Cryptocurrency trading can be tricky, especially in volatile markets like Bitcoin. But with a Futures Grid Bot, you can automate your trades, capture profits in sideways markets, and manage risk efficiently. In this guide, we’ll show you step-by-step how to set up a BTC Grid Bot for 60,000 – 75,000 USDT, understand how it takes long and short trades, and use TP/SL for controlled profits and losses.

1️⃣ What is a BTC Grid Bot?

A Futures Grid Bot is an automated trading tool that places multiple buy (long) and sell (short) orders at defined price levels. Instead of manually timing the market, the bot:

Buys at lower grid levels → Sells at higher levels (Long trades)

Sells at higher grid levels → Buys back at lower levels (Short trades)

Captures profits repeatedly in sideways or choppy markets

Neutral Mode allows it to take both long and short trades simultaneously, maximizing profit potential in fluctuating markets.

2️⃣ Why Use a Grid Bot for BTC?

Automation – No need to watch charts 24/7

Profit in Sideways Markets – Even if BTC doesn’t trend strongly up or down

Micro Profits Add Up – Multiple small gains accumulate over time

Risk Management – TP/SL and isolated margin minimize losses

3️⃣ How BTC Grid Bot Trades Long & Short (60k – 75k)

Grid Range: 60,000 – 75,000 USDT

Grids: 45

Mode: Neutral (long + short)

Long Trades (Buy Low → Sell High)

Bot buys BTC at lower grid levels, e.g., 60,000 – 67,500

Sells automatically at higher grid levels to capture profit

Short Trades (Sell High → Buy Low)

Bot sells BTC at higher grid levels, e.g., 67,500 – 75,000

Buys back at lower levels to capture profit

Neutral Mode ensures both sides operate continuously → micro profits captured whether market moves up or down.

4️⃣ Step-by-Step BTC Grid Bot Setup

Step 1: Open UM Grid Bot

Go to Futures → Bots → UM Grid → Create New Bot

Step 2: Select Pair

BTCUSDT

Step 3: Set Mode

Neutral → Long + Short

Step 4: Margin & Leverage

Margin: Isolated (risk limited to invested capital)

Leverage: 15x – 20x

Step 5: Price Range

Lower: 60,000

Upper: 75,000

Step 6: Grids

45 grids

Step 7: TP / SL

Take Profit: 15%

Stop Loss: 10%

Close All Positions on Stop: ON

Step 8: Advanced Settings

Trailing Up / Trailing Down: OFF

Grid Trigger: OFF

Step 9: Create Bot

Review → Create → Bot starts automatically

5️⃣ Understanding ROI and Profits

Each grid trade earns micro profits ≈ 0.5% – 1%

TP ensures total profit target ≈ 15%

SL ensures losses don’t exceed 10% of invested capital

Example:

Buy at 61,500 → Sell at 65,000 → Profit ≈ 0.5% per grid

Sell at 74,000 → Cover at 72,500 → Profit ≈ 0.5% per grid

6️⃣ Monitoring & Risk Management

Even automated bots need monitoring:

Check every 2–3 hours for large price swings

Pause bot during major news events or strong trends

Withdraw profits periodically → avoid greed

Adjust grid if BTC moves out of range

Key Rule:

Grid Bot trades only within the set range.

