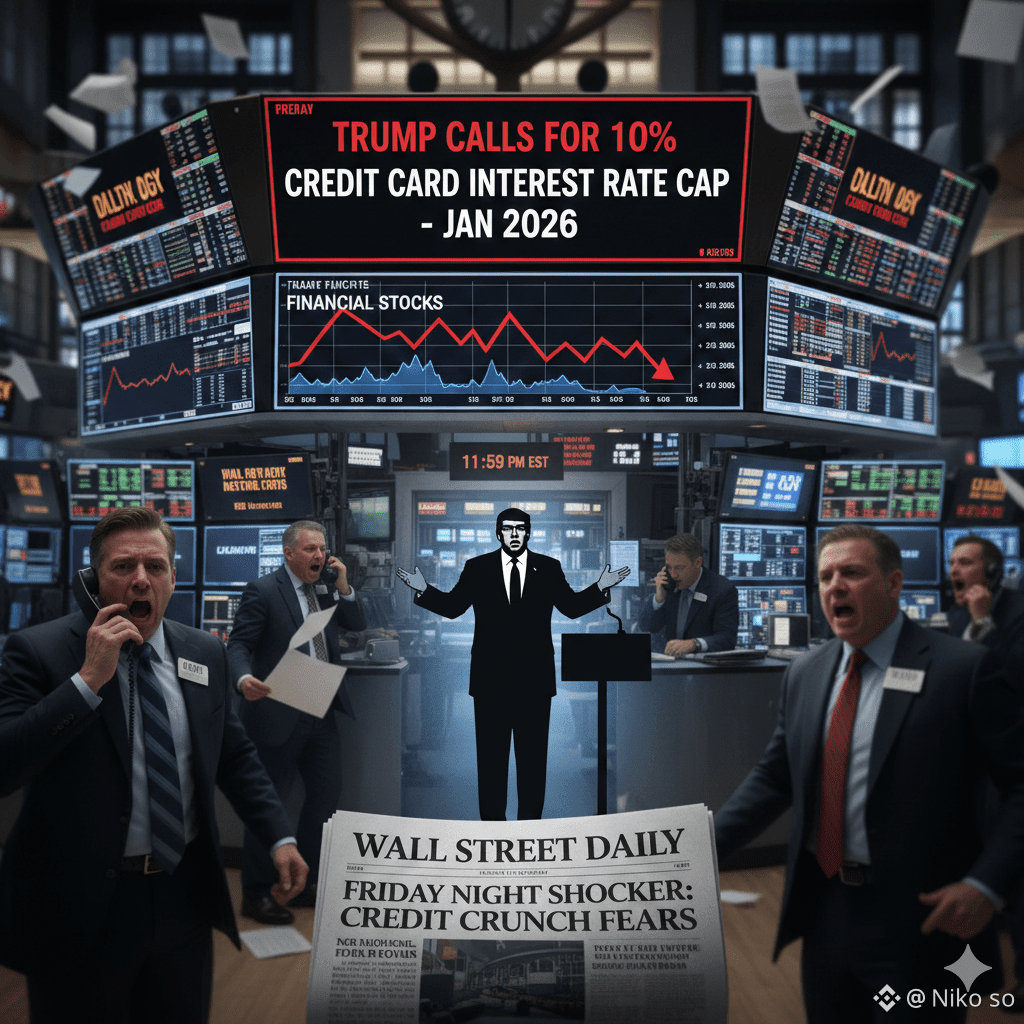

In another unexpected Friday-night announcement, former U.S. President Donald Trump has called for a one-year cap on credit card interest rates at 10%, proposed to take effect from January 20, 2026. The statement immediately grabbed attention across financial markets, banks, and political circles, reviving concerns about sudden policy shifts and market volatility.

A Direct Hit on the Credit Industry

Credit card lenders in the United States typically charge 20% to 30% or more in interest, especially for unsecured consumer debt. A 10% cap would significantly compress profit margins for banks and financial institutions, potentially forcing them to rethink lending models, tighten credit access, or introduce new fees to offset losses.

Financial leaders and banking analysts reacted cautiously, noting that such a move—if enforced—could reshape the consumer lending ecosystem. Shares of financial stocks may see volatility as markets attempt to price in regulatory risk.

Big Announcement, Few Details

So far, no clear enforcement mechanism or legislative roadmap has been outlined. Without congressional approval or regulatory backing, the proposal remains a political statement rather than an actionable policy. However, even rhetoric of this scale can move markets, especially when it targets a core revenue stream of the financial sector.

Political and Economic Implications

Supporters argue that a cap could provide relief to consumers struggling with high-interest debt amid inflation and rising living costs. Critics warn that it may reduce credit availability, particularly for higher-risk borrowers, and could lead to unintended consequences in the broader economy.

The timing of the announcement—late on a Friday—mirrors past moments when surprise statements have triggered market uncertainty, reinforcing expectations of increased volatility as investors assess potential outcomes.

Market Watch Ahead

As the new trading week begins, investors will closely monitor:

Reactions from major banks and regulators

Responses from lawmakers and economic advisors

Volatility in financial stocks and related assets

Until more clarity emerges, the proposal remains a powerful headline with the potential to influence sentiment more than fundamentals—for now.$BTC $ETH $SOL #Binance #BTC走势分析 #USJobsData