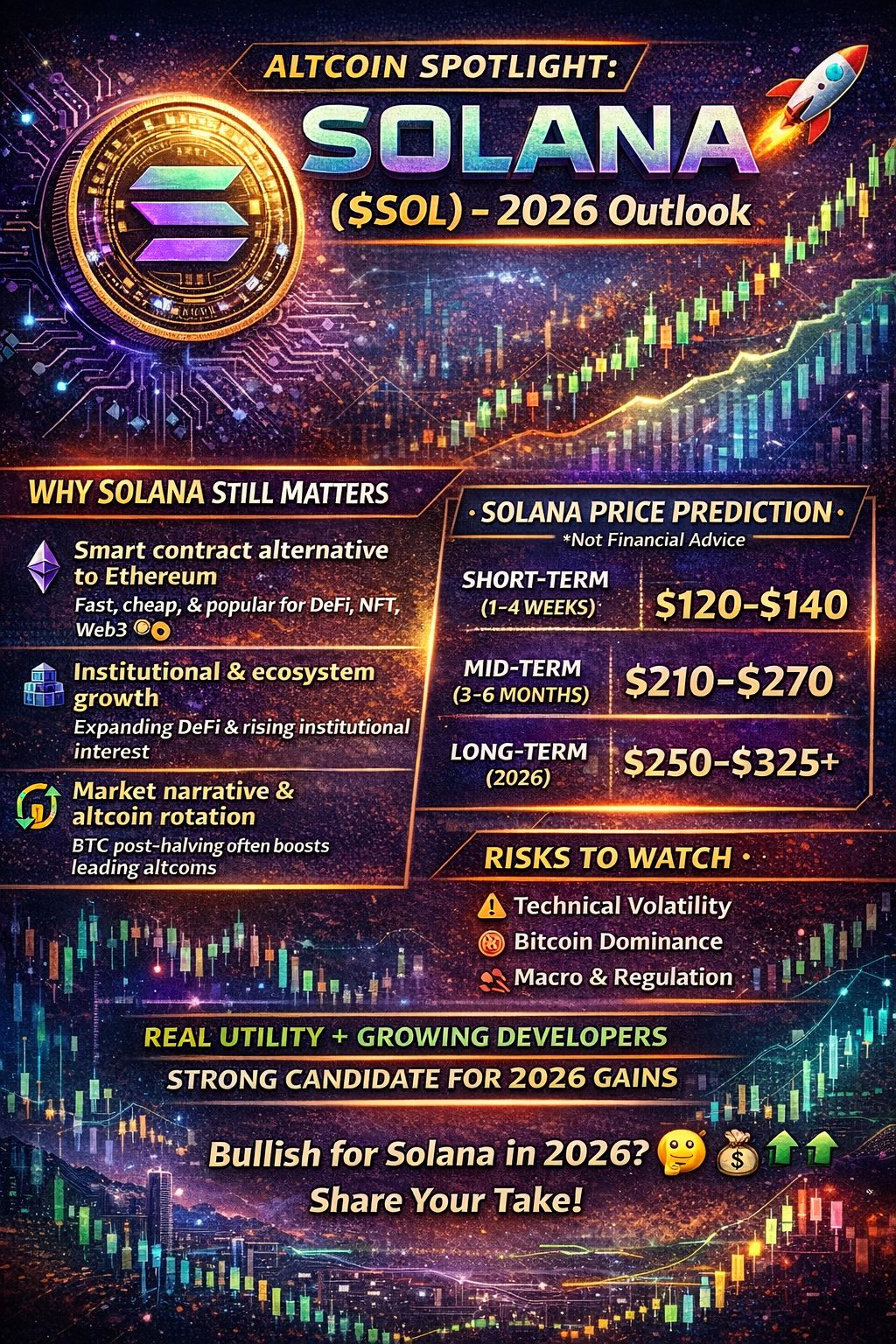

🔮 $SOL Price Prediction (Not Financial Advice)

📉 Short-Term (1–4 weeks):

Price may continue to range or correct slightly if Bitcoin dominance remains high, but support near key levels could attract traders looking for bounce setups.

📆 Mid-Term (3–6 months):

Average 2026 forecasts place Solana roughly between $210–$270, contingent on macro momentum and ecosystem growth. Bullish scenarios could even push toward $300+ if adoption accelerates.

📆 Long-Term (2026):

Some analysts suggest Solana could reach $250–$325+ by the end of 2026 in a strong market environment — especially with institutional inflows and broader DeFi activity.

⚠️ Risks to Watch

❌ Technical volatility — Solana has faced outages and network stress events before, which can shake trader confidence.

❌ Bitcoin dominance — If BTC continues dominating the market, altcoins including Solana could lag until rotation begins.

❌ Macro & regulation — Altcoin performance still hinges on broader regulatory clarity and macro conditions influencing institutional participation.

🧠 Final Take

Solana ($SOL) remains one of the top altcoin plays for 2026 thanks to its utility, ecosystem growth, and institutional interest. While short-term volatility is expected, mid- to long-term setups look promising if DeFi adoption and market rotation into altcoins gain traction.

👉 Summary:

📌 Real adoption + developer support

📌 Range-bound near-term price action

📌 Mid-term bullish if macro & network growth align

💬 What’s your call on $SOL for 2026 — accumulate or wait for dips? 👇

#sol #solana #CryptoNews #FederalRatesCrypto