As we look toward 2026 and beyond, the blockchain landscape is undergoing a massive shift. The "speculative phase" of crypto is being replaced by a "utility phase" dominated by three massive pillars: Real World Assets (RWAs), Autonomous AI Agents, and the Activation of Bitcoin Capital.

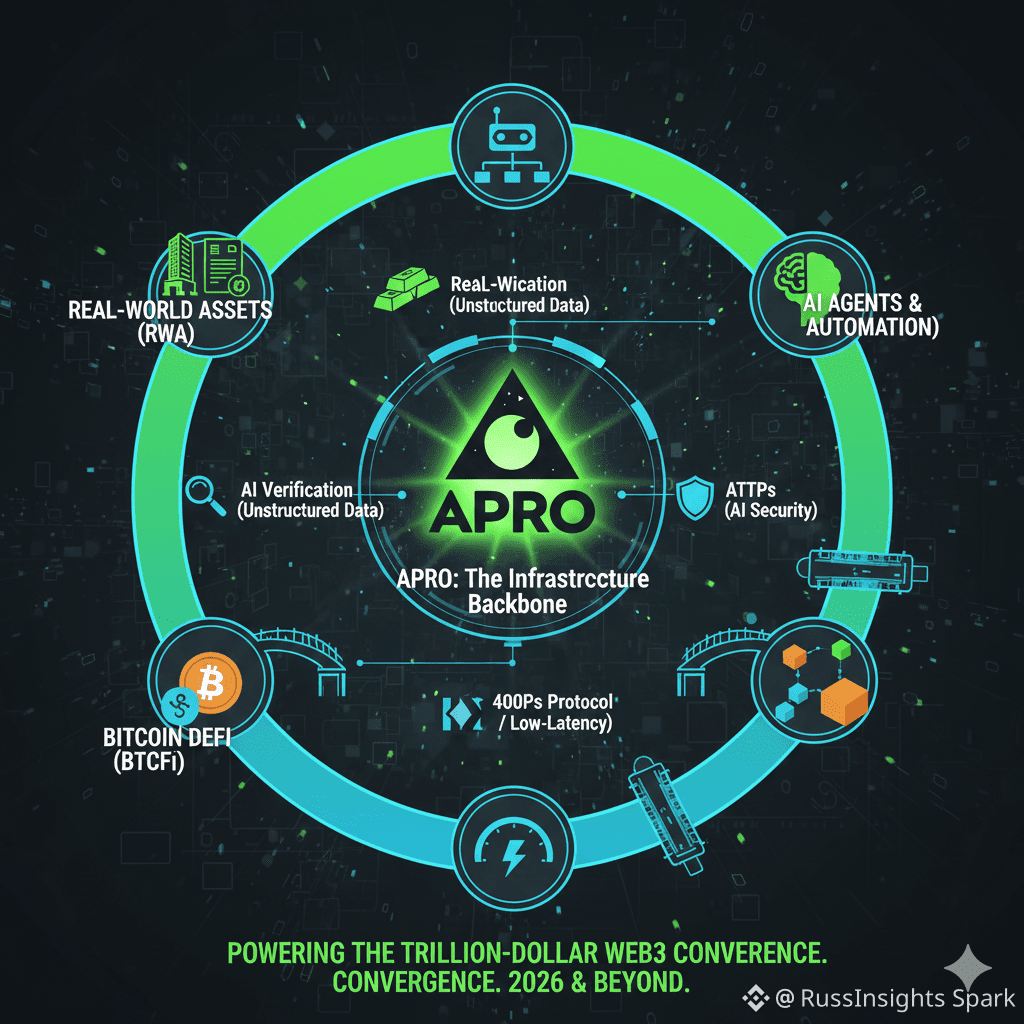

At the center of this convergence sits APRO (AT). By evolving from a traditional price-feed tool into a sophisticated Oracle 3.0 infrastructure, APRO is positioning itself as the indispensable engine for the next decade of decentralized finance.

1. The RWA Explosion: Beyond Simple Tokenization

The RWA market is projected to reach between $16T and $30T by 2030. However, the "hidden" hurdle is that real-world assets like real estate deeds, private credit contracts, and shipping manifests are messy. They exist as "unstructured data" (PDFs, images, and legal text).

APRO’s AI-driven Submitter Layer solves this by using Large Language Models (LLMs) to read, verify, and "digest" these complex documents in real-time. By providing the world’s first scalable way to bring unstructured legal data on-chain, APRO is the primary candidate to become the standard data provider for institutional giants like BlackRock and Franklin Templeton as they move deeper into on-chain finance.

2. Powering the "Agentic" Economy

2026 is the year of AI Agents. These autonomous programs don't just follow code; they make decisions. But an AI agent is only as good as the data it receives. If an agent receives "hallucinated" or manipulated data, the financial consequences are instant and irreversible.

APRO’s ATTPs (AgentText Transfer Protocol Secure) provides a secure "handshake" between AI models and blockchain data. This ensures that when an AI agent executes a trade or manages a portfolio, it is acting on verifiable truth. As the economy of AI agents grows, APRO's "Oracle as a Service" (OaaS) becomes the "utility bill" that every agent must pay to stay secure.

3. The Great Awakening: Bitcoin DeFi (BTCFi)

For years, Bitcoin was "digital gold" valuable but dormant. Today, Bitcoin Layer 2s and protocols like Lightning Network, Runes, and CKB are turning BTC into a productive asset.

APRO has a significant first mover advantage here. By natively supporting the Bitcoin ecosystem with specialized signature services (like DLCs), APRO is the bridge that allows Bitcoin holders to finally use their BTC as collateral for loans, insurance, and complex derivatives without leaving the security of the Bitcoin-aligned environment.

4. Growth Roadmap: From Price Feeds to Global Sensory Network

APRO's 2026 roadmap signals a transition into a comprehensive data foundation:

Q1-Q2 2026: Launch of Video and Live Stream Analysis, allowing oracles to verify real world events (like logistics or sports) as they happen in 4K resolution.

Ecosystem Maturity: The "Data APY Supermarket" will allow any data provider to monetize their information, creating a "Network Effect" where more data leads to more dApps, which leads to higher demand for the $AT token.

Conclusion: The Infrastructure Dark Horse

While legacy oracles struggle with high gas costs and "dumb" data delivery, APRO is building the nervous system of a smarter Web3. With its dual-layer security, AI verification, and multi-chain dominance (spanning 40+ chains including Solana and BNB), APRO isn't just a project to watch. It is the infrastructure that the trillion-dollar "On-chain Everything" future requires.