Last week, Bank of America enacted a new policy authorizing its wealth advisors across Merrill Lynch and its Private Bank to recommend cryptocurrency allocations of 1% to 4% to their clients . This isn't just a research note; it's a formal, actionable guideline for managing real client money. The recommended vehicles are regulated spot Bitcoin ETFs like those from BlackRock ($IBIT) and Fidelity ($FBTC), signaling a clear preference for regulated, familiar products .

This move is part of a clear trend, following similar expansions by firms like Morgan Stanley, JPMorgan, and Vanguard . What makes this moment different is the scale and influence of Bank of America, which effectively brings a "stamp of approval" to millions of traditional investors who have been watching crypto from the sidelines.

💡 What This Means for the Market Now

This news is bullish, but its immediate impact is nuanced. Here’s the reality check:

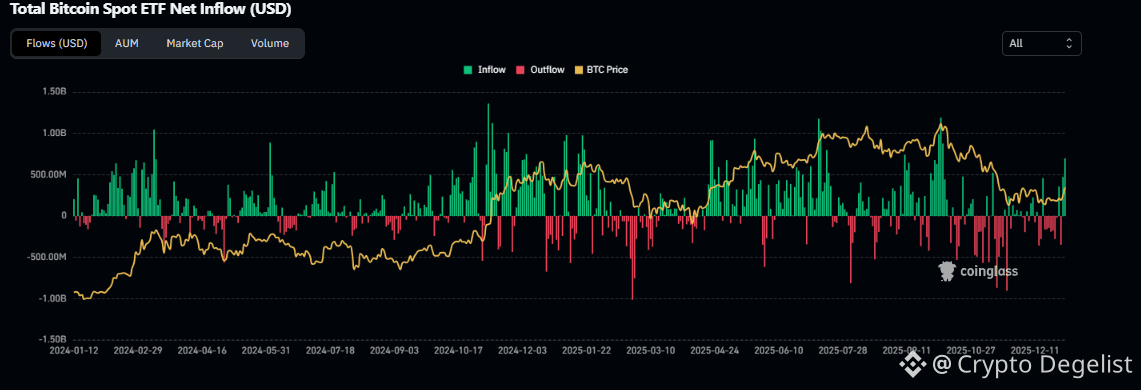

A Structural Shift, Not a Short-Term Pump: This policy creates a long-term, steady inflow mechanism. It means fresh capital can enter the crypto market consistently through familiar financial advisors, not just during hype cycles. However, this week's market reaction has been balanced, with Bitcoin consolidating . The real effect will compound over months and years.

The "Smart Money" Rotation: Data shows a notable trend: while retail holdings in ETFs have faced pressure, institutional ownership of $BTC has grown from 20% to 28% in recent times . The Bank of America move could accelerate this rotation from "weaker" to "stronger" hands, which typically builds a more stable price foundation.

A Spotlight on Fundamentals: This institutional embrace forces a focus on core assets with clear regulatory standing. It primarily benefits BTC and $ETH , which are the pillars of these ETF products. While the broader market is seeing a rebound—with major altcoins like $XRP and $SOL posting strong weekly gains—the institutional narrative firmly anchors around the largest, most established cryptocurrencies .

🔭 The Week Ahead: Other Catalysts in Play

While institutional adoption is a dominant theme, traders are also watching several other key events that could drive volatility:

Macroeconomic Data: Key U.S. jobs data (like Non-Farm Payrolls on Friday) and inflation figures can sway market sentiment, as they influence expectations for Federal Reserve interest rate policy .

Network Upgrades: Ethereum is implementing a scaling upgrade this week to increase data capacity for its Layer 2 networks, which may help reduce transaction costs over time .

Geopolitical Context: The recent geopolitical developments are being viewed by some analysts through a long-term strategic lens, contributing to a market environment where assets like crypto and gold are being assessed for their roles in a changing global landscape .

✍️ The Takeaway for Your Strategy

The Bank of America news is a fundamental, long-term positive. It validates crypto as a legitimate asset class for the world's largest wealth managers. For your strategy, this underscores the importance of a disciplined, long-term approach over chasing daily volatility. It reinforces that building core positions in major assets like $BTC and $ETH, perhaps through dollar-cost averaging, aligns with where the most reliable, large-scale new money is being directed.

As always, stay informed, manage your risk, and remember that real wealth in crypto is often built with patience as these structural shifts play out.

#CryptoNews🚀🔥V #InstitutionalCrypto o #BankOfAmerica