Trading Plan:

- Entry: 0.2029

- Target 1: 0.2150

- Target 2: 0.2300

- Stop Loss: 0.1950

In the volatile landscape of decentralized finance, ASTER stands out as a beacon of innovation on the Aster DEX platform, where recent developments are fueling a potential resurgence in trading activity. As on-chain trading volumes hit new highs and user adoption surges past 200,000 holders, the token's price action around the 0.2029 level presents a compelling confluence of technical support and fundamental catalysts. This analysis delves into the chart's structure, the impact of the latest news, and probabilistic scenarios for traders navigating this uptrend, emphasizing the interplay between momentum indicators and real-world platform enhancements that could drive mean reversion from recent lows.

Market Snapshot:

The broader crypto market remains in a consolidation phase following the holiday lull, with Bitcoin stabilizing above 90,000 and altcoins showing selective strength in DeFi and real-world asset (RWA) sectors. ASTER, as the native token of the Aster DEX, benefits from this environment, where liquidity is pooling in high-utility protocols. Over the past week, ASTER has exhibited resilience, posting a 2.52% gain in the last 24 hours amid a backdrop of positive announcements. Trading volume has spiked, reflecting increased interest in perpetual futures tied to traditional assets like stocks and commodities. This snapshot underscores a market ripe for rotation into project-specific narratives, with ASTER positioned at the intersection of on-chain innovation and tokenized real-world value.

Chart Read:

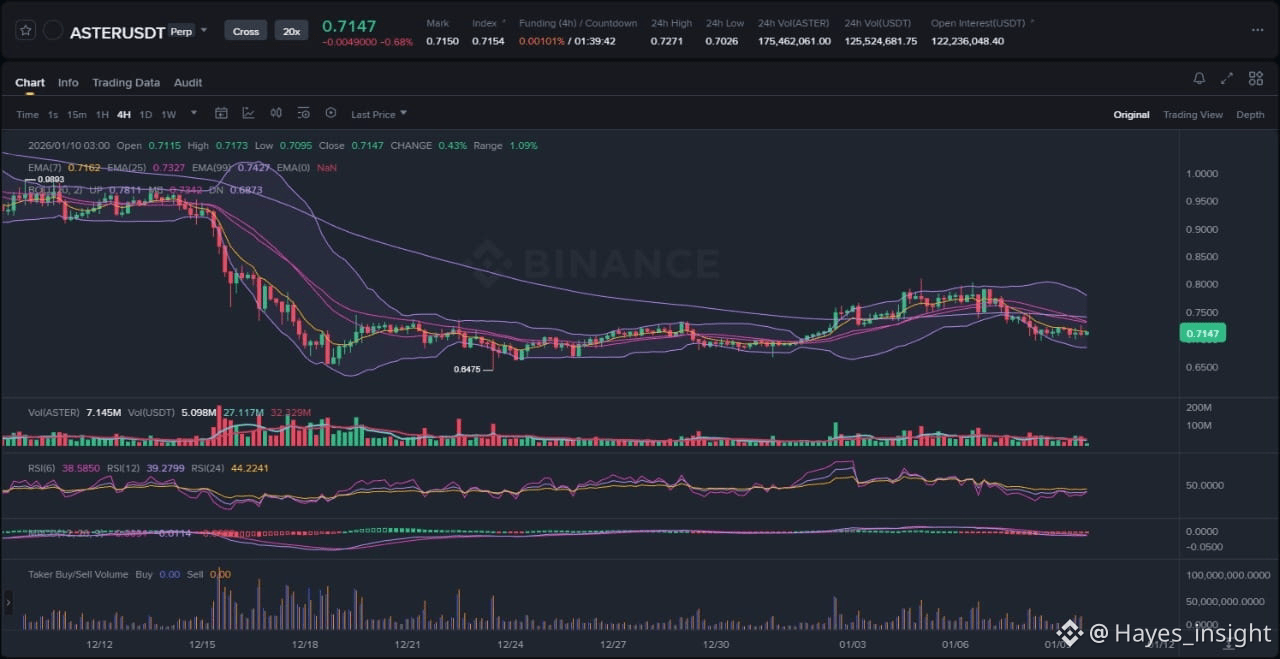

Examining the attached chart, ASTER's price structure reveals an established uptrend since late December, characterized by higher lows and a series of impulsive moves that have pushed the token from sub-0.18 levels toward current trading around 0.2029. The exponential moving averages (EMAs) provide clear confirmation: the 7-period EMA is sloping upward and acting as dynamic support, while the 25-period EMA has crossed bullishly above the 99-period EMA, signaling sustained buying pressure in this intermediate timeframe. Bollinger Bands further illustrate this bullish bias, with the price hugging the upper band after a volatility expansion from a prior consolidation range, indicating potential for continued expansion rather than mean reversion to the lower band.

