Key Takeaways

October 10 was a market flash crash, primarily driven by macroeconomic factors, market makers’ risk protocols, and network congestion.

Binance’s core systems were fully operational throughout the market shock. There was no platform-wide downtime nor glitch, and all core matching, risk checks, and clearing functions continued without interruption.

Binance has taken responsibility for two platform-specific incidents; the two issues did not cause the flash crash.

On October 10, 2025, the crypto market faced a macro shock. While some placed the blame on a Binance glitch, the reality was that cascading liquidations were driven by macro risks from highly leveraged positions, market makers’ risk controls limiting liquidity, and Ethereum network congestion delaying transfers. In this blog, we’ll be sharing the facts to be fully transparent and acknowledge where our platform faced strain.

The Macro Setup

Following headlines related to the trade war, global financial markets fell sharply, with virtually every asset class impacted. Crypto, having rallied for months into early October and carrying elevated leverage, was particularly exposed. Across the derivatives market, positions were near record levels, with BTC futures and options open interest exceeding $100 billion. On-chain data showed most Bitcoin holders were sitting on profits – conditions ripe for rapid profit-taking and forced deleveraging once a shock hit.

The impact wasn’t confined to crypto: U.S. equity markets shed roughly $1.5 trillion in value that day, with the S&P 500 and Nasdaq enduring their largest single-day drops in six months and $150 billion in systemic liquidations.

Extreme Market Movement Triggered Market Makers’ Risk Controls

As the sell-off intensified, the extreme market movement triggered market makers’ algorithmic risk controls and circuit breakers and automatically started to manage inventory and reduce exposure. This behavior, while expected under extreme volatility, temporarily pulled liquidity from order books.

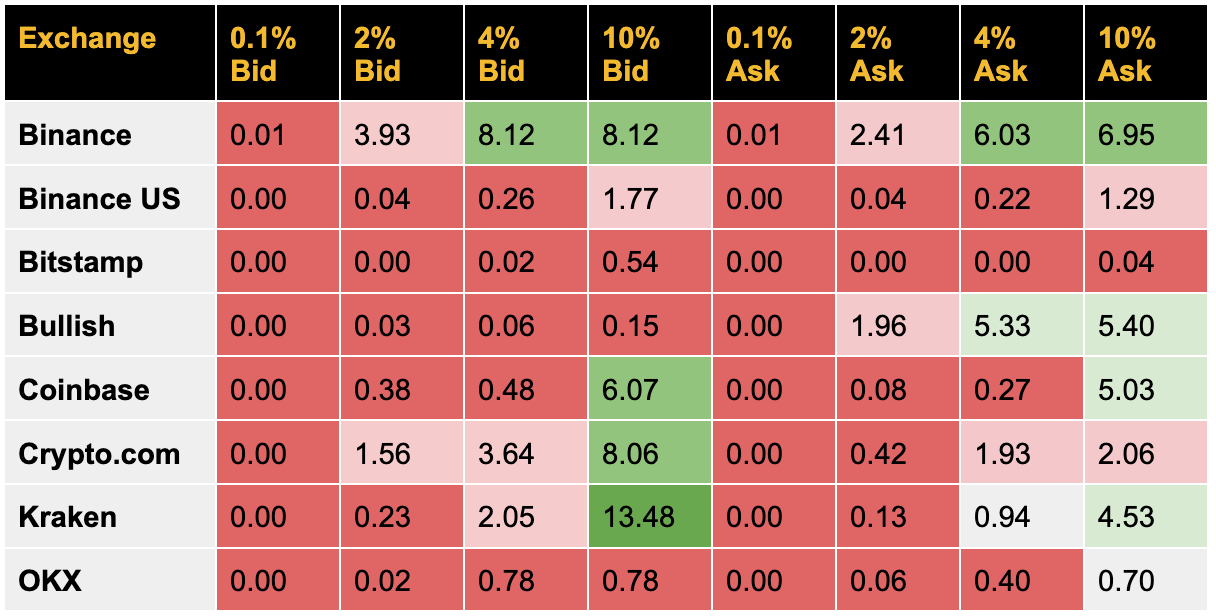

According to the order book depth from Kaiko's data (figure 1), ‘BTC liquidity was zero or near zero at every level’ on some exchanges — except for Binance, Crypto.com, and Kraken, major exchanges had almost no bid orders within a 4% price spread. This thinning meant that each additional forced sell moved prices more than usual. On top of that, cross‑venue risk management and arbitrage across exchanges were impaired.

Figure 1: BTC Minimum Depth Dries Up, Causing Spreads to Widen Significantly During the October 10 Crash

Source: Kaiko, Binance Research (Pairs: BTC-USDT, BTC-USDC, BTC-USD - based on average values per minute on October 10, 2025)

Network Congestion

A compounding factor in the October 10 flash crash was blockchain congestion on Ethereum which caused gas fees to spike from single digits to over 100 gwei at times and delayed block confirmation, slowing arbitrage and cross-platforms flows. In an already thin market, this widened spreads and made position rebalancing even more difficult, creating a brief liquidity vacuum that amplified price swings. Until selling pressure eased and markets stabilized, it was difficult to rebalance between exchanges or to deploy liquidity where it was most needed.

