When I first heard people talk about Fogo, the conversation sounded familiar. Speed. Throughput. Low latency. The same checklist we’ve seen repeated across dozens of chains.

But the more I looked into it, the more I felt like that framing misses the point.

Because the real question isn’t how fast a chain looks in a perfect demo. The real question is what happens when the network is busy, messy, and under pressure — when real traders and real apps are depending on it.

That’s where Fogo starts to feel different.

The real focus: not just speed, but timing you can trust

In crypto, we celebrate peak performance. In real systems, what people actually care about is consistency.

A trading system doesn’t break because it’s slightly slower one day. It breaks when behavior becomes unpredictable:

orders cancel late

confirmations become uneven

endpoints randomly fail

latency spikes without warning

Those small inconsistencies quietly destroy confidence.

What stands out about Fogo is that its design reads like a team obsessed with repeatable timing, not just raw speed. The goal seems to be simple: make the network behave in a way that builders and traders can actually plan around.

That’s a very different mindset.

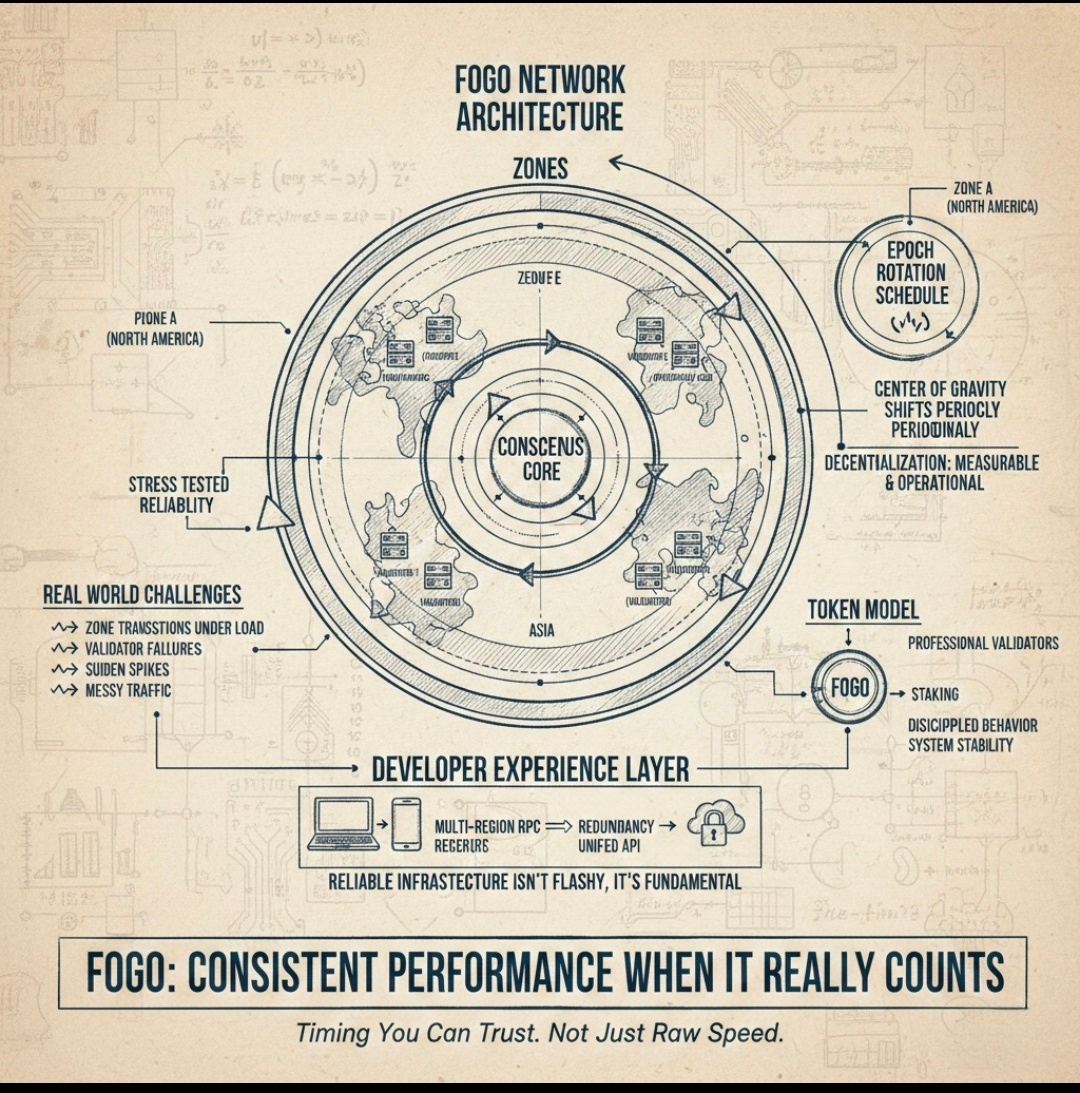

Zones: facing a reality most chains avoid

There’s an uncomfortable truth in high-performance infrastructure: physical distance matters. Systems that are closer together usually perform better. Traditional finance has known this for years.

Many crypto projects prefer to talk around that reality. Fogo leans into it.

The zone-based approach — where validators in a zone are geographically close — is basically an admission that if you want very low latency, you have to control the environment where consensus happens.

That may sound less ideological, but it’s more honest from an engineering perspective.

The interesting twist: rotation instead of permanent advantage

What makes the design more thoughtful is the rotation model.

Instead of one region permanently holding the performance advantage, Fogo’s epoch design suggests that consensus can move between zones over time. Think of it like the network deliberately shifting its center of gravity on a schedule.

Why does that matter?

Because it turns decentralization into something measurable and operational. Not just “we are globally distributed,” but “we regularly prove the system can run elsewhere without falling apart.”

That kind of rhythm is something institutional systems actually value.

