In traditional companies, decisions are controlled by executives and boards.

In crypto, many projects flip this model completely by using governance tokens.

Governance tokens give users real power — allowing communities, not corporations, to decide how a blockchain project evolves.

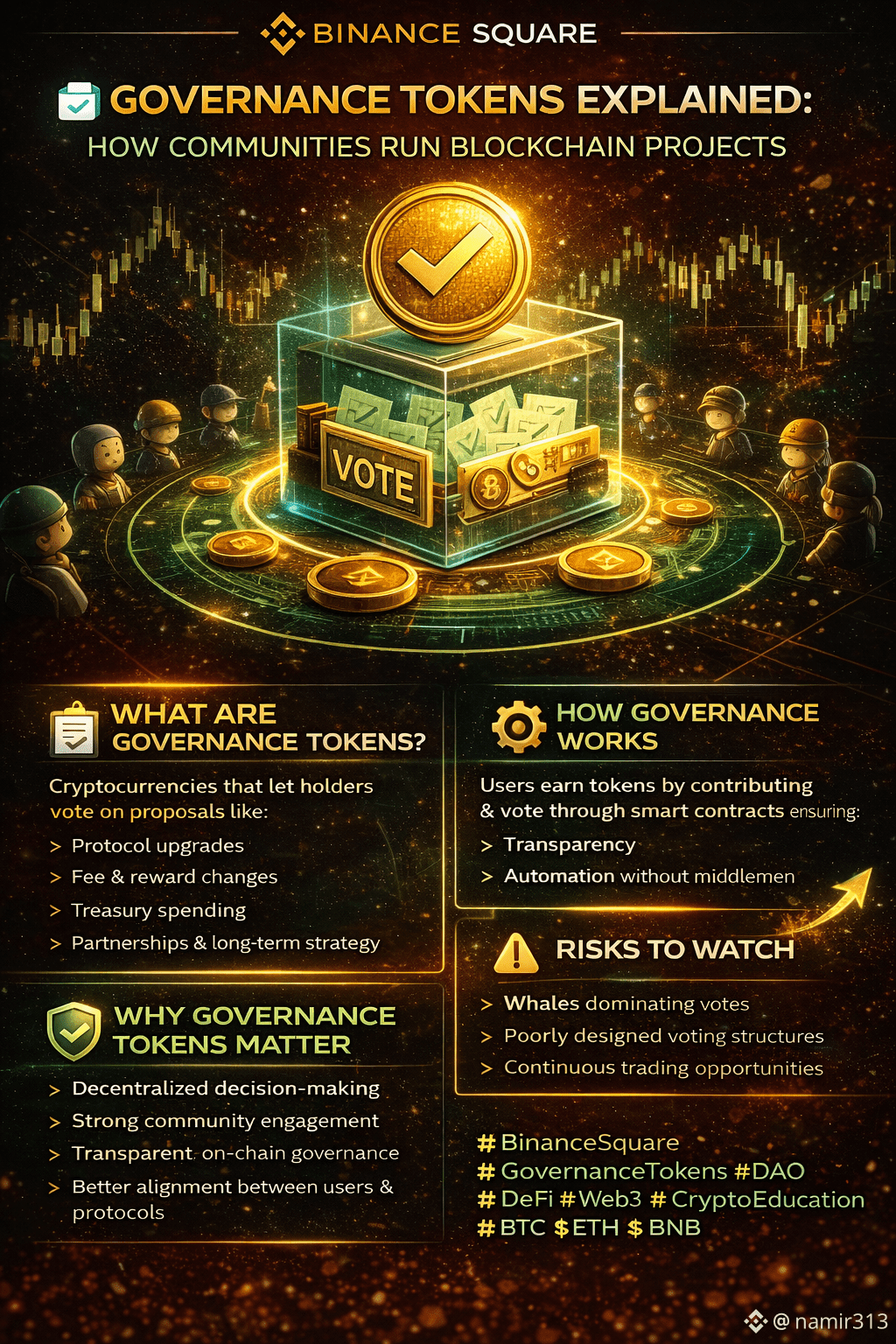

🔍 What Are Governance Tokens?

Governance tokens are cryptocurrencies that allow holders to vote on proposals such as: • Protocol upgrades

• Fee and reward changes

• Treasury spending

• Partnerships and long-term strategy

In most systems, one token equals one vote, aligning decision-making with ownership.

⚙️ How Governance Works

Users earn governance tokens by actively participating — lending, staking, providing liquidity, or contributing to the ecosystem.

Votes are executed through smart contracts, ensuring transparency and automation without intermediaries.

📌 Real Examples:

• MakerDAO (MKR): Governs the DAI stablecoin through on-chain voting

• Compound (COMP): Fully decentralized lending protocol governed by its users

• Uniswap (UNI): Community-led decisions for the world’s largest DEX

🌐 Why Governance Tokens Matter ✅ Decentralized decision-making

✅ Stronger community engagement

✅ Transparent and on-chain governance

✅ Better alignment between users and protocols

⚠️ Risks to Watch

Large holders (“whales”) can dominate votes, and majority decisions don’t always guarantee long-term success. Designing fair and balanced governance remains a key challenge.

🔮 The Future of Governance

New models like delegation, reputation-based voting, and DAO frameworks aim to improve participation and reduce centralization. Governance tokens will continue shaping the future of DeFi, DAOs, and Web3.

✨ Final Thought:

Governance tokens turn users into owners, not just participants — making decentralization real, not just a promise.

#BinanceSquare #GovernanceTokens #DAO #DeFi #Web3 #CryptoEducation$BTC