Trade Update: Discipline Pays Again 📊🔥

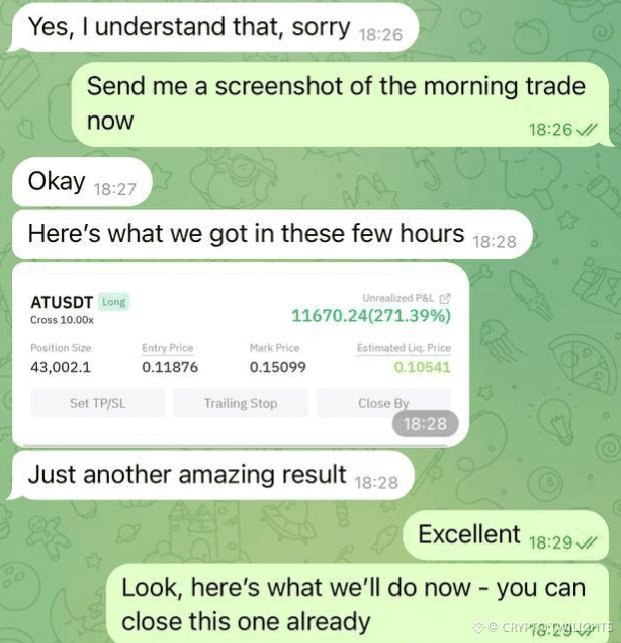

Today’s result is another reminder of why discipline, patience, and execution matter more than anything else in trading. The screenshot you see isn’t just numbers on a screen — it’s the outcome of following a plan, trusting the process, and not letting emotions take control.

From the very start of this morning trade, the idea was simple:

✔️ Wait for confirmation

✔️ Enter at the right zone

✔️ Stick to the setup

✔️ Let the market do its job

No rush. No revenge trading. No chasing green candles.

And within just a few hours, the market delivered exactly what was expected.

---

📈 Why This Trade Worked

This move didn’t happen by luck. It came from:

Understanding market structure

Identifying the trend correctly

Entering with proper timing

And most importantly, holding the position with patience

Many traders exit too early because they fear pullbacks. But pullbacks are part of every healthy move. If your setup is valid and your risk is defined, you don’t need to panic at every small dip.

Today, patience was rewarded.

---

🧠 The Power of Execution

A strategy is useless if you can’t execute it properly.

You can have the best analysis in the world, but if:

You hesitate to enter

You close too early

You move stop-loss emotionally

Or you overtrade

Then results will never be consistent.

This trade was executed exactly as planned. Entry was respected. The position was allowed to breathe. And when the price expanded, it showed what clean execution can do.

That’s how real growth happens in trading.

---

💡 Lessons to Take From This Trade

Every successful trade teaches something. Here are a few key takeaways:

✅ Trust your setup – If you’ve done your analysis, let it play out.

✅ Avoid noise – Don’t let random opinions shake your plan.

✅ Patience is a weapon – The market pays those who can wait.

✅ One good trade is enough – You don’t need to trade all day.

✅ Protect your capital – Risk management always comes first.

Remember: Our job is not to predict every move, but to manage risk and catch high-probability setups.

---

⚠️ Discipline Over Emotions

Trading is not about excitement. It’s about control.

Most losses come from:

Fear when price pulls back

Greed when price moves fast

Ego after a win

And frustration after a loss

The traders who survive and grow are the ones who stay calm in both profit and loss.

Today’s result came because emotions were kept out of the equation.

---

📊 Consistency Beats Big Wins

Anyone can get one lucky trade.

But repeating good results again and again comes only from consistency.

Consistency in:

Analysis

Entries

Risk

And mindset

This is how small wins compound into big results over time.

Don’t chase jackpots. Build a process.

---

🚀 For Every Trader Reading This

If you’re struggling right now, remember:

Every profitable trader was once confused.

Every disciplined trader once made emotional mistakes.

Every consistent trader once faced drawdowns.

What separates them is that they didn’t quit.

Keep learning. Keep journaling your trades. Keep refining your execution. And most of all, keep believing in your ability to improve.

---

🏁 Final Thoughts

Today’s trade is not about showing off results.

It’s about showing what’s possible when: ✔️ You respect your plan

✔️ You manage your risk

✔️ You stay patient

✔️ You execute with confidence

Let this be motivation to focus more on discipline than on profits. Because when discipline becomes a habit, profits become a byproduct.

Stay sharp. Stay focused.

The market always rewards those who respect it. 💪📈