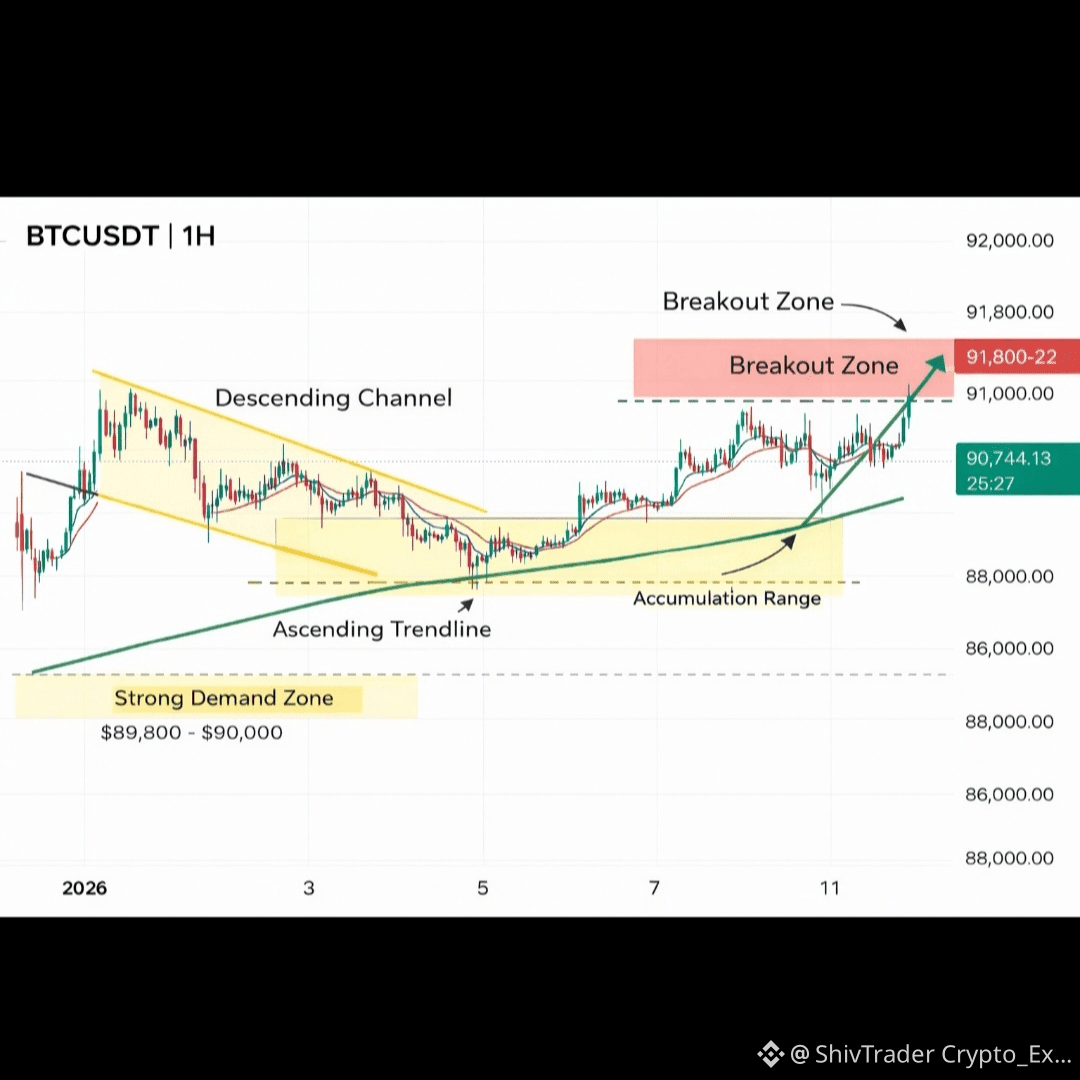

📈 Primary Trend (Structure-Based)

Overall trend: Higher Timeframe Bullish

Price made higher highs & higher lows earlier

Current move is a corrective + consolidation phase, not trend reversal

👉 This is a bullish market in pause mode, not bearish.

📊 Current Pattern on Chart (Most Accurate)

✅ Descending Channel → Range Accumulation

Why this is accurate:

Price corrected from ~94K in a controlled descending channel

Correction stopped at strong horizontal demand zone (yellow line ~90K)

After breakdown attempt, price failed to continue down

Now price is moving sideways = absorption of selling pressure

📌 This confirms Accumulation after correction

🧱 Key Zones (From Chart)

Major Support: 89,800 – 90,000

→ Multiple candle rejections = strong buyers

Range High / Resistance: 91,800 – 92,200

→ Sellers active here

This creates a box / rectangle pattern

📐 Final Pattern Name (Professional TA)

✔️ Range Accumulation after Bullish Trend

✔️ Also called: Bullish Base Formation

📍 Bias remains bullish until 89.6K breaks

📉 Indicator Confirmation

EMA 9 & 20

Price holding near EMAs

EMAs flattening → breakout preparation phase

MACD

Histogram turning green

Momentum shifting from bearish to bullish

➡️ Indicators confirm trend continuation setup

🧠 What This Pattern Usually Does

Liquidity taken below support ❌

Sellers trapped

Sideways compression

Sharp breakout upward 📈

🎯 Clean Trade Logic (Pattern-Based)

Buy (Range Low):

90,200 – 90,500

Stop Loss (Structure Break):

89,600

Targets (Measured Move):

TP1: 91,500

TP2: 92,300

TP3: 93,200+

Risk-to-Reward is favorable, pattern-valid, and trend-aligned.

🔑 Summary (One Line)

$BTC BTC is in bullish accumulation after correction — breakout probability increases as range tightens.