Nobody thought regulated securities would meet privacy protocols so soon.

When I dug into DUSK’s playbook, the ambition looked less like marketing and more like plumbing.

After tracking the team’s moves and ecosystem signals closely, one thing stood out: DUSK is building the rails for compliant tokenization, not just private transfers.

This single shift quietly rewrites how institutions might move real-world assets in Web3.

Think of it as a secure vault with a convertible door - privacy inside, selective visibility when needed.

Can tokenized, regulated securities really coexist with privacy without turning into legal spaghetti?

Value proposition

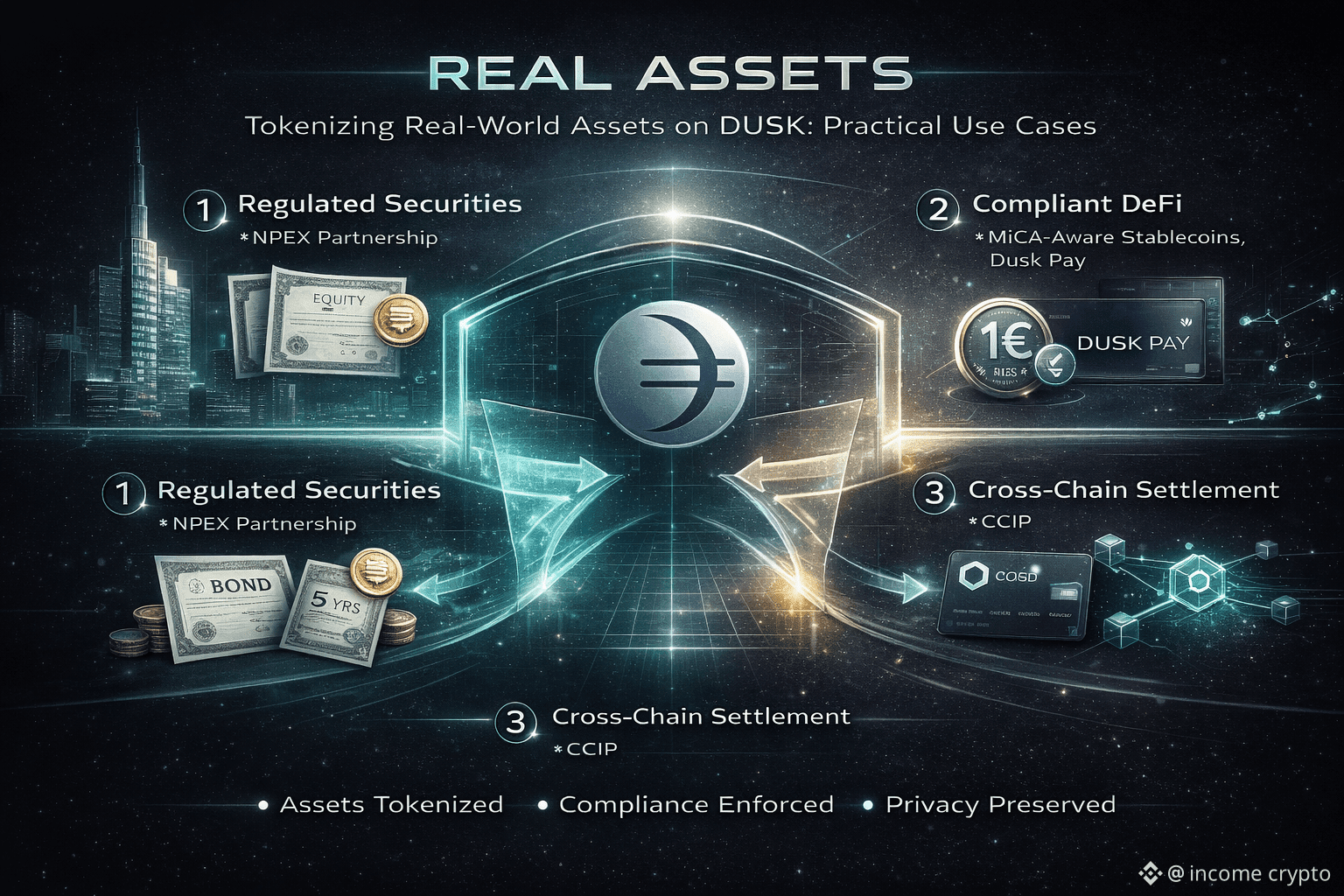

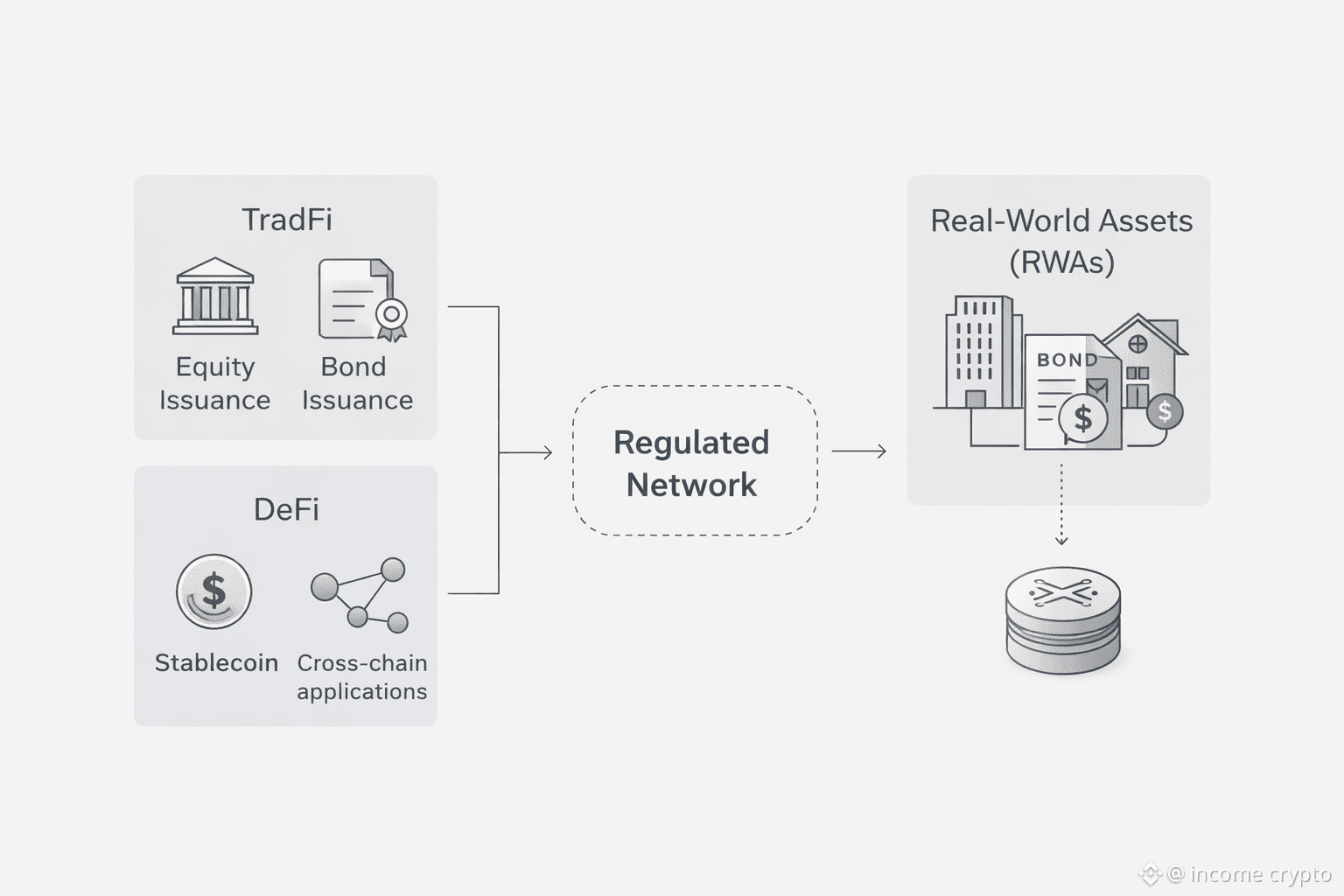

I see DUSK as a privacy-oriented chain that’s explicitly designed to host tokenized real-world assets in regulated contexts. The idea isn’t to hide everything; it’s to enable selective disclosure, so equity and bond issuances can live on-chain while meeting compliance needs. That makes the @Dusk token more than a utility for staking - it becomes a governance instrument and participation stake in an ecosystem aiming for real-world adoption.

Recent update - impact story

The NPEX partnership signals a practical pilot pathway for regulated securities issuance on DUSK. Combined with work on MiCA-aware stablecoins and payments tooling like Dusk Pay, the protocol is aligning technical primitives with legal-minded processes. The practical impact is simple: institutions get an infrastructure stack that supports private settlement and the selective audit trails they need to onboard regulated assets. This is not a finished product - it’s a growing ecosystem and the recent DUSK update narrowed the technical gap between proof-of-concept and pilot issuance.

Why it matters - trader & investor POV

