Unrealized Profit Is Not Your Money Until You Close the Trade

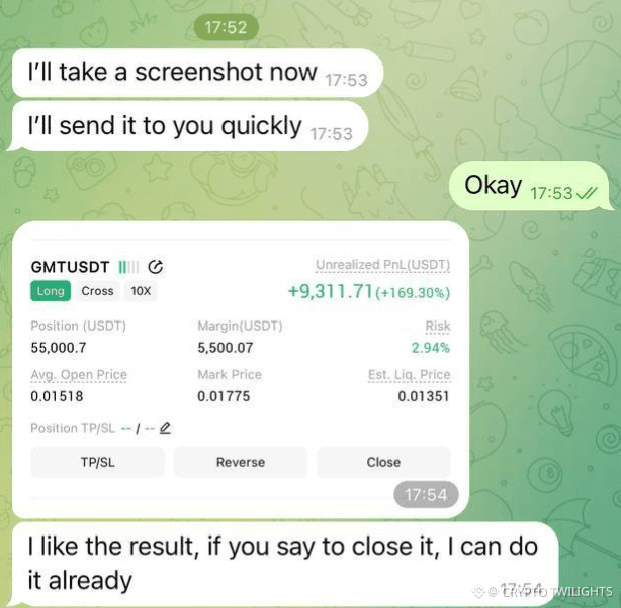

This screenshot tells a story many traders dream about—but few truly understand.

A position is running strong. Unrealized PnL is up heavily. Numbers look beautiful. Emotion kicks in. Confidence rises. And then comes the most dangerous question in trading:

“Should I close it… or let it run?”

This is where most traders lose discipline—not because the trade is bad, but because emotions start trading instead of the plan.

---

Unrealized Profit Is Just a Number on the Screen

Until a trade is closed, profit is not real.

Unrealized PnL can disappear in minutes. The market doesn’t care how patient you were, how long you waited, or how perfect your entry was.

Many traders feel rich while the trade is open… and feel shocked when the market takes it all back.

That’s why professionals never fall in love with open profit.

---

The Psychological Trap of Big Green Numbers

When you see large unrealized gains:

Greed whispers: “What if it goes even higher?”

Fear responds: “What if it reverses right now?”

Ego adds: “I was right. I should hold longer.”

This internal battle causes hesitation. And hesitation leads to poor decisions—either closing too late or holding without protection.

The market rewards clarity, not hope.

---

The Role of a Trading Plan

A professional trader does not ask others when to close a trade.

Why? Because the decision was already made before entering.

Your trading plan should clearly define:

Partial profit levels

Final target

Trailing stop logic

Invalidation point

If you’re asking “Should I close?” after the trade is already deep in profit, it means one thing:

The exit plan was missing.

---

Smart Ways to Handle a Winning Trade

There is no single correct method, but there are disciplined approaches:

1. Partial Close

Lock some profit. Reduce emotional pressure. Let the rest run risk-free.

2. Move Stop Loss to Breakeven or Profit

The market can’t hurt you anymore. Now you’re trading with confidence, not fear.

3. Trail the Stop

Let the market decide when the move is over. This removes emotional guessing.

4. Close Fully When Target Is Hit

A planned exit is a successful trade—no regrets, no “what ifs”.

What matters is not which method you choose, but that you choose it in advance.

---

Big Profits Don’t Mean Big Skill—Consistency Does

One screenshot doesn’t make a trader successful.

One big trade doesn’t define your journey.

What truly matters:

Can you repeat this process?

Can you protect gains consistently?

Can you walk away satisfied without chasing more?

Professional trading is boring, systematic, and emotionally controlled.

If you need excitement, the market will gladly teach you expensive lessons.

---

The Market Will Always Give Another Opportunity

Many traders don’t close because they fear missing more upside.

But the truth is simple:

Opportunities never end. Capital does.

Protecting profit is more important than squeezing the last move out of a trend. Survival comes first. Growth comes second.

---

Final Thought

A good entry feels exciting.

A disciplined exit feels professional.

Anyone can catch a move.

Very few can manage it correctly.

If you want to trade like a professional, stop asking how much more you can make—and start asking how much you’re willing to protect.

Because in the end, the market doesn’t reward dreams.

It rewards discipline.