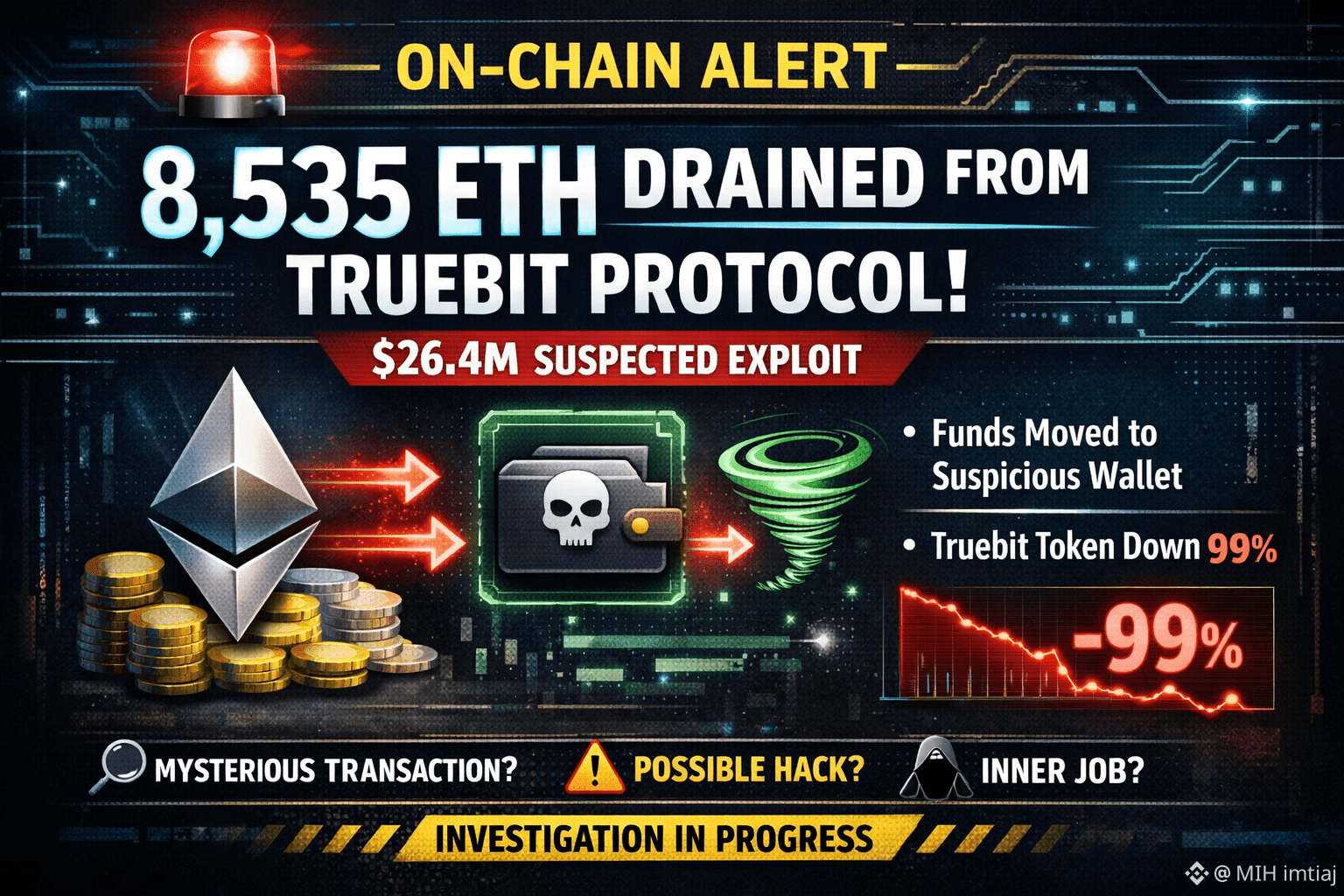

The crypto market is shaking once again. The entire on-chain ecosystem lit up today as one of the largest flagged transactions surfaced — Truebit Protocol had 8,535 $ETH (worth roughly $26.44M) siphoned out into an unknown wallet, which multiple security platforms have already labeled as a suspected exploit.

This wasn’t just “a weird transaction” — it was an anomaly that instantly drew the attention of on-chain security teams, blockchain researchers, and the entire crypto community.

🔥 Timeline: How it all started

🕒 Transaction spotted

On-chain monitoring tools first noticed a massive withdrawal from the Truebit Protocol: Purchase Contract to a newly-created external wallet.

🕒 Cyvers / CertiK flag it

Security platforms like Cyvers Alerts quickly categorized the activity as “Highly Suspicious” due to:

Abnormally large transfer size

New, unlinked destination wallet

Transaction flow not matching typical internal patterns

Contract-trigger behavior showing anomaly

🕒 Market panic

After the news spread, $TRU (Truebit Token) saw a dramatic crash — in some markets dropping over 99% in a vertical freefall.

🧨 Hack, misconfiguration, or insider move?

Though no official statement has come from Truebit yet, on-chain data points to three possibilities:

1️⃣ Smart Contract Exploit

This happens when:

Misconfigured permissions exist

Withdrawal functions lack safeguards

Input validation is weak

Lookonchain and other analysts say the transaction does not look like a routine payout.

2️⃣ Internal operation executed incorrectly

Sometimes dev teams accidentally trigger large transfers via:

Misconfigured scripts

Testing errors

Incorrect contract selection

3️⃣ Insider involvement (less common but possible)

Not frequent, but history shows insider threats have caused similar large unauthorized token movements.

📡 Destination wallet behavior: What is the ETH being used for?

Initial tracing reveals:

The ETH is being broken into smaller chunks

If it moves into mixers like Tornado Cash → it’s almost certainly an exploit

If deposited to CEXs → could be internal operations gone wrong

So far, wallet behavior shows high-risk indicators.

🧪 Technical Breakdown (Advanced)

✔️ Abnormal contract interaction pattern

Transfer does not match normal Truebit payout ABI activity

No associated rapid sub-transactions

Gas behavior resembles exploit execution

✔️ Withdrawal triggered externally

Exploit structures often follow this chain:

external call → fallback trigger → vulnerable function → drain sequence

Parts of that behavior appear here.

✔️ Hypothesized attack path

Likely flow:

purchase contract → permission flaw → bulk transfer → rogue external wallet

📉 Market Reaction

TRU token:

Price collapsed up to 99%

Liquidity pools thinned out instantly

Extreme slippage on DEXs

Panic sell pressure everywhere

ETH market stayed relatively stable, but sentiment turned bearish.

🧭 Why the next 24 hours are crucial

✔ Official statement expected from Truebit

✔ Security teams will publish the exploit vector

✔ ETH movement from the attacker wallet will reveal intent

✔ Exchanges may blacklist addresses

✔ This incident may become another DeFi case study

🧩 Final Verdict (Current Summary)

The 8,535 ETH (~$26.4M) drained from Truebit Protocol is far beyond a normal on-chain anomaly — all signs currently point to a suspected exploit, which immediately triggered a 99% crash in the TRU token. The investigation is still ongoing, but the patterns strongly indicate unauthorized and irregular activity.

#ETHETFsApproved #TRU #cryptouniverseofficial #TradingCommunity