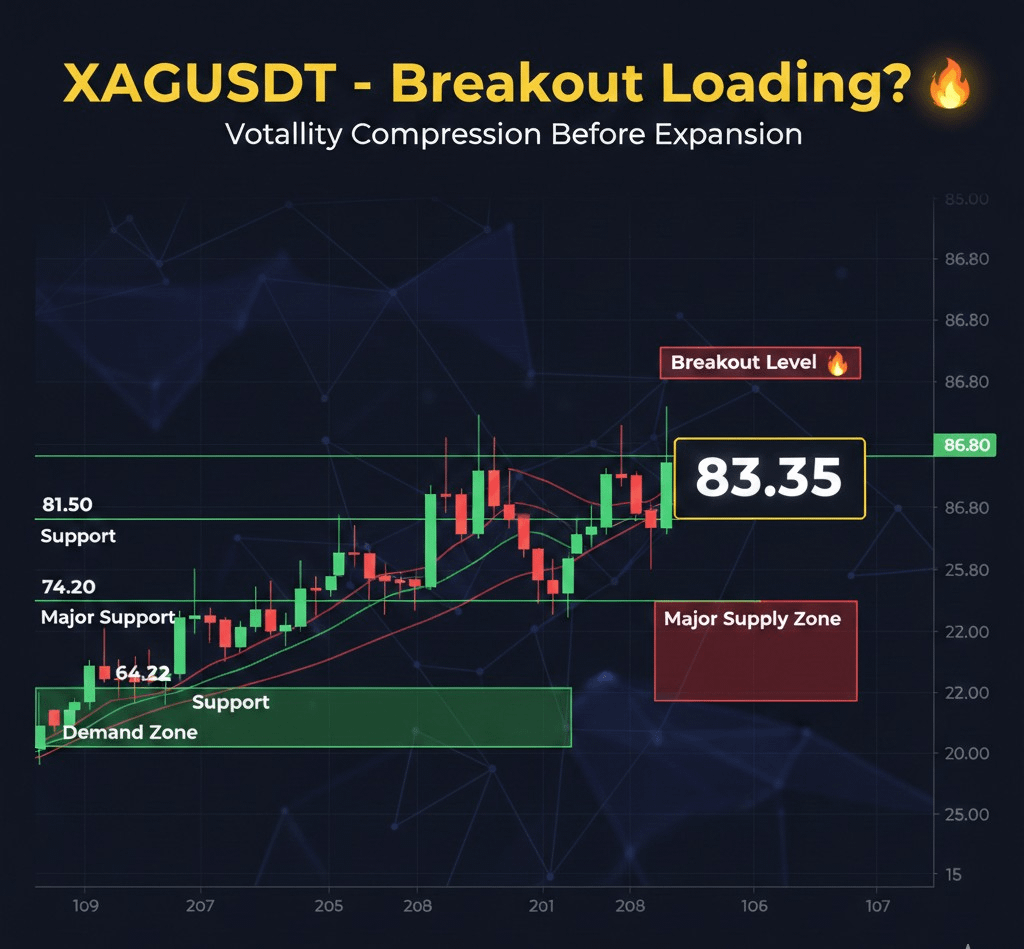

$XAG XAGUSDT is currently trading around 83.35, stabilizing after a sharp sell-off from the 121.74 high down to the 64.52 swing low. The market has formed a short-term recovery structure on the 4H timeframe, with price consolidating between 81.50 support and 86.80 resistance. This range compression suggests volatility contraction — typically a precursor to a strong breakout move. Buyers are defending higher lows, indicating accumulation near demand zones. $XAG

🔎 Key Levels to Watch

Immediate Support: 81.50

Major Support: 74.20

Extreme Demand Zone: 64.50

Immediate Resistance: 86.80

Breakout Resistance: 99.40

Major Supply Zone: 112.00 – 121.70

If bulls reclaim 86.80 with strong volume, momentum could expand toward 99.40, where liquidity is resting. A clean break above 99 opens the door toward the psychological 110–120 supply zone.

However, failure to hold 81.50 may trigger a pullback toward 74.20, and deeper weakness could retest 64.50 demand.

⚡ $XAG is compressing — smart money watches consolidation before expansion. The breakout from this range could deliver the next high-RR opportunity.

📌 Not financial advice. Trade with proper risk management.

Disclaimer: I am not your financial advisor.

#cryptotradinganalysisboss #BinanceSquare #TechnicalAnalysis #altcoins