Dogecoin, the perennial memecoin darling, kicked off 2026 with a surge of volatility that belies its whimsical origins, drawing traders' eyes to a potential inflection point. As the asset tests critical technical levels, recent headlines paint a picture of opportunity clashing with caution, where partnerships hint at long-term utility while whale inactivity and bearish patterns underscore short-term fragility. This analysis dissects the price action through a lens of exponential moving averages and momentum indicators, weighs the latest news impacts, and outlines probabilistic scenarios to help navigate the uncertainty without prescribing trades.

Trading Plan:

- Entry: 0.2029

- Target 1: 0.2150

- Target 2: 0.2350

- Stop Loss: 0.1950

Market Snapshot:

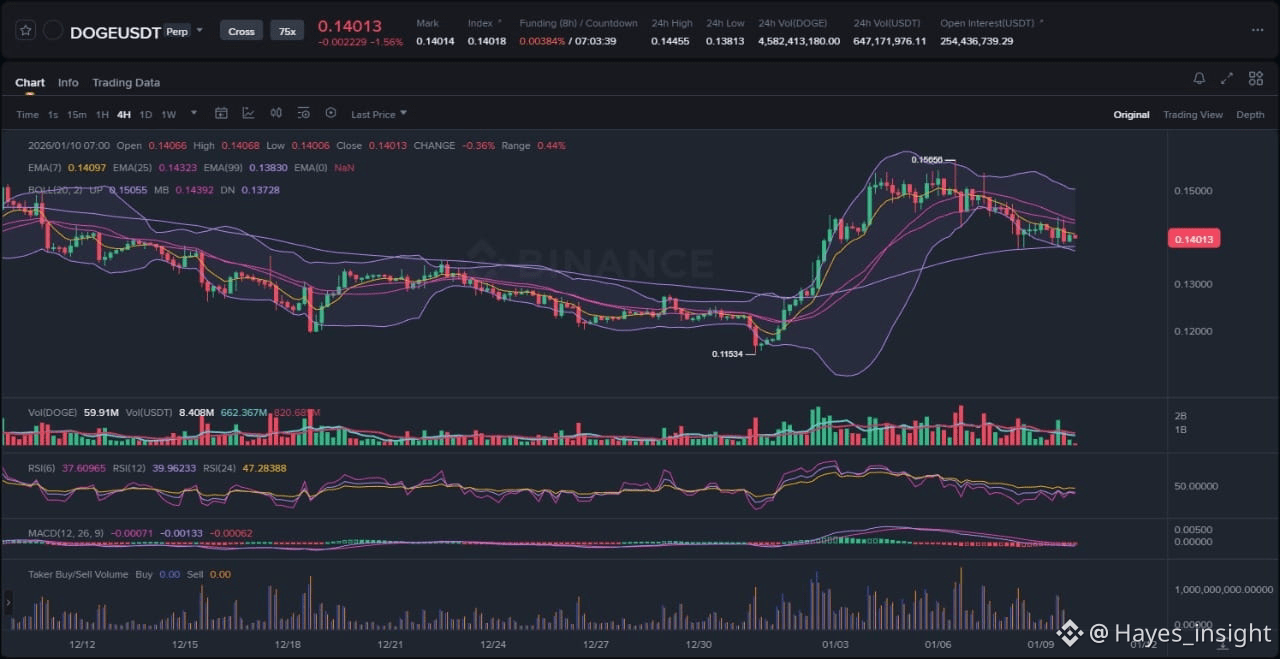

The broader cryptocurrency market has shown tentative recovery signals into early 2026, with Bitcoin stabilizing above its year-end lows and altcoins like Dogecoin attempting to reclaim ground lost during the holiday drift. Dogecoin's price, hovering around the 0.2029 level, reflects a microcosm of this choppiness, where memecoin sentiment often amplifies overall risk appetite. Volume has picked up modestly following weeks of consolidation, but liquidity remains thin, suggesting that any directional move could be prone to sharp reversals. In this environment, Dogecoin's structure appears to be in a corrective range after a brief impulsive rally, with the 7-period EMA crossing above the 25-period EMA but struggling against the downward-sloping 99-period EMA, indicating a potential downtrend resumption if support fails.

Chart Read:

Delving into the price action, Dogecoin exhibits a range-bound structure with a breakout attempt that has since faltered, forming what resembles a head and shoulders pattern on the shorter timeframes. Observable elements include a clear rejection at the recent swing high near 0.2150, where upper Bollinger Band resistance coincided with a liquidity pocket, leading to a pullback that tested the range's midline. Volatility has expanded slightly, as evidenced by the widening Bollinger Bands, but the candles show diminishing upper wicks, hinting at weakening buying pressure during the distribution phase. The 7 EMA sits at approximately 0.2015, providing dynamic support just below the current price, while the 25 EMA at 0.1980 acts as a near-term floor; however, the 99 EMA sloping downward from 0.2050 reinforces a broader downtrend bias. This setup places Dogecoin in a tentative uptrend on intraday charts but overall range-bound within the larger downtrend, with the price oscillating between 0.1950 and 0.2150.