From an investor viewpoint, tokenizing equity and bonds on a privacy chain shifts where value accrues. The $DUSK token participates in governance decisions that can determine listing standards, treasury allocation, and builder rewards for compliant applications. For traders, the reduced transparency in mempools and the selective-disclosure model mean different liquidity dynamics - order execution may look and behave differently compared to public chains. For holders, staking ties directly to governance influence, so participation matters beyond yield.

Extra angles - what to watch

Adoption signals to monitor include the volume of regulated asset pilots, on-chain activity tied to issuance events, and the diversity of validators supporting confidential settlement. Builder rewards will be a critical lever - if the treasury funds practical tooling for issuers and custodians, we’ll see more integrations. Cross-chain settlement via CCIP or similar rails matters too; seamless settlement reduces counterparty friction and makes tokenized assets usable across ecosystems.

Risk notes - stay critical

Balancing privacy and regulatory compatibility is delicate. DUSK’s approach aims for compatibility, not regulatory endorsement. Execution risk remains high: legal frameworks differ by jurisdiction, and institutional adoption hinges as much on custody, compliance workflows, and operational audits as on protocol tech. That’s a governance and treasury problem as much as a technical one.

DUSK’s real test isn’t privacy - it’s whether the team can operationalize compliant tokenization at scale.

Don’t wait until a headline to check who’s actually building the rails - watch governance votes, pilot issuances, and builder reward flows. For more updates and insights on this project, stay connected with IncomeCrypto.