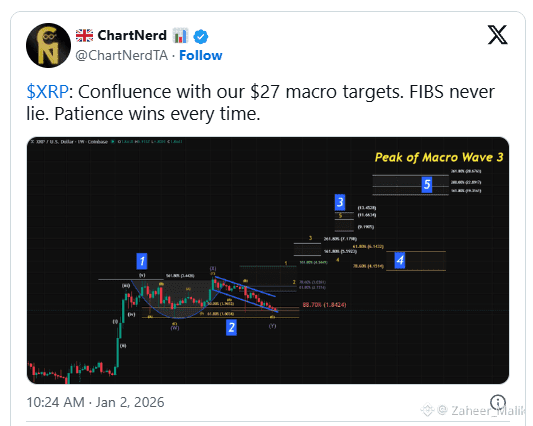

Renowned crypto analyst ChartNerd (@ChartNerdTA) has released a long-term technical analysis of XRP, pointing to a possible massive upside move toward $27. The analysis is based on a strong alignment between Fibonacci extensions and a developing Elliott Wave structure on the weekly XRP/USD chart.

Instead of focusing on short-term price fluctuations, the chart highlights a large cup and handle pattern that has been forming over several years. XRP’s surge to its all-time high in July 2025 marked the completion of the cup. This was followed by a healthy and controlled pullback during the rest of 2025, forming the handle portion of the pattern.

Cup and Handle Confirms Wave 2 Completion

According to ChartNerd’s Elliott Wave labeling, XRP previously completed a macro Wave 1 advance and then entered a prolonged Wave 2 corrective phase. This corrective phase perfectly aligns with the handle formation seen on the chart.

During this consolidation, $XRP XRP respected several key Fibonacci retracement levels, including the 61.8% and 78.6% zones. A critical 88.7% retracement level near $1.84 is highlighted as a major invalidation point. Although XRP briefly dipped below this level multiple times, price quickly recovered—indicating strong demand and structural strength.

As XRP approaches the end of the handle, a confirmed breakout would signal the transition from Wave 2 into the powerful Wave 3 phase.

Wave 3 Targets Indicate Strong Upside Momentum

In Elliott Wave theory, Wave 3 is typically the strongest and most explosive move. ChartNerd’s Fibonacci extension projections place the first major Wave 3 target at the 161.8% extension, around $5.59.

Additional upside targets appear near $7.17 and $13.45, derived from higher Fibonacci extensions such as the 261.8% level. Notably, the chart shows very limited resistance between the breakout zone and these price levels, suggesting that XRP could experience a rapid expansion if bullish momentum enters the market.

Wave 5 Projection Supports $27 Macro Target

Beyond Wave 3, the analysis extends into Wave 5, which represents the final impulse of the macro cycle. Fibonacci projections between 161.8% and 261.8% place potential long-term targets between $19 and $28, with $27 emerging as the upper macro target.

Between Wave 3 and Wave 5, a Wave 4 consolidation is expected, with retracement zones marked near $4.15 and $6.14. This phase may bring volatility, but according to the structure, it would not invalidate the broader bullish trend.

Final Thoughts

ChartNerd’s analysis presents a technically compelling bullish scenario for $XRP XRP. If the cup and handle breakout is confirmed, the transition into Wave 3 could mark the beginning of a powerful multi-year rally, potentially driving XRP into double-digit—and even $27+—territory.

🚀 FOLLOW me.

💰 Trade smart, not emotional

📈 Stay ahead of the market

Appreciate the support 😍

Thank You & Stay Profitable! 💎