One Trade. One Decision. Full Responsibility.

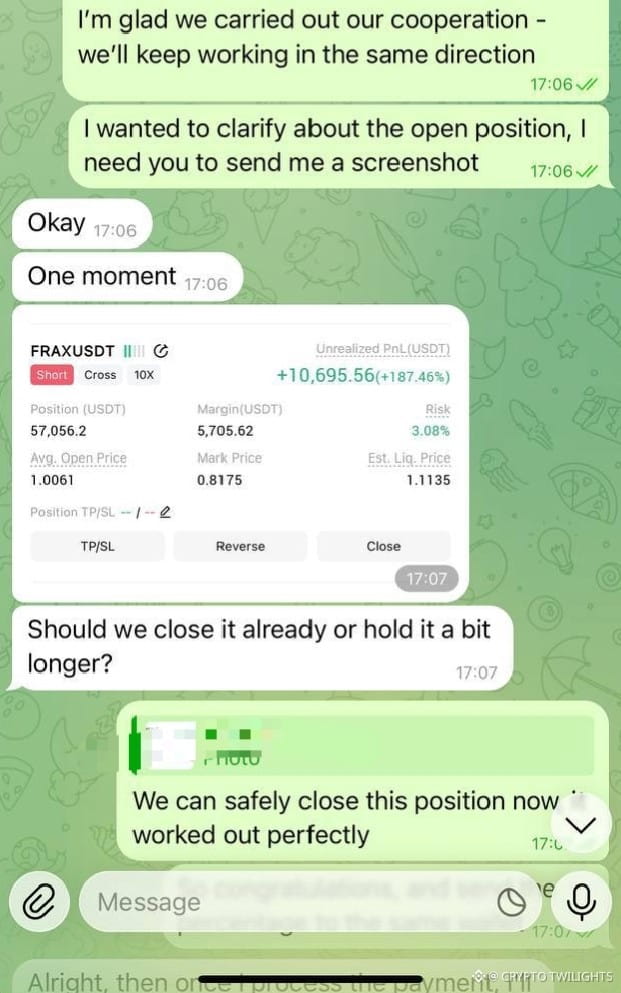

This screenshot is not about showing numbers.

It’s about showing process.

Anyone can post profits after the trade is over. Very few people talk about what to do when the position is deep in profit and emotions start kicking in.

Look at the situation carefully:

The trade was already heavily in profit

Leverage was involved

The market had already moved a big distance

Greed could easily whisper: “Let’s hold more… maybe it will give more”

This is exactly the moment where most traders give back profits.

---

The Real Question Was Simple

> “Should we close it already or hold it a bit longer?”

This is not a technical question.

This is a discipline question.

Markets don’t punish bad analysis only —

they punish indecision, greed, and hesitation.

---

Why Closing Was the Right Decision

When a trade reaches a level where:

Risk is already reduced

Target zone is achieved

Momentum has done its job

Then the job of a trader is not prediction anymore.

The job becomes: 👉 Protection of capital

👉 Protection of profits

Holding more at that point is not strategy —

it’s hope.

And hope is expensive in trading.

---

My Trading Strategy (Simple but Ruthless)

I don’t chase the market.

I don’t marry positions.

I don’t try to extract the last drop.

My strategy is built on three pillars:

1. Entry with a Clear Idea

Before entering any trade, I already know:

Why I am entering

Where the trade becomes invalid

Where profit makes sense

If these three are not clear, the trade doesn’t exist.

2. Let the Trade Do Its Work

Once entered:

No over-management

No emotional interference

No panic

I let price action speak.

If the market agrees with my idea, I stay patient.

If it doesn’t, I accept the loss without argument.

3. Exit Without Greed

This is where most traders fail.

Profit is not yours until you close.

When the market gives what was planned:

I don’t negotiate

I don’t fantasize

I execute

Closing a profitable trade is a skill, not weakness.

---

Why Most Traders Lose After Winning

Here’s a hard truth:

Most traders don’t lose because of bad entries.

They lose because they don’t know when to stop.

They turn:

Good trades into break-even

Great trades into losses

Why?

Because they confuse confidence with greed.

Confidence follows a plan.

Greed ignores it.

---

Discipline > Profit Screenshots

A single trade means nothing without consistency.

What matters is:

Can you repeat this process?

Can you close when emotions say “hold”?

Can you accept that the market will always give more after you exit?

Missing extra profit is normal.

Losing locked profit is optional.

---

The Market Will Always Be There

Another setup will come.

Another opportunity will form.

Another trend will appear.

But capital only survives if you protect it.

That’s why closing this trade was not about fear —

it was about respecting the plan.

---

Final Thought

Trading is not about being right all the time.

It’s about being controlled all the time.

One disciplined close is better than ten emotional holds.