Gold markets were shaken hard after President Trump nominated Kevin Warsh as the next Federal Reserve Chair, triggering sharp volatility across precious metals 🌪️💥

But don’t confuse a violent correction with a trend reversal — this looks more like a reset before the next rally 👇

🔑 Key Takeaways

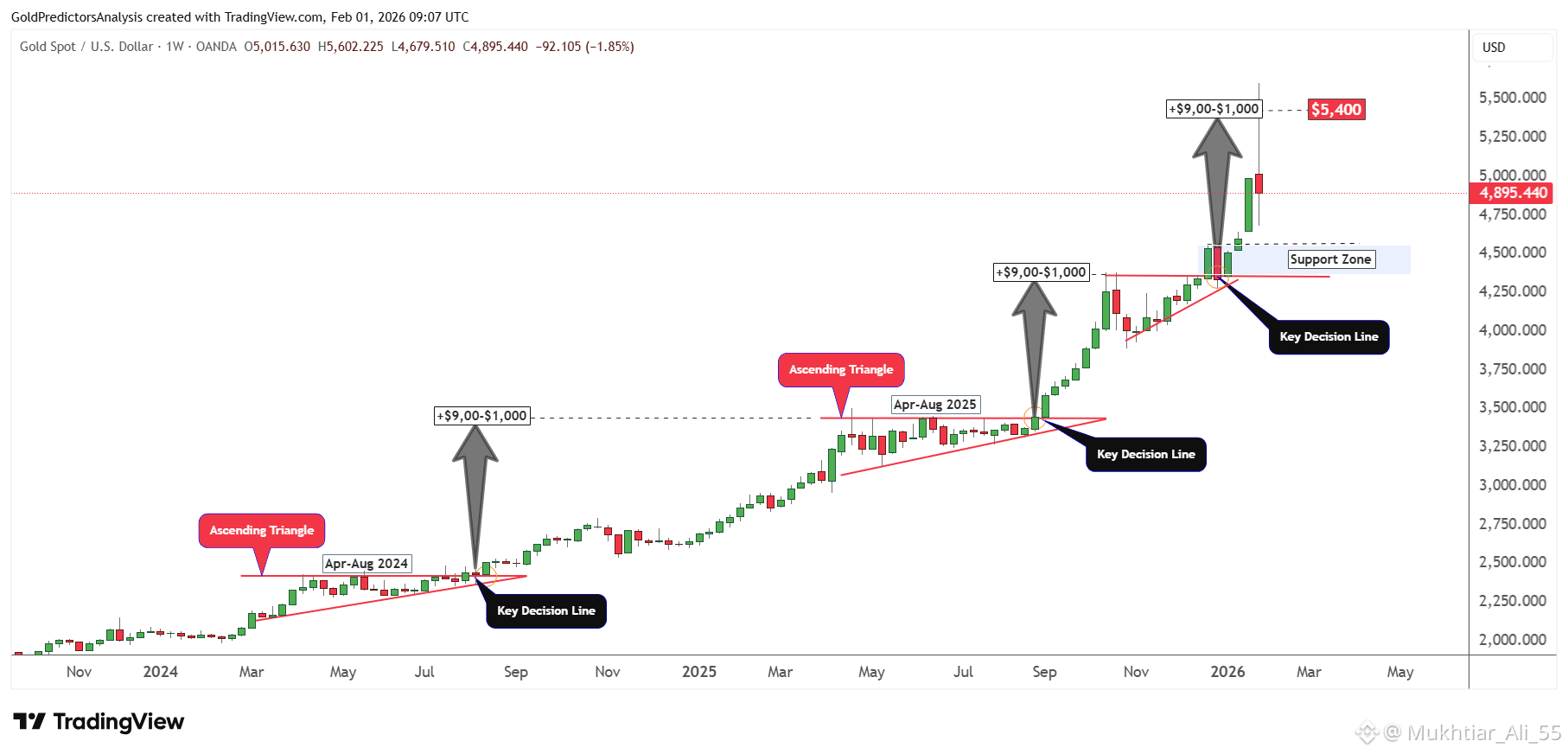

🏆 Gold corrected sharply from the $5,600 record high

🛡️ Price is still holding above the critical $4,000 support

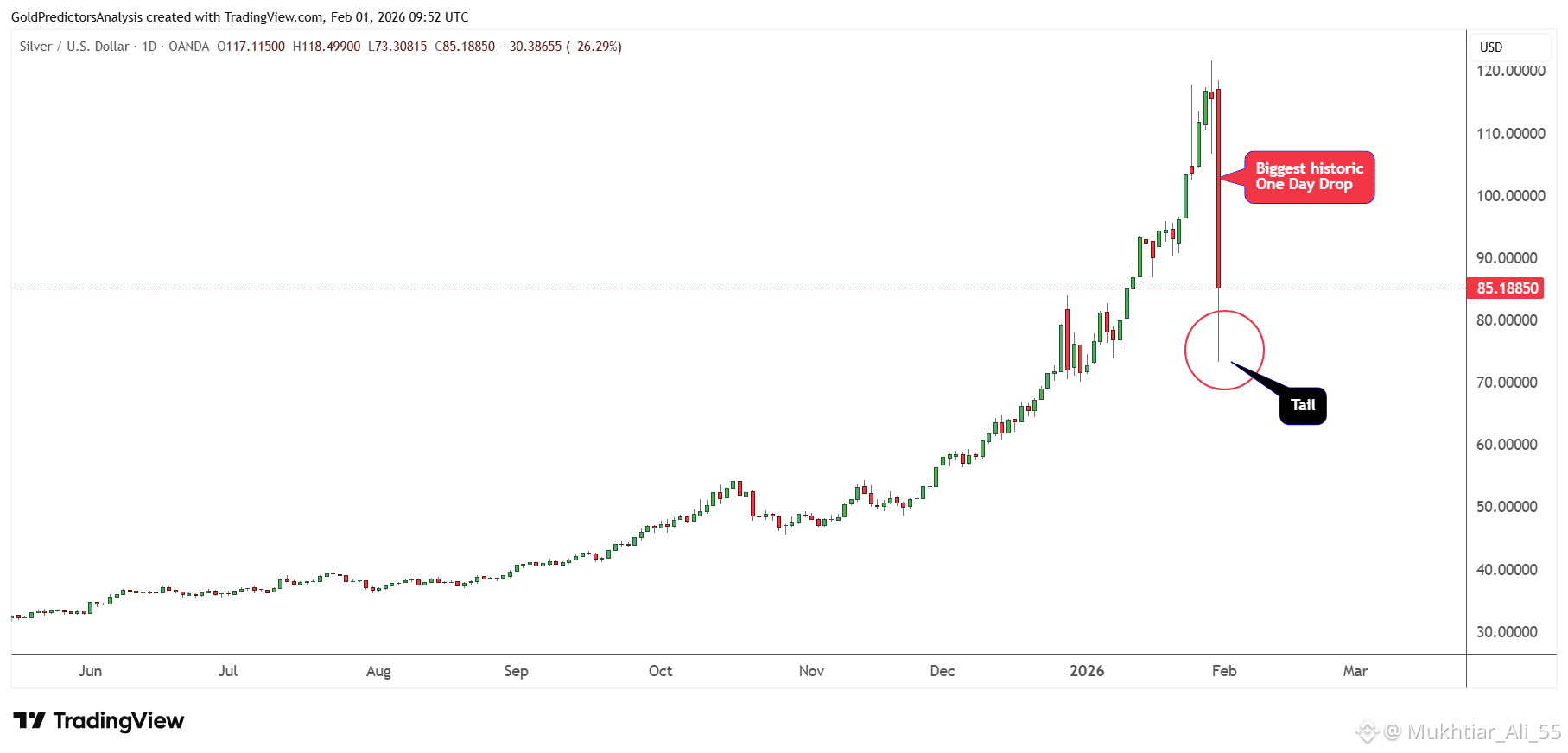

🥈 Silver, platinum, and critical materials also saw heavy sell-offs

🏦 Warsh’s Fed nomination caused short-term market relief

⚠️ A decisive break below $4,000 would invalidate this bullish outlook

📉 Market Reaction: A Shock, Not a Collapse

The announcement of Kevin Warsh — seen as a more conservative and hawkish Fed pick — briefly calmed markets and triggered repositioning 🔄

As a result:

🥇 Gold dropped over 10%

🥈 Silver crashed more than 30%

⚙️ Copper stocks, uranium, and critical materials suffered double-digit losses

This wasn’t panic — it was a release valve after an overstretched rally 💨

The long lower wicks on gold and silver candles clearly show buyers stepping in 🐂📊

🏦 A Conservative Fed Can’t Fix Structural Problems

Even if Warsh starts out hawkish, the Fed:

❌ Can’t fix fiscal instability

❌ Can’t solve geopolitical tensions

❌ Can’t print critical metals needed for military and industrial supply

🌍 Global supply shortages remain

🏛️ Central banks are still net buyers of gold

🧠 And once trust in the system cracks, it doesn’t return overnight

📈 Gold’s Technical Structure Still Bullish

Since 2024, gold has respected a clear bullish structure:

Ascending triangles → breakout rallies

Consolidations → new highs

The break above $4,400 triggered a powerful move toward $5,400, which was exceeded to $5,600 🚀

Friday’s historic drop to $4,679 signals high volatility, not trend failure.