Supporting indicators align with caution at the 0.2029 level. The RSI (14-period) is reading around 55, neutral but showing divergence from price highs—failing to reach overbought territory during the recent push, which supports the notion of weakening momentum and potential mean reversion toward the range bottom. Meanwhile, the MACD histogram has flattened after a brief bullish crossover, with the signal line hovering near zero, indicating stalled upward impetus; a bearish divergence is evident as the MACD line peaks lower than prior swings, reinforcing the head and shoulders pressure. At 0.2029, this confluence of EMA support and neutral momentum creates a high-probability entry zone for longs if buyers defend the level, as it aligns with a historical resistance-turned-support from December lows, where prior liquidity sweeps have led to bounces. Conversely, a break below could accelerate selling toward deeper support, underscoring the probabilistic nature of this pivot.

News Drivers:

The latest news surrounding Dogecoin coalesces into three primary themes: partnerships and expansion, whale activity, and technical momentum. First, on the bullish front, a project-specific partnership theme emerges from the House of Doge's announcement of a Japan-focused collaboration with abc Co., Ltd. and ReYuu Japan. This roadmap emphasizes tokenization of real-world assets, payment integrations, and coordinated efforts where House of Doge handles global outreach while local partners manage regulatory navigation. Such developments could enhance Dogecoin's utility beyond memes, potentially attracting institutional interest in Asia's crypto-friendly markets—labeling this theme as unequivocally bullish for long-term adoption.

Contrasting this optimism are two bearish market and technical themes. The second item highlights whale inactivity amid Dogecoin's volatile start to 2026; after weeks of bearish drifting, the memecoin surged briefly but large holders have remained dormant, with on-chain data showing minimal accumulation. This quietude raises risks of a liquidity grab or distribution, as absent whale buying leaves the price vulnerable to retail-driven fades—categorized as bearish, potentially signaling capitulation if momentum wanes. Third, technical analysis from Coinpaper points to a head and shoulders pattern pressuring Dogecoin's price, with weakening bullish momentum targeting the 0.13978 support level for a short-term correction. This reinforces on-chain and sentiment-driven downside, marking the theme as bearish and aligning with observed chart rejections.

Overall, the news sentiment is mixed but tilts bearish in the short term, with the positive partnership news clashing against the chart's fading action. This discrepancy suggests a classic sell-the-news dynamic or distribution phase, where bullish headlines fail to ignite sustained buying, possibly due to broader market skepticism toward memecoins. The Japan collaboration could provide a macro tailwind if it materializes into tangible integrations, but whale silence and pattern breakdowns indicate immediate headwinds, creating a tug-of-war that traders must monitor closely.

Scenarios:

For continuation of the nascent uptrend, Dogecoin would need to demonstrate conviction by reclaiming the recent swing high above 0.2150 with expanding volume, ideally pushing the price beyond the upper Bollinger Band and flipping the 99 EMA to horizontal or upward. This would confirm bullish mean reversion, potentially targeting the range top and prior resistance zones, supported by a MACD histogram expansion and RSI pushing toward 70 without divergence. Key to this scenario is a clean break above the 25 EMA confluence, where buyers absorb selling pressure and form higher lows, signaling accumulation resumption amid the positive news flow.

Alternatively, invalidation could unfold via a breakdown below the range bottom near 0.1950, invalidating the short-term structure and accelerating the downtrend toward deeper supports like the 0.13978 level mentioned in news. This fakeout scenario might mimic a liquidity sweep, drawing in longs before reversing on low volume, exacerbated by whale inaction; watch for a decisive close below the 7 EMA with MACD crossing bearish to confirm. If the head and shoulders neckline at 0.1950 holds initially but fails on retest, it could trap early bulls, leading to a distribution cascade. In a mixed case, prolonged consolidation within the range might occur if news catalysts balance out, but any failure to hold 0.2029 risks a probabilistic tilt toward the bearish path, especially if broader market liquidity dries up.

What to Watch Next:

Monitor volume behavior for spikes above average during tests of 0.2029, as sustained inflows could validate support and hint at reversal. Track reactions at key areas like the head and shoulders neckline, where a bounce might signal short-covering while a breach invites downside acceleration. Keep an eye on momentum shifts via RSI divergence or MACD zero-line crosses, particularly if whale wallets show renewed activity to counter the current quietude. Additionally, observe liquidity sweeps around EMA clusters, as false breaks often precede true directional moves in this volatile asset.

Risk Note:

Dogecoin's memecoin nature amplifies risks from sentiment swings and low liquidity, where external factors like regulatory whispers or Bitcoin correlation could override technicals, potentially leading to outsized drawdowns beyond anticipated stops.

In summary, Dogecoin stands at a crossroads where technical fragility meets selective optimism, demanding vigilant analysis for any edge.

(Word count: 1723)

#DOGE #CryptoAnalysis #MemecoinMarkets $DOGE