ATOM (Cosmos) is currently showing a modest positive price movement with a 24-hour increase of around 2.2% to 2.5 USD. Market sentiment is leaning towards fear (Fear and Greed Index at 27), indicating cautious investor behavior. Recent news is bullish, highlighting Cosmos Labs' 2026 roadmap focusing on enterprise adoption through Proof-of-Authority (PoA) and privacy features, which could enhance its long-term value proposition. However, technical indicators show some bearish signals, particularly an overbought RSI, suggesting potential short-term price corrections.

Detailed Breakdown

Market Signals

Price & Volume: ATOM spot price is around $2.52, up about 2.23% in the last 24 hours, with solid trading volume (~1.14 million ATOM). The contract market also shows a similar price increase (~2.48%) with high open interest (~10.5 million contracts), indicating active trader participation.

Technical Indicators:

Bullish indicators are currently neutral or weak.

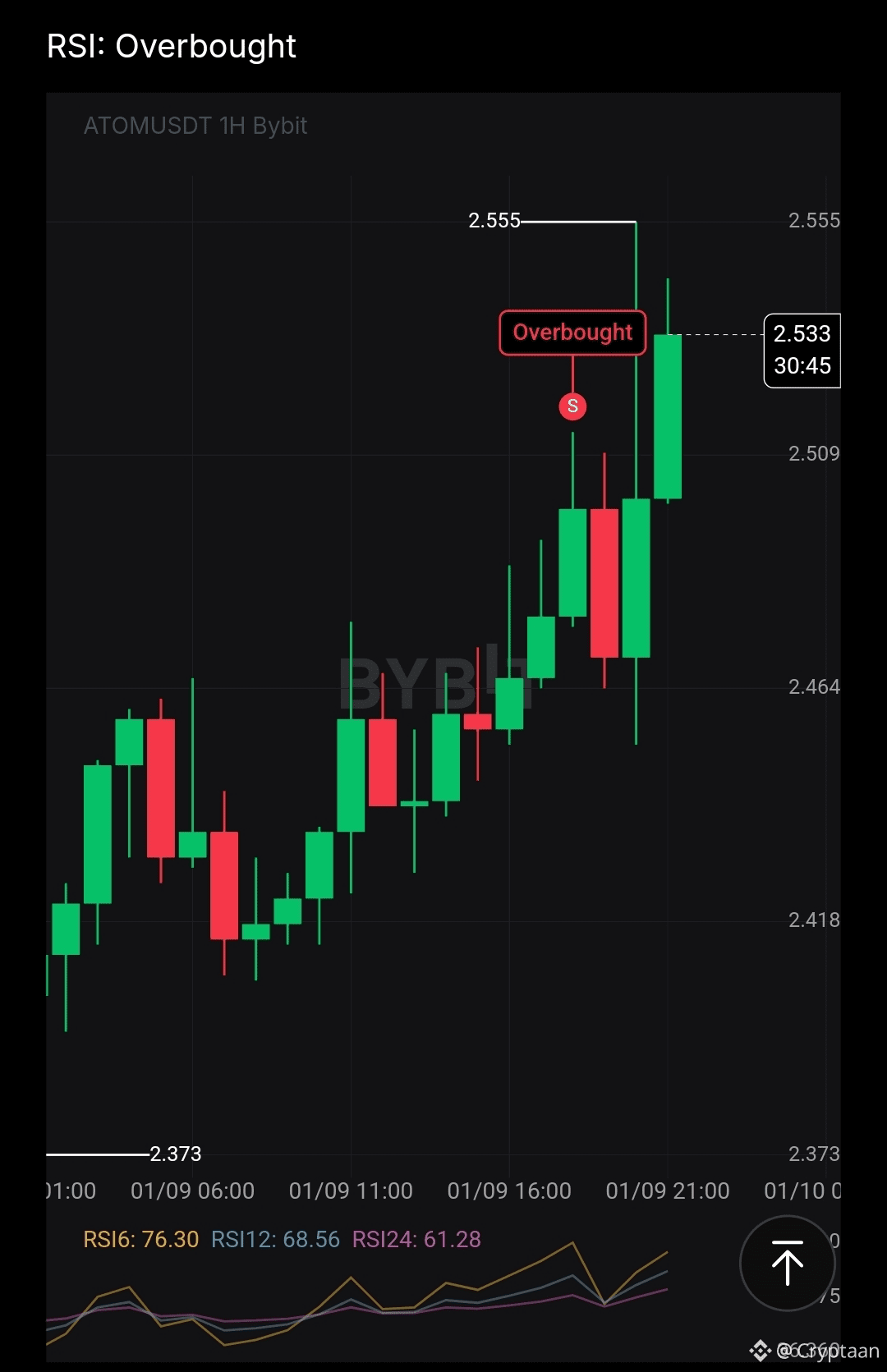