🔍 What to watch next:

🟢 Consolidation likely above $4,400–$4,600

⚠️ A break below $4,400 opens downside toward $4,000

❌ Only a break below $4,000 would threaten the bull market

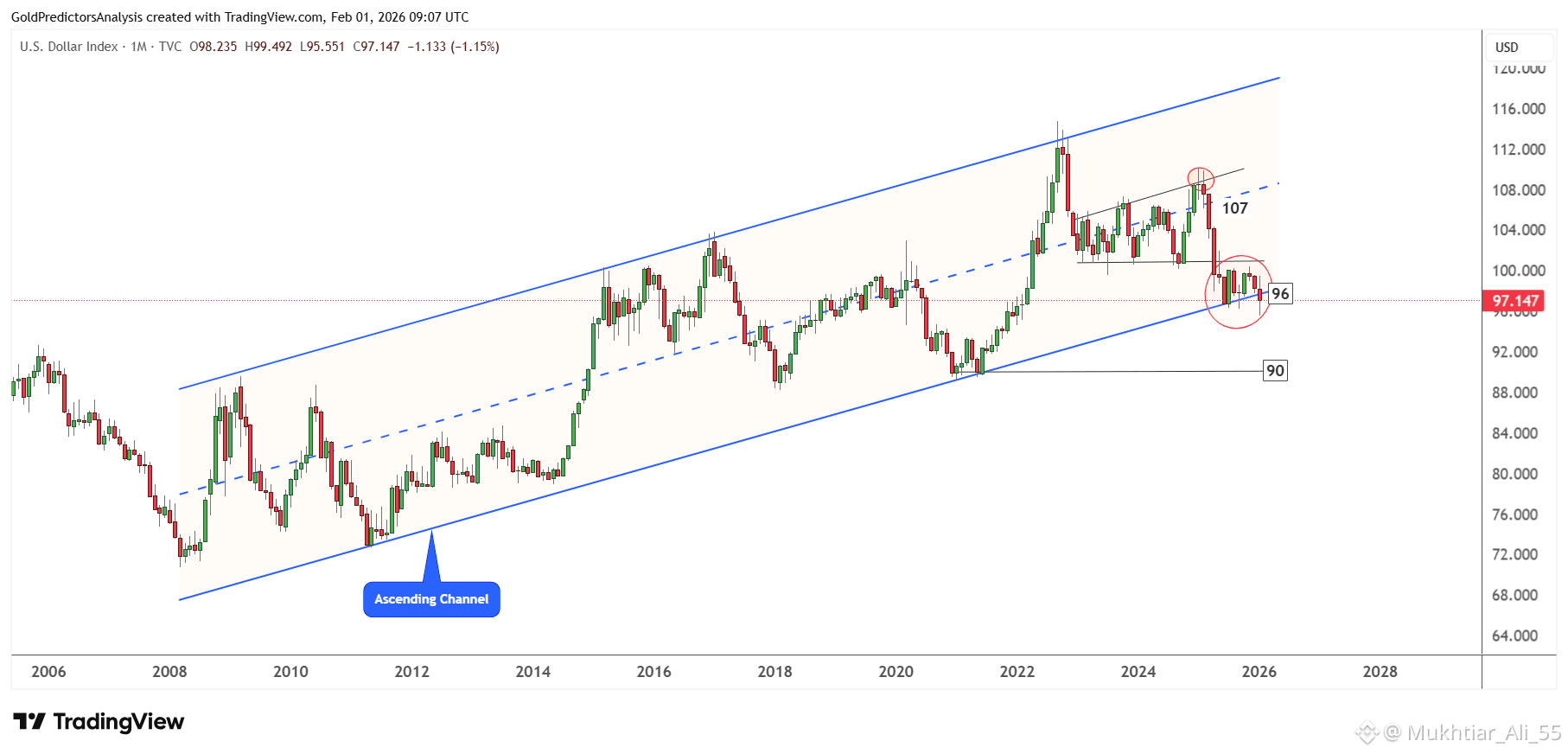

💵 US Dollar Adds Short-Term Uncertainty

USD rebounded from 95.50 toward 97

A move above 100.50 could delay gold’s next leg

A break below 95.50 could send the dollar toward 90, boosting gold 📉➡️🥇

Despite the bounce, the long-term USD structure remains bearish.

