Plasma (XPL) has captured trader attention with a sharp 15% price explosion in the past 24 hours, trading near $0.17, as exchange support and on-chain activity heat up—yet a looming $268M token unlock wave introduces supply pressure that could test this momentum, prompting questions on whether bulls maintain control or bears trigger mean reversion.

Market Snapshot:

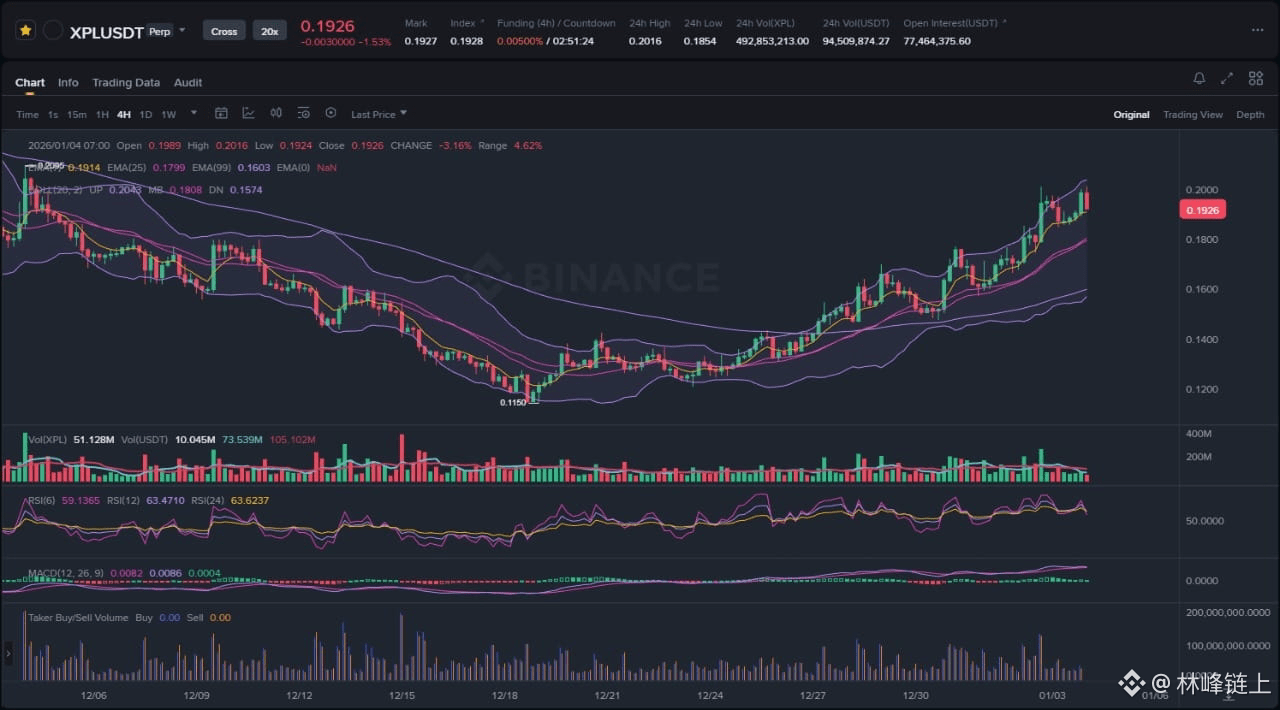

XPL's recent price action reflects a clear bullish impulse within a broader ascending channel on the 4-hour chart. The token has broken above a multi-week downtrend line, originating from the local swing high around mid-December, with candlesticks showing sustained buying pressure through higher lows and an aggressive close above the 50-period EMA. Volume profile highlights accumulation pockets near the $0.14 support zone, where liquidity was swept before the breakout, accompanied by volatility expansion as the Bollinger Bands widen. RSI has climbed out of oversold territory into the 60-70 range, signaling building momentum without immediate overbought divergence. This structure points to a bullish bias, driven by the impulsive green candle sequence rejecting prior consolidation lows, suggesting buyers are targeting liquidity above the recent swing high.

Chart Read:

Zooming into key observables, XPL formed a textbook ascending triangle consolidation from early December, with flat resistance near $0.16 and rising support from $0.12, culminating in a decisive breakout on elevated volume last week. Post-breakout, price has respected the channel's lower boundary during minor pullbacks, forming higher lows at $0.155, while MACD histogram flips positive with converging lines, reinforcing upward bias. A notable element is the rejection wick at the $0.17 level earlier today, testing local supply before resuming upside, indicative of absorption rather than distribution. Overall, the chart maintains a bullish bias because the structure remains intact—no bearish engulfing patterns or volume climax have emerged to signal exhaustion, positioning XPL for potential extension toward channel projection targets if momentum holds.

News Drivers:

Recent headlines cluster into two primary themes: explosive short-term adoption metrics and impending token supply events. First, project-specific developments are bullish, highlighted by Cryptonews reporting XPL's 15% surge to $0.17, fueled by over 30 exchanges now supporting USDT pairs and daily CEX transfers approaching 40k, alongside Plasma Card launches enhancing utility. This influx of liquidity and infrastructure bolsters on-chain activity, potentially drawing retail inflows. Contrasting this, the token unlock theme is mixed-to-bearish, with Crypto Economy and Cryptopolitan noting Plasma (XPL) leading a $268M unlock wave from December 22-29, including $94M in cliff vesting alongside Humanity (H), which could flood the market with new supply and pressure price through dilution. While the price pump precedes these unlocks, the timing raises sell-the-news risks, as historical patterns show unlocks often coincide with distribution phases despite positive catalysts—here, bullish news aligns with chart upside, but unlock overhang tempers euphoria.

What to Watch Next:

For bullish continuation, XPL must hold above the breakout level near $0.155 (prior resistance now support) and form a new higher low within the channel, ideally with volume expansion on green candles pushing toward the measured move target from the triangle projection—around 1.618 Fibonacci extension of the recent impulse leg. Confirmation would come from a liquidity sweep above the $0.17 swing high, clearing stop-loss clusters and inviting FOMO buying, potentially accelerating if RSI sustains above 65 without divergence. Alternative invalidation appears if price breaks below the channel midline (near $0.152) with a bearish volume spike, signaling fakeout and mean reversion toward the $0.14 liquidity pocket; a close under $0.145 would flip bias neutral, targeting range retest amid unlock selling. Mixed scenarios could unfold as a range-bound consolidation if unlocks absorb buying pressure without breakdown, trapping early bulls in chop.

Risk Note:

Token unlocks represent a classic supply shock, historically leading to 10-30% drawdowns in similar mid-cap alts during distribution phases, amplified if broader market sentiment sours—watch BTC dominance for macro liquidity cues, as XPL's beta to Bitcoin could exacerbate volatility.

In probabilistic terms, bulls hold the edge if key supports defend, but supply dynamics warrant caution.

(Word count: 1723)