The other day I was sitting in a quiet café in Peshawar, trying to finalize a small DeFi settlement for a friend’s tokenized real estate share. The agent I’d been using some hyped autonomous tool everyone was raving about started strong. It pulled market data, checked compliance, even drafted the transfer. Then, midway through, it simply… blanked. Reset. Asked me the same KYC questions it had answered two days earlier. No memory of our prior session, no record of the tweaks we’d made to risk parameters. I watched the transaction hang, fees burning, trust evaporating. That moment felt like watching a house of cards collapse not because the cards were weak, but because someone kept sweeping the table clean every few minutes.

It’s not intelligence these agents lack. It’s continuity. On public blockchains today, most AI agents are stateless wanderers: brilliant for a single transaction, amnesiac the next. Every context switch wipes the slate. No accumulated experience, no compounding wisdom, no dignity of persistence. Developers building with current frameworks tell the same story when you ask quietly over coffee or late-night Discord: the model might reason beautifully in isolation, but throw it into a multi-step DeFi workflow or RWA management loop and it forgets the last compliance check, the prior valuation, the user’s stated preferences. What should be a reliable workforce becomes a parade of short-term temps smart, but unreliable. We hype the poetry these agents write or the art they draw, but real economic value demands agents that don’t forget, that build on yesterday instead of restarting from zero.

This is where trust fractures. In DeFi, one forgotten margin call can liquidate positions. In RWAs, a missed provenance update can invalidate ownership proofs. We’re building skyscrapers on sand because the foundation verifiable, persistent memory is missing. The market chases flashy “AGI-adjacent” demos while ignoring the plumbing: how do you make an agent’s decisions provably correct, tamper-proof, and accumulative without off-chain crutches that reintroduce central points of failure?

