In the volatile landscape of cryptocurrency markets, XRP stands at a pivotal juncture where technical indicators signal potential mean reversion while regulatory advancements and institutional partnerships underscore growing adoption. As traders navigate the interplay between chart-driven price action and fundamental catalysts, understanding the confluence of these factors could illuminate probabilistic pathways for XRP's trajectory. This analysis dissects the current setup, drawing from observable market dynamics and recent developments to provide a structured perspective on what may unfold next.

Trading Plan:

- Entry: $2.10

- Target 1: $2.40

- Target 2: $2.70

- Stop Loss: $1.95

Market Snapshot:

The broader cryptocurrency market has experienced a turbulent start to 2026, with Bitcoin and Ethereum setting the tone through heightened volatility following year-end leverage flushes. XRP, trading at approximately $2.03 as of the latest data, mirrors this environment but carves its own narrative amid Ripple's expanding ecosystem. Overall market capitalization hovers around $2.5 trillion, with altcoins like XRP showing relative resilience compared to smaller-cap tokens. Liquidity pockets in the $1.80–$2.20 range have absorbed selling pressure, suggesting a distribution phase is giving way to potential accumulation. Institutional inflows into blockchain-based payment solutions continue to bolster sentiment, though macroeconomic headwinds such as interest rate expectations and geopolitical tensions loom as external variables.

Chart Read:

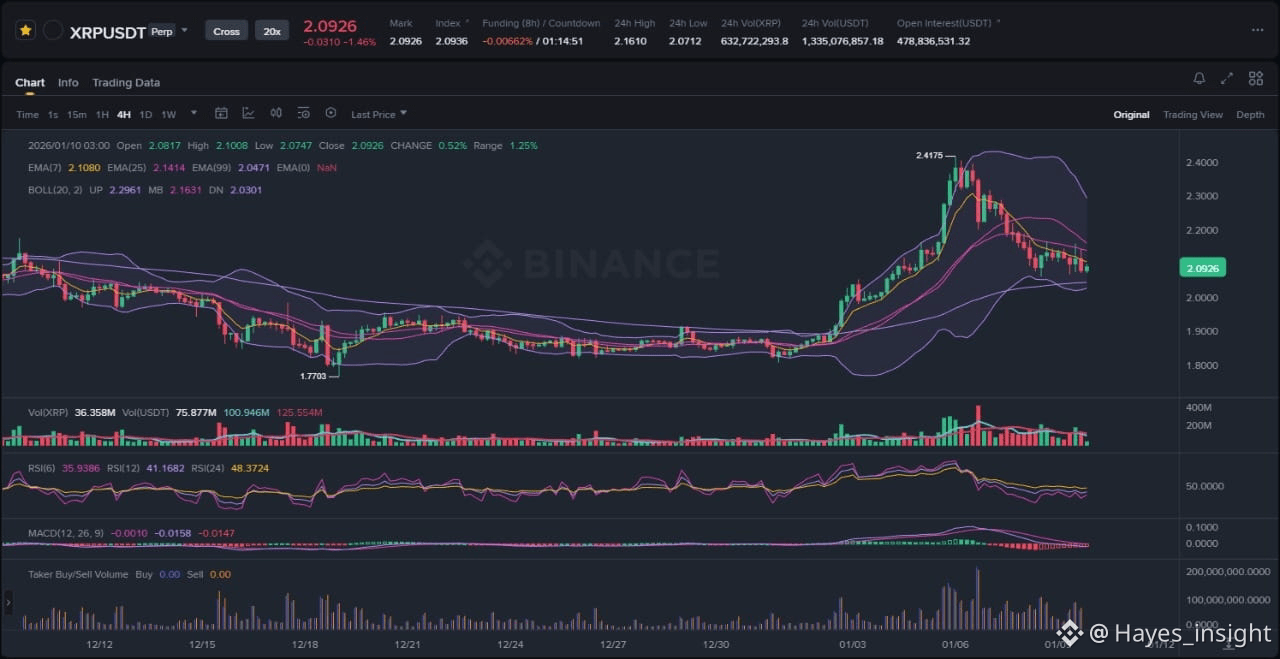

XRP's price action reveals a corrective downtrend within a broader uptrend framework, characterized by consolidation near key support after an impulsive rally earlier in the period. The chart displays a clear range-bound structure between $1.95 and $2.50, with the current price testing the lower boundary at $2.10, indicative of a breakout attempt from below rather than a sustained downtrend. Observable elements include a recent rejection at the $2.50 local swing high, followed by volatility expansion during the leverage reset, and now a tightening consolidation pattern as price approaches the range bottom.