Implications Across Market

In the thinnest markets, even modest orders impact the order book, creating sharp “wicks” on charts. Mechanical selling and forced liquidations amplified price movements, while slowed arbitrage and cross‑venue transfers widened temporary price gaps. Some pegged or derivative tokens briefly decoupled from their reference values, reflecting the same stresses: thin liquidity, rapid flow, and delayed capital movement.

Like All Exchanges, Binance Faced Strain Processing High Volume Under Extreme Market Conditions

The October 10 dislocation was a systemic, macro‑driven risk‑off move. That said, we acknowledge that parts of the Binance platform experienced temporary strain under extreme market conditions and have compensated impacted users, and strengthened safeguards.

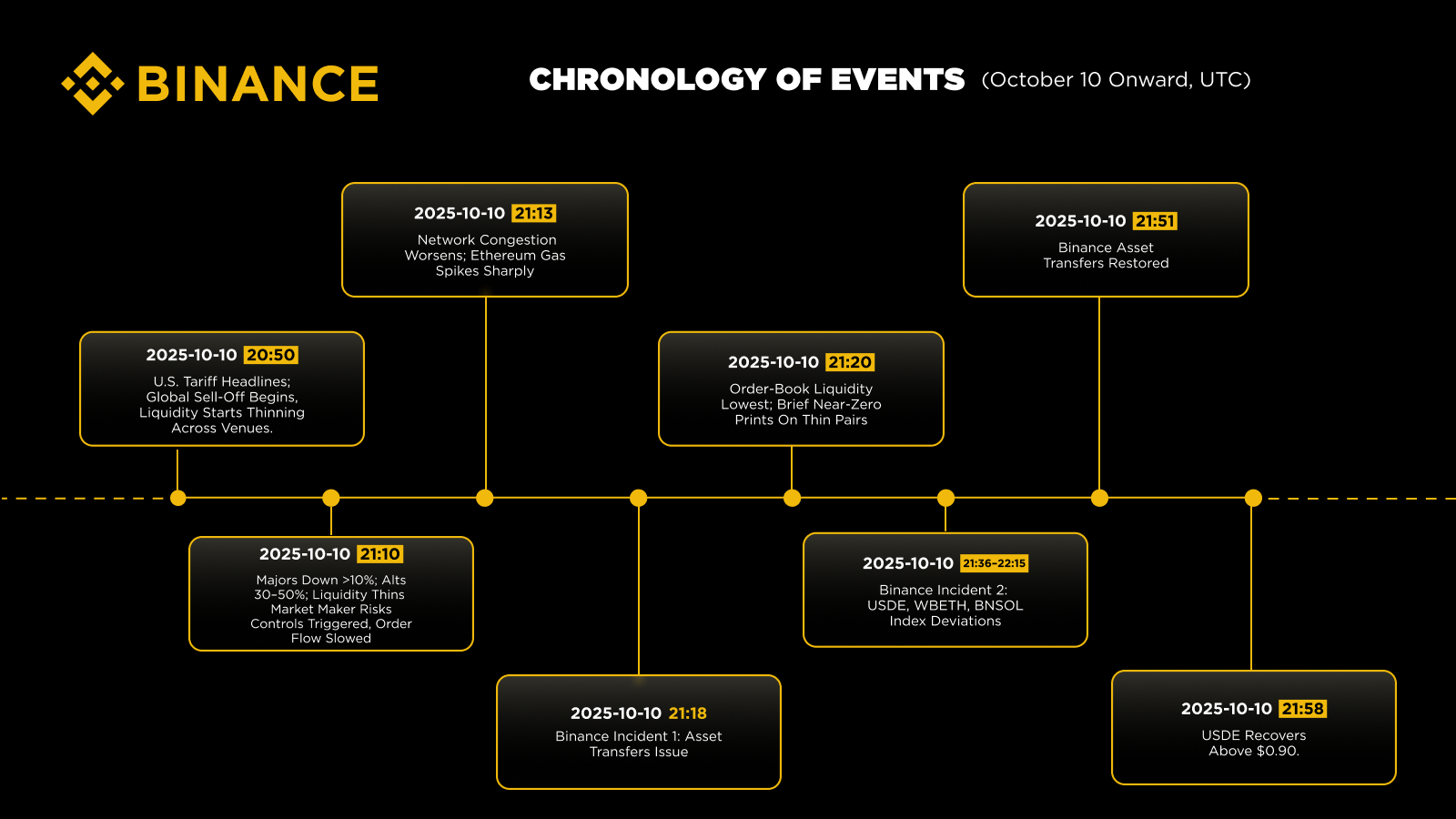

Importantly, Binance’s platform-specific issues did not cause the flash crash. With the highest-volatility window between 21:10–21:20 UTC, roughly 75% of the day’s liquidations had already taken place before the widely-reported three-token depeg (USDe, BNSOL, WBETH) occurred at 21:36 UTC. This timing shows that most deleveraging happened during the initial macro shock which started at 20:50 UTC, when forced liquidations accelerated price declines amid thinning order books.