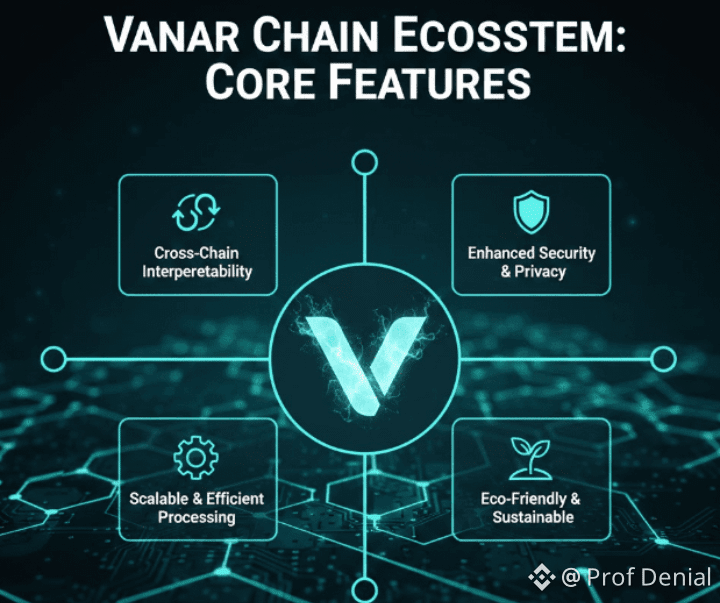

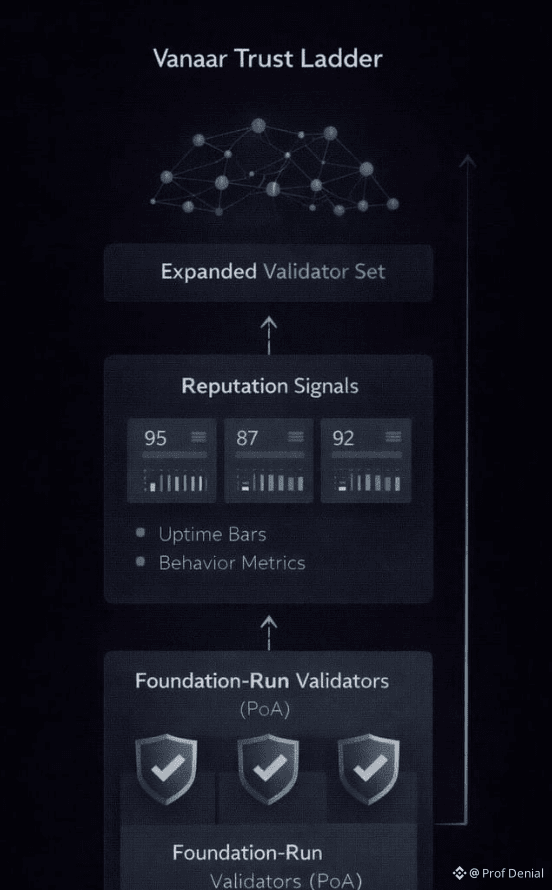

Vanar Chain ($VANRY) never pretended to be the loudest voice in the room. It didn’t chase narrative fireworks or promise instant riches. Instead, it quietly rebuilt the bricks of trust from the ground up. Designed as an AI-native Layer 1, Vanar embeds intelligence directly into the protocol starting with Neutron, its semantic compression layer that crushes massive files (deeds, invoices, contracts) into tiny, on-chain “Seeds” with ratios up to 500:1. These aren’t just compressed blobs; they’re verifiable, machine-readable proofs that agents can query without oracles or middleware.

Layer that with Kayon, the on-chain reasoning engine, and suddenly smart contracts and agents can reason over live, compressed data natively. No blind faith in off-chain compute. Add recent integrations like OpenClaw the viral open-source agent framework that exploded to massive adoption and Vanar gives these agents a true second brain: persistent, verifiable memory that survives resets, sessions, even chain forks. Early access APIs are live, letting builders spin up agents that handle PayFi settlements or RWA compliance loops with zero amnesia. What emerges isn’t another toy agent spitting memes; it’s a trustworthy workforce capable of compound intelligence learning from past executions, refining strategies, executing error-free over weeks or months.

Philosophically, this hits deeper. Human progress has always depended on external memory: diaries that capture fleeting insights, libraries that preserve collective wisdom, hard drives that let us build on yesterday without starting over. When cracks appear errors, forgotten details, broken trust we don’t discard the whole structure. We mend it, sometimes with gold, turning scars into strength. Vanar treats every agent interaction the same way: respect the experience, anchor it on-chain with ZK-verifiable proofs, let it compound. In a world obsessed with novelty, this direction feels almost defiant dignity through persistence, value through continuity.

Right now, the market isn’t kind to this kind of quiet conviction. $VANRY hovers in the low $0.00X range, volume thin, sentiment flatlined. Retail has worn thin from endless hype cycles that promise the moon and deliver dust. No viral memes, no celebrity endorsements, no get-rich-quick bait so the price lies flat, enduring what feels like physiological torture for holders. It’s the bear’s favorite punishment: rewarding storytelling over substance, punishing the ones who build tools instead of narratives.

But this phase is deceptive. Infra plays like Vanar thrive in silence because they don’t need hype to accrue value they accrue usage. Developer stickiness is forming: once an agent framework integrates Neutron Seeds or Kayon reasoning, migrating away means losing verifiable history, breaking compound gains. Path dependency becomes a moat stronger than any marketing budget. Bear markets refine; they burn away the toys and leave the reliable workforce standing. When the cycle turns and it will the agents executing real economic activity (DeFi automation, RWA tokenization, continuous PayFi flows) won’t be the flashy ones. They’ll be the ones that never forget.

In 2026, whoever can make AI agents not just smart, but trustworthy verifiably continuous, error-resistant, and economically reliable will hold the ticket to what comes next. Vanar isn’t selling dreams. It’s building the bricks of trust we’ve been missing all along.

What part of this agent amnesia pain have you felt most in your own building or using? Are you seeing the shift toward verifiable infra yet?