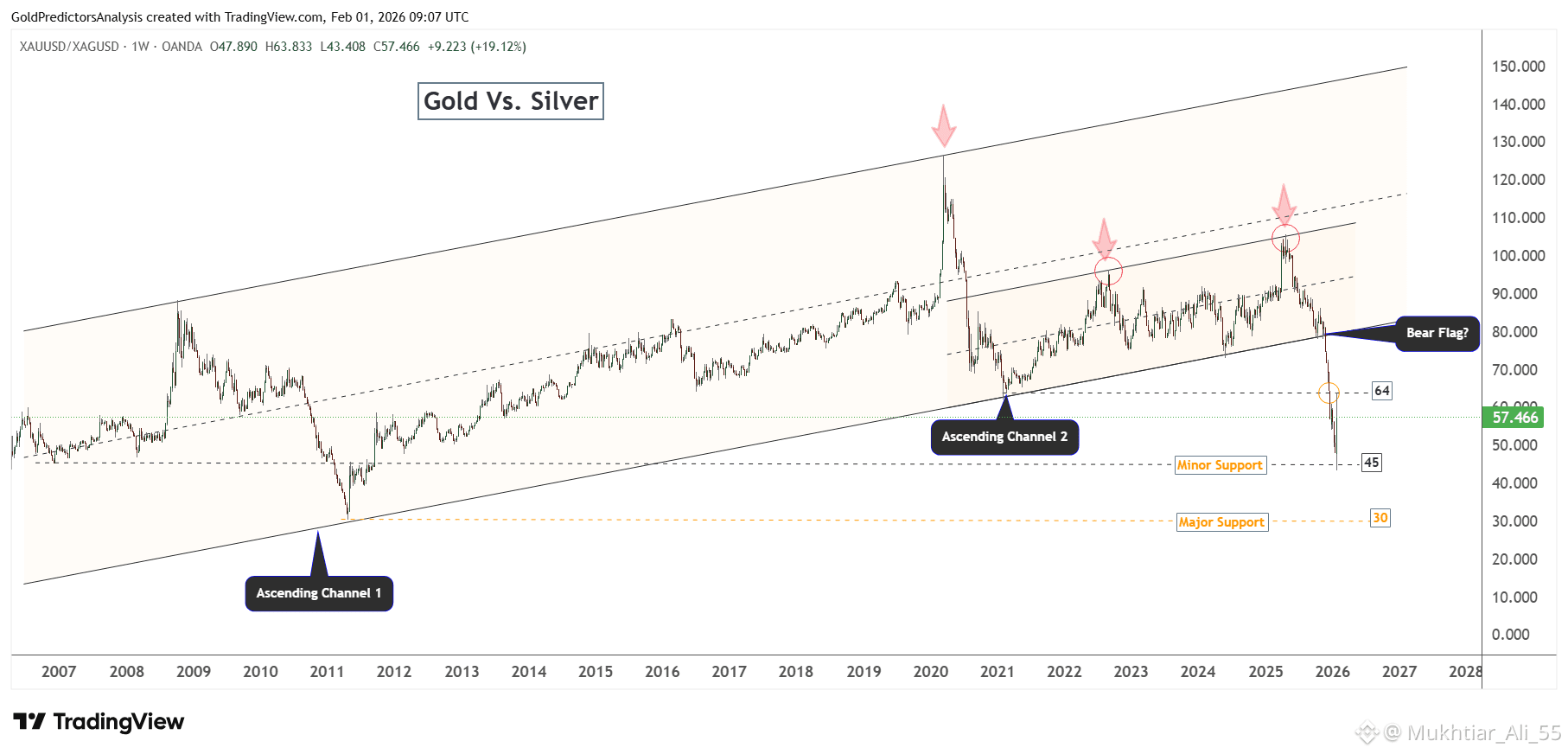

🥈 Silver & Ratios to Watch

Gold/Silver ratio rebounded from 45 toward 64

Short-term uncertainty, but bullish structure intact

A break below 45 could ignite a silver-led rally

Major support near 30 remains key for future tops

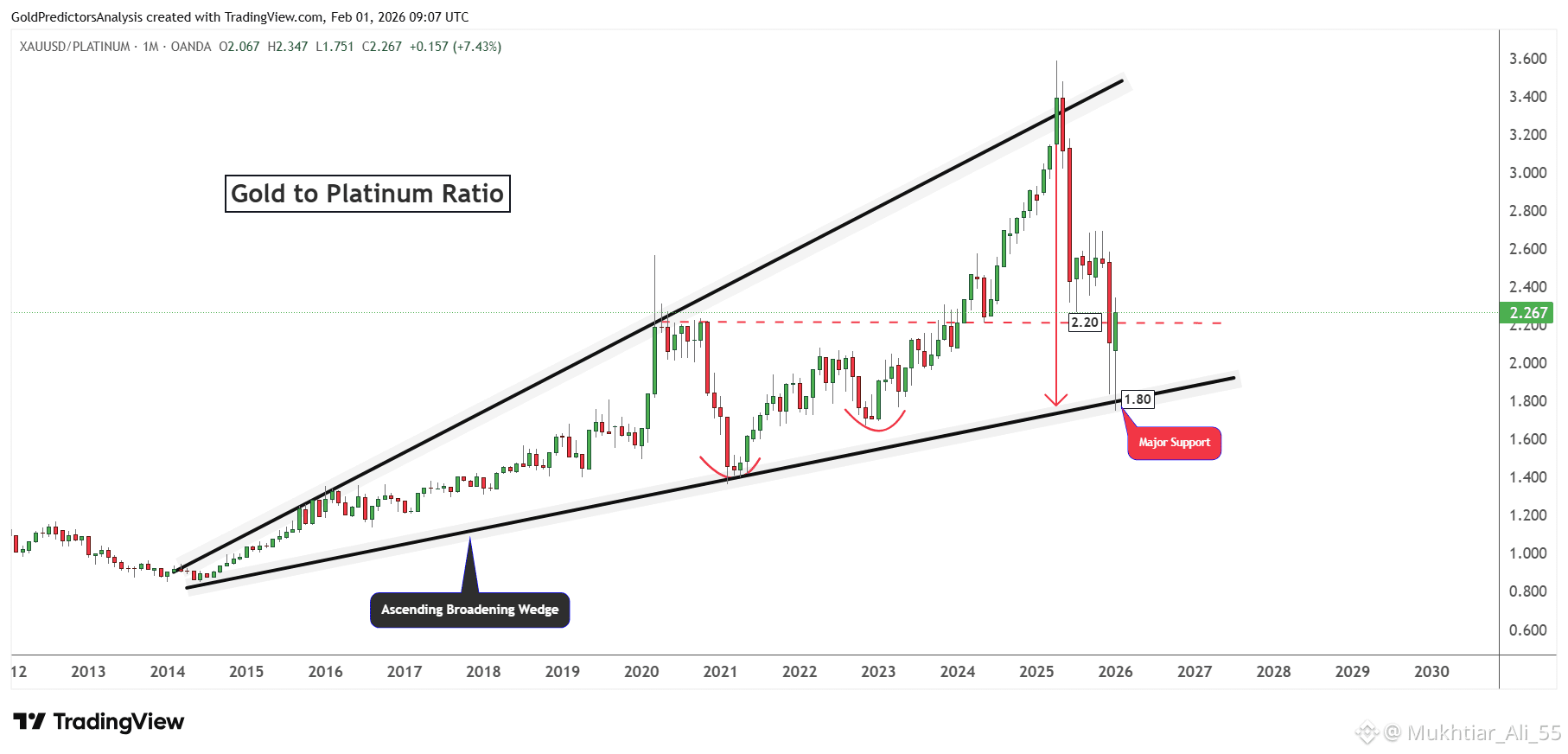

⚙️ Gold–Platinum Ratio Sends Warning

Ratio hit long-term support at 1.80, then rebounded above 2.20

This triggered a sharp plunge in platinum and palladium

Signals that gold may continue to outperform other metals 🥇👑

🧠 Final Thoughts

This correction does not end the gold bull market.

It resets it 🔄

🔥 Fiscal instability

🌍 Geopolitical risk

⚙️ Structural supply shortages

All remain firmly in place.

📌 As long as gold holds above $4,000, the long-term bullish trend stays intact.

Short-term caution is wise — let the dust settle before chasing entries ⏳⚠️

The next rally is being prepared… quietly 🐂✨

#GOLD #XAUUSD #PreciousMetalsTurbule #GoldForecast #KevinWarshNextFedChair