🎯 Opportunity (Bullish 📈)

Institutional inflows support next upward leg: Bitcoin (BTC) currently trades at 88,979.03 USDT, consolidating just below the psychological $90,000 mark. Continuous institutional accumulation—particularly Tether’s purchase of 8,888 BTC—signals strong long‑term confidence. Coupled with recovering sentiment and improving macro liquidity, probabilities favor a retest and potential breakout above $90 k soon.

News drivers (Bullish 📈)

Institutional demand resurging: Tether’s latest acquisition worth ≈ $780 million boosts BTC’s perceived scarcity. Metaplanet’s steady accumulation toward 210,000 BTC by 2027 reinforces the institutional buy‑the‑dip narrative.

Macro & ETF structure: Despite short‑term ETF outflows ($348 million), overall 2025 inflows (>$22 billion) remain robust, underlining enduring institutional conviction.

Cross‑asset sentiment shift: As dollar liquidity expands under Fed easing expectations, high‑beta assets like BTC and peers (ETH and SOL) benefit from risk‑on rotation; both exhibit recovery potential if BTC breaks 90 k.

Technical drivers (Bullish 📈)

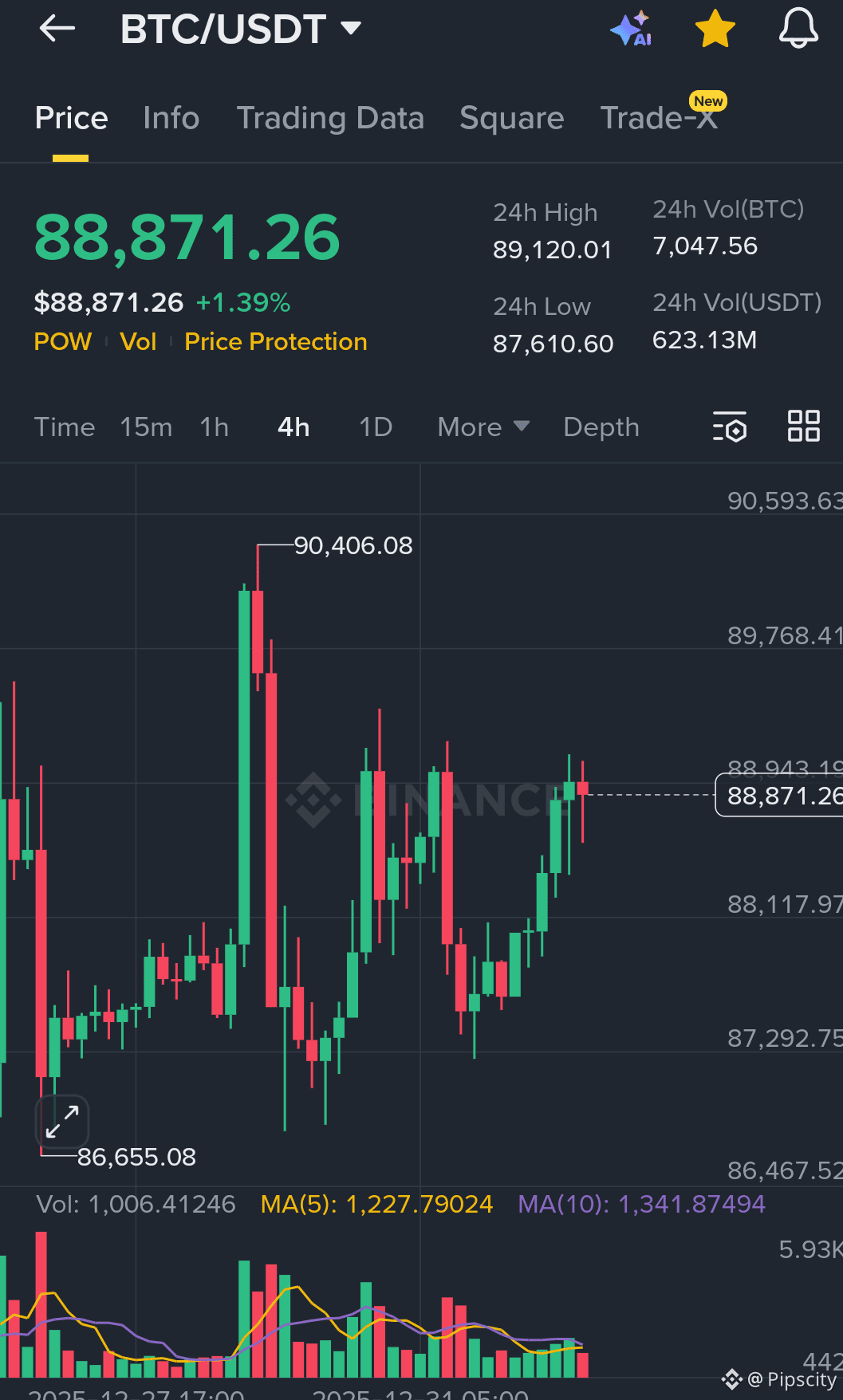

Momentum alignment: Hour‑level MACD remains positive, EMA (7) crossed above EMA (25), RSI ≈ 62 – neutral‑to‑bullish.

Support and resistance: Key support ≈ $88,564 USDT; resistance ≈ $90,000 USDT (short‑term) and $102,500 USDT (mid‑term).

Derivatives structure: Long‑short ratio among elite traders ≈ 2.0, funding rate positive (5.6E‑5), showing healthy long bias continuation.

Sector rotation: Altcoin season index 39 — early cycle; ETH’s short‑term weakness amid ETF outflows could revert once BTC breaches 90 k, followed by renewed flows into SOL and PEPE.

🚨 Risk (Moderate 🤔)

High‑volatility liquidity squeeze risk:

While BTC’s trend bias is bullish, several metrics warn of instability: (1) Large whale transfers > $90 million may signal profit‑taking; (2) Seven‑day net outflow > $140 million shows short‑term selling pressure; (3) Fear‑Greed Index 27 reflects prevailing caution even amid price strength.

Comprehensive risk view

Whale redistribution pressure: A 1,029 BTC (≈ $91 million) transfer from Bybit to Binance could generate spot‑side selling liquidity.

ETF and macro divergences: If US ETF redemptions persist or Fed fails to deliver rate cuts in Q1 2026, BTC may face temporary downward repricing.

Altcoin contagion effect: Weak ETH and XRP flows could weigh on broader market confidence. Monitor cross‑correlation with PEPE and SUI for risk on/off signals.

⚡ Action (Bullish 📈)

Buy dips near 88 k aiming for 90 k breakout: Price momentum suggests accumulation above $88,000 remains advantageous. Short‑term traders can target $90 k, while swing positions may ride toward $102,500 if macro conditions stay supportive. Keep tight risk management because whale‑driven volatility may spike