This confirms that the primary driver was a market-wide risk-off and liquidation reflexivity, not platform-specific anomalies. Binance’s core matching engine, risk checks, and clearing systems remained fully operational without interruption throughout.

The following detail our findings of the two incidents:

Incident 1: Asset transfer subsystem degradation (21:18-21:51 UTC)

During the peak of the sell‑off, our internal asset‑transfer subsystem slowed for about 33 minutes. This affected moving some funds between Spot, Earn, and Futures. Core matching, risk checks, and clearing continued operating; the disruption was confined to the transfer path and its dependents. A small number of users also saw balances display as “0” in the UI when backend calls failed; this was a fallback display issue, not a loss of funds.

Root cause: a performance regression on a hot read path to the asset database that surfaced under surge load. One frequently called API lacked an effective cache and read directly from the database. Under traffic 5-10x normal, database connections saturated, thread pools backed up waiting for connections, and timeouts rippled outward. A prior cloud‑provider version upgrade had also removed a built‑in query‑caching behavior, reducing headroom for this specific query under stress.

Remediation: We have fully compensated all eligible users who were impacted by this incident during the 21:18-21:51 UTC window based on system logs and documented attempts.To resolve the incident, we’re adding caching, expanding database capacity and replicas, optimizing connections, separating critical functions, and improving UI fallbacks.

Incident 2: Index deviations for USDe, WBETH, and BNSOL (21:36-22:15 UTC)

After order‑book depth thinned across the market and on‑chain congestion slowed cross‑venue rebalancing, the indices for USDe, then WBETH and BNSOL, deviated abnormally from expected values. The combination of thin local liquidity, accelerated liquidations, and slower cross‑venue flows meant that temporary moves on our venue carried too much weight in the index calculation during stress.

Root cause: Index inputs for these 3 tokens were overweight on our own order books and not sufficiently anchored to underlying reference values (especially for wrapped/staked tokens), while outlier/deviation guards were not tight enough for a fast‑moving, thin market.

Remediation: We tightened parameters during stabilization and immediately began a methodology update for these 3 tokens. All impacted users have been fully compensated.

K-line display: On 12 October (UTC) we had announced and implemented a front-end display update, to optimize K-line charts display price data. This was in consideration of the $0 wick for ATOM/USDT and IOTX/USDT that occurred during a period of extremely low liquidity, where due to intense sell pressure, the system matched legacy bid orders from 2019, resulting in a one-off candlestick reflecting the artificially low price. This was a UI adjustment and did not affect any actual trading data or API information. Some misunderstood it as an attempt to alter data and upon receiving community feedback, we promptly rolled back the update. Binance has never, and never will tamper with actual trading or historical data.

Putting Our Users First

In addition to technological improvements, as of October 22, 2025, we have fully compensated eligible users impacted by both incidents above and credited them with over US$328 million.

As previously announced, Binance launched the Together Initiative on October 14, a US$300 million discretionary goodwill program, designed to provide support to users impacted by the flash crash yet did not qualify for compensation as they were not directly impacted by Binance’s platform issues above, and a US$100 million low‑interest loan fund for institutional participants severely affected by market conditions to stabilize operations.

Binance will continue to prioritize user protection and the steady development of the industry, and will continue to invest and build upon its efforts to promote the long-term healthy development of the crypto ecosystem.

Further Reading

Binance Launches the $400 Million “Together Initiative” to Support Market Recovery and Restore Confidence

Resolution of USDe, BNSOL, and WBETH Price Depeg and Risk Control Enhancements

Statement on Recent Market Volatility and Latest Progress Update on User Protection Measures

Disclaimer and risk warning: The compensation plans and Together Initiative described herein is provided only to eligible users on a goodwill basis in Binance’s sole discretion, without admission of fault or liability by Binance. It does not waive any of Binance’s rights or create any obligation on Binance to provide compensation or restitution in similar or future circumstances, or on any other claim, issue or matter relating to or arising from the aforementioned incident. Nothing in the compensation plans, the Together Initiative nor this communication shall constitute financial advice, or any form of guarantee. The determination of eligible users and compensation amounts will be a final determination made and calculated by Binance. Any claim beyond, outside of or in addition to the compensation plans or Together Initiative shall be separately submitted to Binance and evaluated on a case-by-case basis, in respect of which all of Binance’s rights remain reserved. Digital asset prices are subject to high market risk and price volatility. The value of your investments can go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not liable for any losses you may incur. Past performance is not a reliable predictor of future performance. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment. To learn more about how to protect yourself, visit our Responsible Trading resource page. For more information, see our Terms of Use and Risk Warning.