The Difference Between Seeing Profits and Securing Profits

In trading, screenshots don’t make you profitable. Decisions do.

Every trader has seen moments where the numbers look unreal—green everywhere, percentages flying, confidence at its peak. But this is exactly the moment where most mistakes happen. Not because the setup was wrong, but because emotions quietly take control.

The market doesn’t reward excitement. It rewards execution.

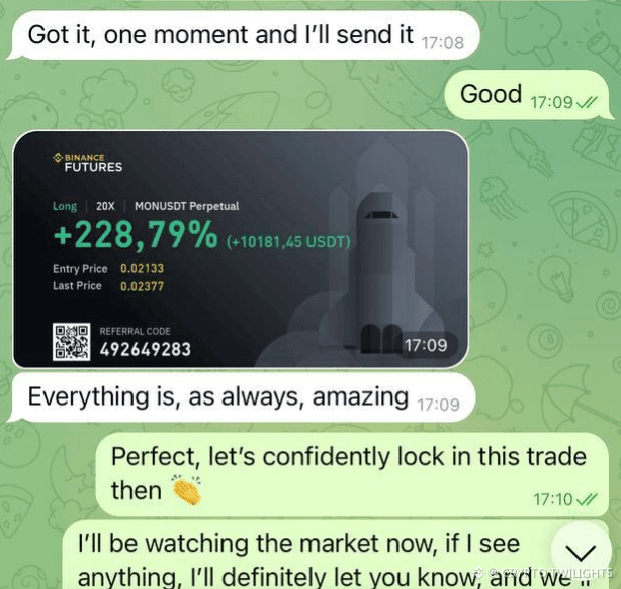

That image you’re looking at represents more than a profitable trade. It represents timing, patience, and the most underrated skill in trading: knowing when to lock in.

Many traders focus heavily on entries. Indicators, confirmations, timeframes, news—everything revolves around getting in. But professional traders know the real money is made after the entry. How you manage the trade decides whether profits remain profits or turn into regret.

Let’s talk about what really matters.

---

Profits Are Temporary Until They’re Locked

Unrealized profit is not yours.

The market can take it back in seconds.

Price doesn’t care about how confident you feel. It doesn’t care about past wins. It doesn’t care about screenshots. If you don’t respect volatility, the same move that gave you confidence can wipe it out.

That’s why experienced traders don’t chase “more.” They protect what the market has already offered.

Locking a trade doesn’t mean fear.

It means discipline.

---

Confidence Is Quiet, Not Loud

Real confidence doesn’t scream “hold more.”

It calmly says: “The plan is complete.”

When you enter a trade with a clear plan—entry, target, invalidation—you remove emotions from the equation. You already know what to do before the market even moves.

The mistake beginners make is adjusting the plan mid-trade based on greed:

“Maybe it will go higher”

“Just a little more”

“I’ll close later”

Later is where most profits disappear.

Professionals act on confirmation, not hope.

---

Watching the Market Is Part of the Job

Once you’re in profit, your work isn’t over.

It’s just different.

Now your job is risk management:

Monitoring momentum

Watching volume behavior

Observing reaction near key levels

This is where patience turns into protection. Not staring at every candle emotionally, but objectively observing whether the market is still doing what you expected.

If the reason you entered is no longer valid, the trade no longer deserves your capital.

Simple rule. Hard execution.

---

One Trade Doesn’t Define You

Another silent killer in trading is attachment.

A trade is not your identity.

A win doesn’t make you a genius.

A loss doesn’t make you a failure.

When you detach emotionally, decisions become cleaner. You stop forcing outcomes. You stop proving points. You simply execute.

That’s how consistency is built.

---

The Market Always Gives Another Opportunity

This mindset separates traders from gamblers.

You don’t need this trade to be perfect.

You don’t need maximum profit every time.

You need repeatable execution.

Markets open every day. Opportunities never end. Capital does—if you don’t protect it.

Locking profits isn’t exiting the market.

It’s surviving long enough to trade again.

---

Final Thought

Trading isn’t about being right all the time.

It’s about being controlled all the time.

The traders who last aren’t the ones with the biggest screenshots. They’re the ones who respect risk, follow their plan, and know when to step back.

Stay patient.

Stay disciplined.

Let the market work — but never forget to protect what it gives.

That’s real trading.