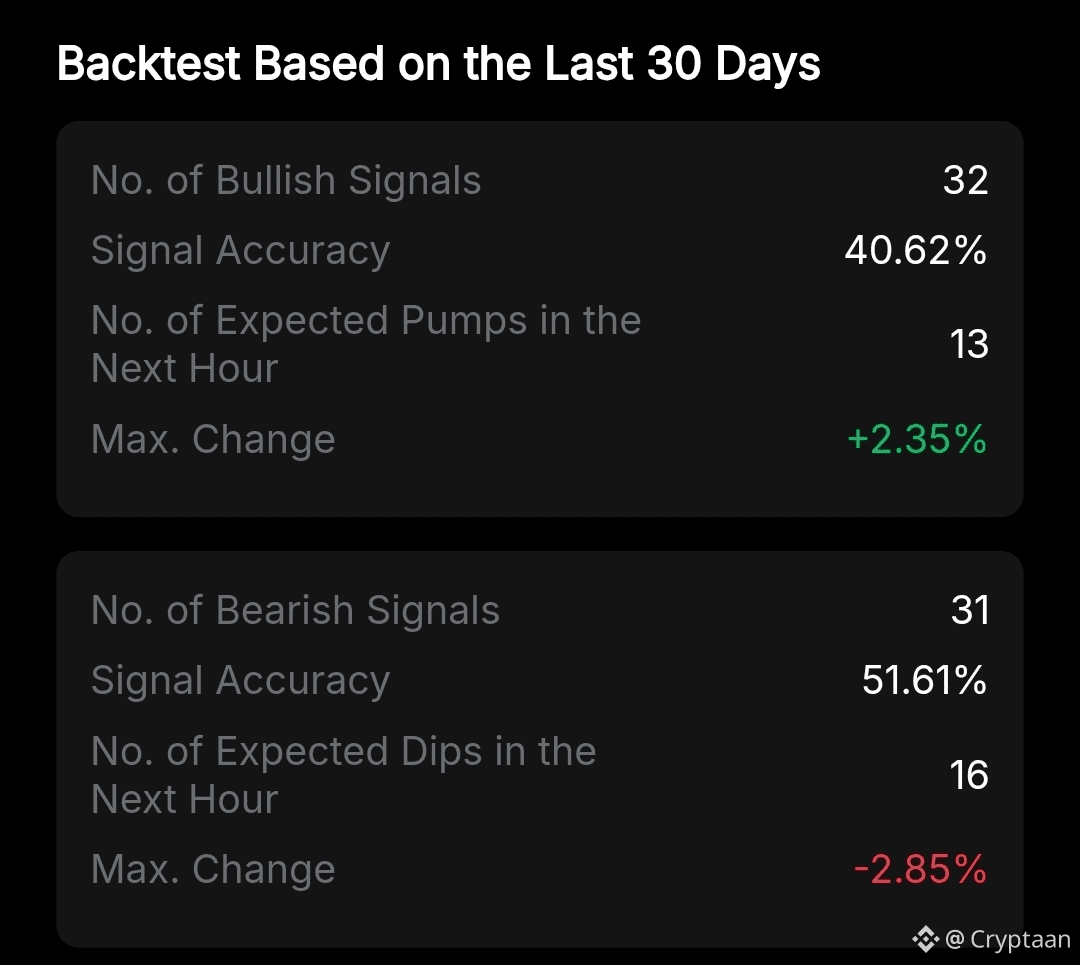

Bearish signals include an overbought [RSI], which often precedes short-term pullbacks.

Funding Rate: Slightly negative funding rate on contracts (-0.00007554), indicating a mild bearish sentiment among futures traders.

Sentiment and News Impact

Fear and Greed Index: At 27, the market sentiment is in the "Fear" zone, suggesting investors are cautious and possibly risk-averse.

News: Cosmos Labs announced a strong 2026 roadmap focusing on:

Introducing a native Proof-of-Authority (PoA) solution to improve enterprise adoption without complicating the existing Proof-of-Stake system.

Developing privacy features using zero-knowledge UTXO models to enable compliant, private transactions for enterprises.

These developments build on Cosmos' strong 2025 performance, supporting over 200 chains and emphasizing interoperability and scalability.

The news is bullish and positions Cosmos as a strong contender for enterprise blockchain solutions, which could drive medium to long-term demand for ATOM.