Price outside the range → bot idle → manual action required

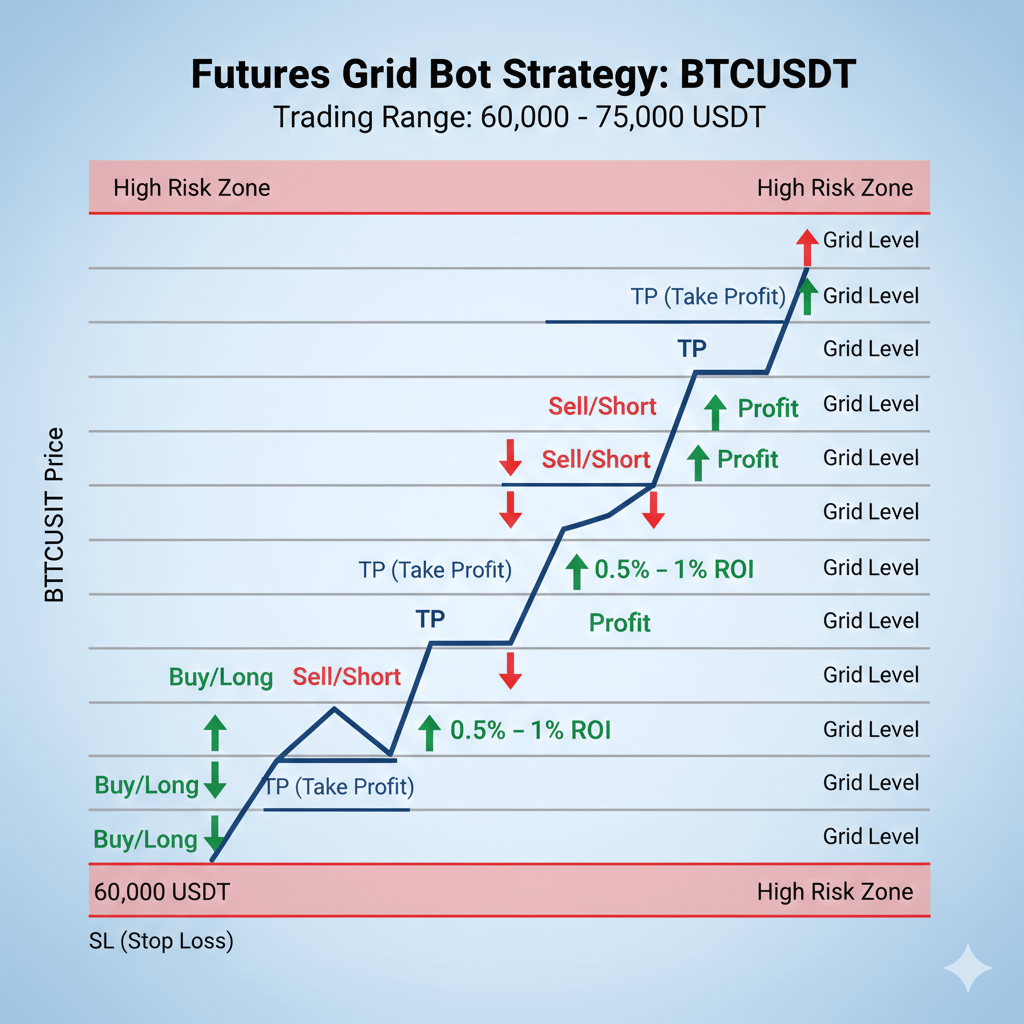

7️⃣ Visual Guide

A diagram helps understand bot operations:

Grid levels labeled from 60,000 → 75,000

Green arrows → Buy / Long positions

Red arrows → Sell / Short positions

Small green arrows → realized profit per grid

Blue line → Take Profit

Red line → Stop Loss

Highlighted zones outside 60k–75k → High Risk Zone

This visual shows how long and short trades work together to capture profit continuously.

8️⃣ Key Tips for Beginners

Start with 100–200 USDT to test the bot

Use Isolated Margin + moderate leverage (15x–20x)

Keep grid range wide to reduce liquidation risk

Withdraw profits regularly

Pause bot during strong uptrend or downtrend

🔥 Final Thoughts

The BTC Futures Grid Bot (60k–75k) is a powerful tool for automated trading. With proper setup, TP/SL, isolated margin, and careful monitoring, even beginners can profit from BTC’s sideways moves.

Remember: Start small, follow the grid plan, monitor market trends, and gradually increase capital as you gain confidence.