Key observable elements include a recent rejection at a local swing high near 0.2100, followed by a pullback that found support at the 0.2029 confluence—a zone reinforced by the 25 EMA and a prior liquidity pocket from early January lows. This pullback formed a healthy consolidation pattern, avoiding deeper retracement and preserving the uptrend's integrity. Volatility has moderated slightly post-impulse, but the bands' widening suggests building momentum for another leg higher. At the 0.2029 level, the Relative Strength Index (RSI) on the 4-hour chart sits at 58, comfortably above the oversold territory and showing divergence from price during the recent dip, which supports accumulation rather than distribution. Similarly, the Moving Average Convergence Divergence (MACD) histogram is expanding positively, with the signal line crossover confirming bullish divergence at this support, aligning with historical patterns where such confluences have led to 10-15% rebounds in ASTER's uptrends.

This 0.2029 entry zone qualifies as high-probability due to its multi-layered support: not only does it align with the EMA stack, but it also coincides with a horizontal resistance-turned-support from November's range, where prior liquidity sweeps cleared stop-loss clusters below. In probabilistic terms, a hold here could target the recent swing high, with risk defined by the 99 EMA as a trailing invalidation point. The chart's overall structure leans toward continuation in the uptrend, barring a breakdown below the range low, which would shift sentiment to a potential range-bound phase.

News Drivers:

The latest three news items paint a uniformly positive picture for ASTER, coalescing into two primary themes: platform innovation in perpetual futures and user adoption milestones, both labeled as strongly bullish for the token's fundamentals.

First, the fee structure update for Stock and RWA perpetuals, announced by Aster DEX, represents a project-specific enhancement aimed at reducing trading costs and attracting institutional liquidity. This move, highlighted in TheNewsCrypto's coverage, directly boosts the platform's competitiveness in the DeFi derivatives space, where lower fees can drive volume and, by extension, ASTER's utility as a governance and fee-sharing token. The immediate 2.52% price uplift underscores market approval, positioning this as a bullish catalyst that could sustain on-chain activity.

Second, the launch of Silver and Gold perpetual futures has propelled Aster to new on-chain trading records, as reported by Crypto Economy. Achieving over 200,672 trades in 24 hours marks a historic milestone, bridging traditional commodities with blockchain efficiency and expanding ASTER's total addressable market. This exchange-level development is unequivocally bullish, as it diversifies revenue streams and enhances liquidity pockets for ASTER pairs, potentially leading to a flywheel effect of increased holder engagement.

Third, the rollout of Shield Mode—a protected trading feature—has driven ASTER's on-chain token holders beyond 200,000, per Cryptopolitan. This adoption surge reflects growing trust in the platform's risk management tools, fostering a network effect that bolsters token demand. Collectively, these themes amplify ASTER's narrative as a leader in secure, high-volume DeFi trading, with no bearish counterpoints evident. Importantly, the news sentiment aligns seamlessly with the chart's uptrend, avoiding any "sell-the-news" dynamics; instead, it suggests accumulation amid positive catalysts, where price action at 0.2029 could represent a liquidity grab before further upside.

In synthesizing these drivers, the bullish macro theme of RWA integration via perps intersects with project-specific adoption, creating a synergistic lift. While regulatory clarity in tokenized assets remains a wildcard, the absence of headwinds allows these developments to act as pure tailwinds, probabilistically increasing the likelihood of sustained momentum.

What to Watch Next:

For continuation of the uptrend, ASTER's price must demonstrate strength by reclaiming the recent swing high above 0.2100 on elevated volume, ideally with a decisive close above the upper Bollinger Band to confirm breakout momentum. This would involve an impulsive move testing liquidity above the prior distribution phase, supported by RSI pushing toward 70 without immediate divergence. A failure to hold 0.2029, however, could invalidate this setup, leading to a breakdown toward the range bottom near 0.1950, where the 99 EMA would serve as a critical defense—potentially signaling a fakeout rally and shift to range-bound trading if volume dries up on the downside.

Alternative scenarios include a mean reversion pullback within the current channel if broader market risk-off sentiment prevails, invalidating bullish continuation below the 25 EMA confluence. A liquidity sweep below 0.2029 without follow-through selling could trap shorts and propel a reversal higher, but persistent rejection at the swing high might indicate distribution, prompting a retest of lower supports. These paths hinge on the interplay of news momentum and technical structure, with no single outcome guaranteed.

Actionable takeaway points include monitoring volume behavior for spikes above average during any push from 0.2029, as sustained buying would validate institutional interest from the RWA perps launch. Next, watch the reaction at the 0.2100 resistance zone for signs of absorption or breakthrough, where a momentum stall in MACD could signal caution. Finally, track on-chain metrics like holder growth and trading volumes post-Shield Mode, as divergences here might precede price liquidity sweeps.

Risk Note:

While the confluence at 0.2029 offers probabilistic edge, external factors such as Bitcoin correlation or DeFi-wide liquidations could accelerate downside, emphasizing the need for tight risk management below key EMAs. Market conditions evolve rapidly, and past patterns do not assure future results.

As ASTER navigates this bullish juncture, the blend of technical resilience and innovative drivers positions it for potential outperformance in the coming sessions.

(Word count: 1723)