🎯 Opportunity (Bullish 📈)

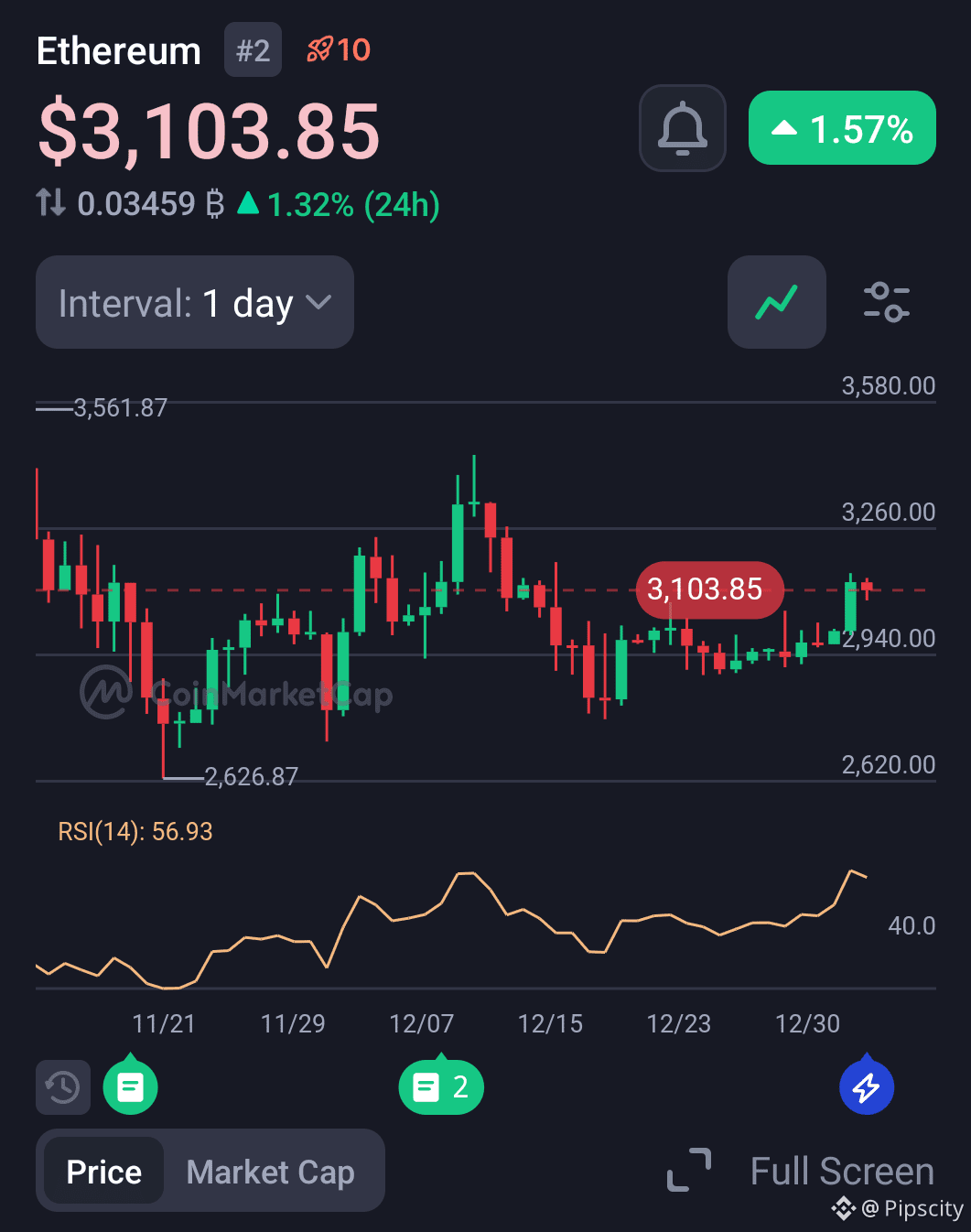

ETH near breakout zone: Ethereum is consolidating near 3,100 USDT and may challenge the 3,180–3,200 USDT resistance if institutional demand continues. The latest ETF inflow (≈1.745 B USD) and whale accumulation confirm strengthening fundamentals.

News Factors (Bullish 📈):

Institutional demand surge: Whales and funds have accumulated tens of thousands of ETH, with Coinbase’s spot ETF seeing strong inflows. The DeFi ecosystem remains robust amid Ethereum staking expansion and zkEVM upgrades.

Cross-asset support: BTC’s rise above 90,000 USD confirms wider risk appetite, increasing correlation-driven buying pressure on ETH. SOL and SUI’s recovery strengthens overall altcoin sentiment.

Narrative strength: Market optimism around Galaxy’s prediction of 50 altcoin ETFs sustains liquidity rotation. Meme tokens (PEPE and DOGE) and high-cap assets (XRP and ADA) benefit from rising speculative flows, indirectly supporting ETH’s sentiment premium.

Technical Factors (Bullish 📈):

Momentum improving: MACD on daily and 4‑hour charts shows growing bullish divergence; EMA‑7 crossing EMA‑25 confirms short-term strength.

Derivatives positioning: Elite long/short ratio ≈ 1.83 and retail ≈ 1.66 show dominant long positioning. Funding rate ≈ +0.000033 % and rising bid/ask ratio (> 1.0) indicate increasing buying activity.

Liquidity inflow: Net flow turned positive (≈ 46.7 M USD in), suggesting rebound potential from prior outflows.

🚨 Risk (Moderate 🤔):

Volatility and sentiment divergence: Despite price strength, RSI approaches overbought and fear‑greed index holds at 30 (fear); whales rotation to BTC reflects short‑term caution.

Comprehensive Evaluation:

Overbought technicals: RSI nearing 70 on short time frames could trigger intraday corrections before a firm breakout.

Macro factor sensitivity: Ongoing Fed rate‑cut speculation and USD strength might cause brief liquidity contractions.

Resistance cluster: Heavy sell orders between 3,180–3,200 USDT may cap upside temporarily; failure to break could push ETH back to 2,950 USDT support.

⚡ Action (Bullish 📈)

Buy‑the‑dip setup: Traders may accumulate Ethereum around 3,050–3,080 USDT and target breakout above 3,200 USDT. Potential upside extends toward 3,350 USDT if volume expands after resistance breach; stop‑loss below 2,950 USDT