📈 Technical Analysis: Enjin ( $ENJ )

📈 Technical Analysis: Enjin ( $ENJ )

Market Capitalization: $74 million

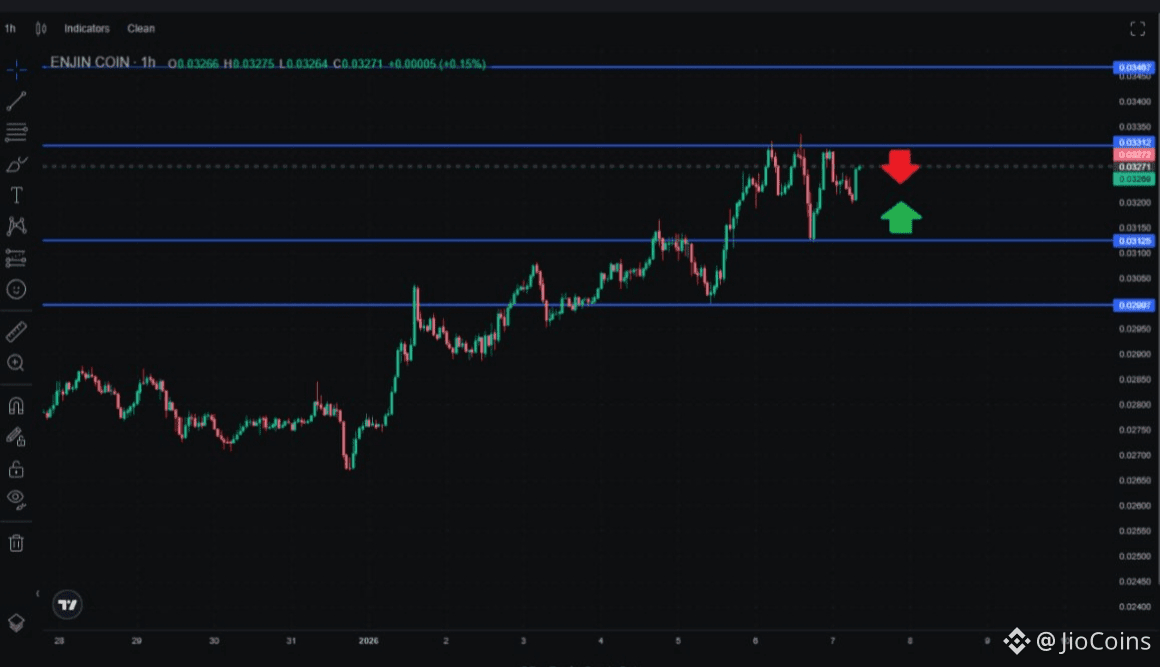

The ENJ chart moves in an upward direction, forming characteristic "steps" – movement from level to level with corrections that turn into short sideways channels.

🟡 Currently, price is in a consolidation phase between key levels.

How to Trade❔

Range Boundary Trading:

💬 Sell on rejection from resistance level. Reversal candlestick configuration is mandatory (pin bar, engulfing, evening star).

💬 Place stop-loss beyond the resistance level.

Take-profit before support level.

💬 Buy on rejection from support level with confirmation from reversal candlestick pattern.

Risk/reward ratio at the moment of trade execution should be minimum 1:2, ideally 1:3.

Breakout Trading❕

💬 If the chart breaks one of the levels with increased volume – possible trade opening in breakout direction.

💬 Stop-loss beyond nearest local extreme (not beyond breakout level!).

💬 Take-profit before next significant levels.

Critically important: risk/reward ratio should either push you toward the trade or refuse it.

Risk Management❕

💬 Don't enter a trade if risk/reward ratio is less than 1:1.5.

💬 With rapid movement in your favor, move stop-loss to breakeven after passing 1.5-2 stop-losses.

💬 Sideways channels are traps for impatient traders. Wait for clear signals!

Conclusion:

ENJ demonstrates a classic stepped growth structure. Patience and discipline are more important than speed here – wait for confirmation from candlestick configurations and don't rush to enter in the middle of the range.

📈 Open trade with $ENJ

🔗 Chat • X • JioCoinsX