The unglamorous layer that really decides adoption

One thing I always watch closely is developer experience — especially RPC reliability.

Users don’t feel consensus algorithms. They feel:

slow API responses

failed requests

unstable endpoints

laggy explorers

If those pieces are weak, the chain feels broken no matter how fast the blocks are.

What I like about the ecosystem signals around Fogo is that infrastructure teams are already talking about multi-region RPC setups and redundancy. It’s not flashy work, but it’s exactly the kind of groundwork that separates a testnet toy from something builders can rely on.

Sometimes the boring parts are the most important.

Where the token model fits into all this

It’s easy to treat gas and staking as standard checkboxes. But in a system trying to enforce tight timing and structured validator behavior, incentives matter more than people think.

If Fogo really wants predictable performance, it needs validators who operate like professionals — not casual nodes that come and go. Staking is one of the few mechanisms a network has to encourage that kind of discipline.

In that sense, the token isn’t just about utility. It’s part of the machinery that keeps the system behaving properly over time.

Why this actually matters

Most performance debates in crypto are still stuck in benchmark culture. Bigger numbers. Faster charts. Cleaner demos.

But real markets care about something else entirely: service reliability.

What serious users want is:

timing they can anticipate

infrastructure that stays responsive

behavior that doesn’t change under stress

systems that keep working during the worst ten minutes, not just the best ten

Fogo appears to be aiming directly at that problem space.

What the next phase will really test

Right now, the architecture tells a coherent story. The pieces fit together logically.

But the real proof will come later, when the network faces real pressure:

zone transitions under load

validator failures mid-epoch

sudden spikes in activity

heavy developer usage

messy real-world traffic patterns

If the network stays calm through those moments, the design will start to speak for itself. If not, it risks becoming just another fast chain with good intentions.

Final thought

To me, Fogo’s most interesting move isn’t trying to win the speed race. It’s trying to make performance feel boringly predictable — the way serious financial infrastructure is supposed to behave.