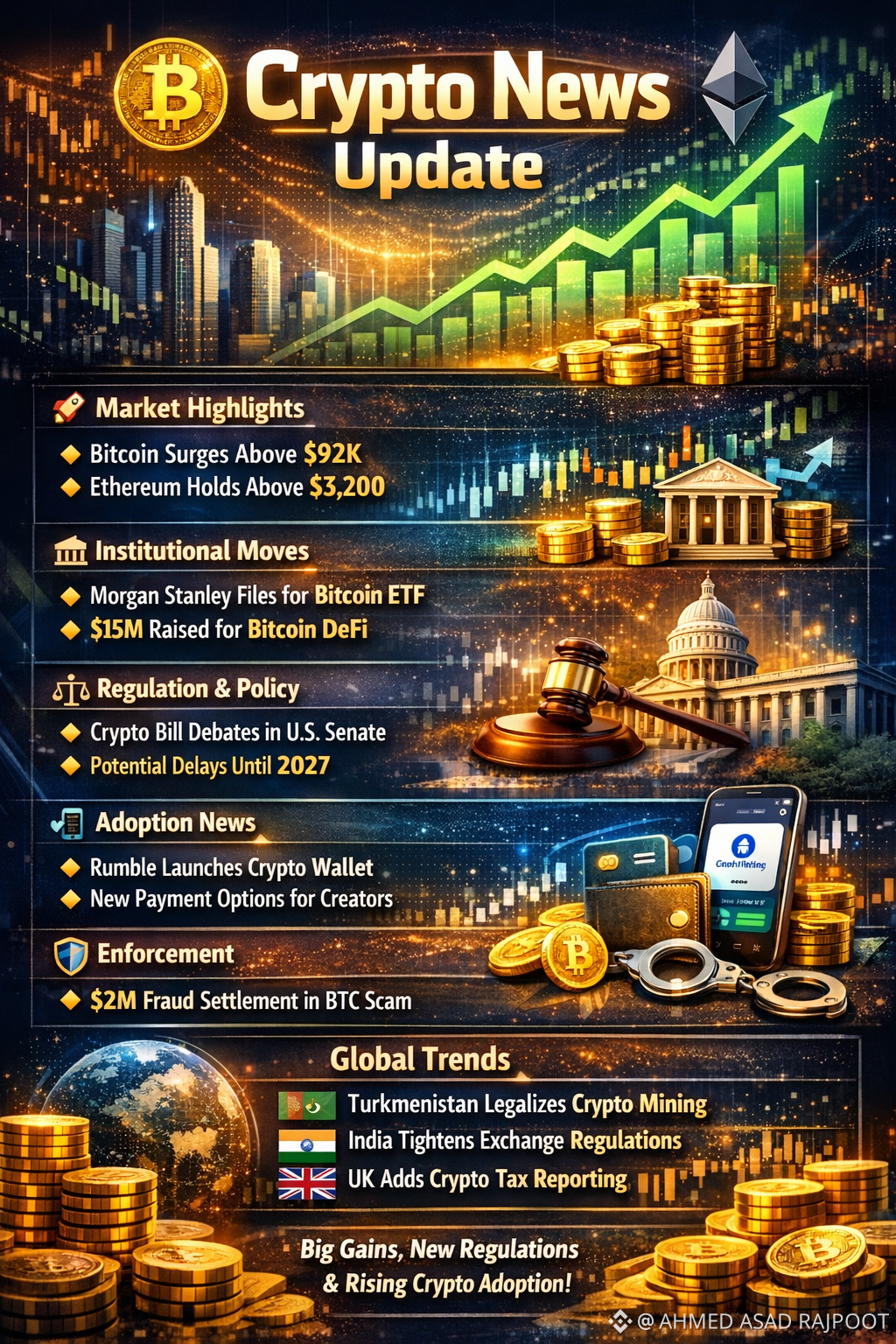

Bitcoin is trading strong, above ~$92,000, with analysts saying the broader crypto market may have bottomed and showing optimism for further gains.

Overall market movement was mixed today, with Bitcoin around $92.8K and Ethereum holding above $3,200.

🧑💼 Institutional & Investment Moves

Morgan Stanley filed for a Bitcoin ETF, signaling continued institutional interest in major crypto products.

Babylon Labs raised $15M to build infrastructure that lets Bitcoin act as on-chain collateral—a tech boost for Bitcoin DeFi.

💼 Regulation & Policy

U.S. Senate crypto market bill markup expected next week, with renewed talks ahead of a government funding deadline.

A major crypto market structure bill could face delays to 2027 implementation due to political negotiations.

📱 Adoption & Product News

Rumble launched a crypto wallet with Tether and MoonPay, aimed at letting content creators get paid directly in crypto.

🛡️ Risk & Enforcement

Bitcoin Depot will pay nearly $2M to settle fraud compensation claims in Maine, highlighting ongoing enforcement around crypto scams.

🌍 Broader Crypto Industry Trends

Other noteworthy developments from recent days:

Turkmenistan legalized crypto mining & exchanges under regulated oversight (but not as legal tender).

49 exchanges in India registered with the Financial Intelligence Unit to curb money-laundering and terror financing risks.

Reports show Bitcoin ATM fraud soared, with hundreds of millions lost to scams in the U.S. — underscoring security risks for retail users.

New UK tax rules require crypto investors to declare holdings & gains to HMRC, part of global regulatory tightening.

🧠 Tech & Altcoin Updates (from broader sources)

Ethereum’s BPO2 upgrade just launched, increasing throughput and lowering transaction costs for Layer-2 networks.

XRP has been rallying, with strong inflows and analysts naming it a top trade in 2026.

Some analysts see long-term price targets like Bitcoin >$150,000 and XRP at $8 by end of 2026.

📌 In a nutshell

Positive trends: institutional interest, tech upgrades, price stability/strength

Neutral/uncertain: mixed markets, regulatory bill delays

Risks: scams, enforcement actions, regulatory reporting requirements