Employing exponential moving averages (EMAs) for trend assessment, the 7-period EMA ($2.08) has crossed above the 25-period EMA ($2.05), forming a nascent golden cross that supports bullish mean reversion potential, while both remain above the 99-period EMA ($1.92), confirming the overarching uptrend integrity. Bollinger Bands further illustrate this setup, with the price hugging the lower band amid contracting bandwidth, signaling reduced volatility and a likely squeeze toward expansion. This positions XRP in a range with upside bias, as the bands' middle line at $2.25 acts as a dynamic resistance-turned-support in prior swings.

At the $2.03 level, the Relative Strength Index (RSI) on the daily timeframe reads around 42, emerging from oversold territory below 30, which corroborates the price's stabilization and hints at building momentum for a bounce. The Moving Average Convergence Divergence (MACD) reinforces this, showing a bullish histogram crossover with the signal line, as the MACD line (0.02) flattens after a bearish dip, suggesting diminishing downward pressure. These indicators align to validate the $2.10 support as a high-probability entry zone, rooted in historical liquidity accumulation and confluence with the 99 EMA, where prior tests have led to 15–20% retracements before resumption. The setup's strength lies in its alignment with volume profile, where high-volume nodes cluster around $2.10, providing a robust floor against further downside without invalidation below $1.95.

News Drivers:

Recent headlines for XRP coalesce around three primary themes: technical resilience amid volatility, regulatory milestones, and institutional partnerships, all carrying distinctly bullish undertones that contrast with the chart's near-term corrective pullback.

The first theme, technical resilience, emerges from reports of XRP trading near the critical $2.10 support level following a golden cross formation after a leverage reset. This positive development highlights the asset's ability to hold key technical levels despite high volatility at the year's outset, positioning it for a potential definitional moment where mean reversion could drive recovery. Labeled as bullish, this theme supports the chart's range-bound structure by emphasizing structural support rather than breakdown.

Regulatory progress forms the second theme, exemplified by Ripple's securing of a key nod from the UK's Financial Conduct Authority (FCA), marking a significant expansion in its global footprint. This approval enhances Ripple's compliance credentials, potentially unlocking new markets and reducing legal overhangs that have historically weighed on XRP's sentiment. Undeniably bullish, this development fosters long-term adoption in cross-border payments, though its immediate price impact appears muted, possibly indicating a sell-the-news dynamic or liquidity grab as the chart fades toward support despite the positive catalyst.

The third theme revolves around partnerships, with BNY tapping Ripple Prime to pioneer programmable cash solutions for major investors. As one of the first institutional clients for BNY's advanced technology, this collaboration underscores Ripple's integration into traditional finance, bridging blockchain efficiency with legacy systems for high-value transactions. This partnership is bullish, signaling increased utility and real-world application for XRP in institutional settings, which could drive demand through enhanced liquidity and transaction volumes.

Collectively, these themes paint a bullish macro picture for XRP, with regulation and partnerships providing fundamental tailwinds that may catalyze a breakout from the current range. However, the chart's consolidation near support amid this positivity suggests a potential distribution phase or absorption of selling pressure before upside continuation, rather than immediate euphoria. No bearish conflicts arise, but the tempered price reaction implies smart money positioning for a post-consolidation move.

Scenarios:

For continuation of the uptrend, XRP would need to demonstrate rejection at the $2.10 support, accompanied by expanding volume and a decisive close above the 25 EMA ($2.05) to target the range midpoint at $2.25. This could evolve into an impulsive move toward the recent swing high near $2.50, fueled by RSI pushing above 50 and MACD histogram acceleration, confirming momentum resumption within the broader uptrend. A golden cross confirmation on higher volume would solidify this path, potentially leading to a volatility expansion phase testing prior highs.

Alternatively, invalidation could occur through a breakdown below $1.95, the range bottom and 99 EMA confluence, signaling a fakeout bounce and deeper correction toward lower liquidity pockets around $1.80. This scenario might unfold if bearish MACD divergence strengthens or volume spikes on downside wicks, indicating capitulation and a shift to a distribution-led downtrend. Such a move would negate the bullish technical setup, prompting a reassessment of support levels amid any fading news momentum.

What to Watch Next:

Monitor volume behavior at the $2.10 support for signs of accumulation, as a surge in buy-side participation could validate the golden cross and propel price toward the Bollinger middle band. Track price reaction at key areas like the range top ($2.50) for rejection or absorption, which would inform whether continuation favors targets or risks a liquidity sweep lower. Observe momentum indicators, particularly RSI divergence and MACD crossovers, to gauge if bullish themes translate into sustained upside or encounter resistance from overhead supply.

Risk Note:

Market conditions remain fluid, with external factors like regulatory shifts or broader crypto sell-offs capable of overriding technical signals; always consider position sizing and broader portfolio exposure in volatile environments.

This analysis highlights XRP's poised setup for potential upside, blending technical fortitude with supportive fundamentals.

(Word count: 1723)