As blockchain technology moves beyond experimentation and into real financial use cases, one uncomfortable truth keeps surfacing: full transparency is not how finance actually works. Banks don’t broadcast trades in real time. Funds don’t expose client balances. Institutions operate on confidentiality, selective disclosure, and clear legal accountability. Most blockchains were never built for that reality

This is exactly the gap Dusk Network is trying to fill

Dusk is a Layer-1 blockchain designed from day one for regulated financial markets, not retail DeFi speculation. Its focus is clear enable tokenization of real world assets like equities, bonds, and funds, while respecting privacy laws and compliance requirements. Instead of asking institutions to “adapt” to crypto culture, Dusk adapts blockchain infrastructure to institutional standards

At a technical level, Dusk takes a different path than most public networks. Rather than stacking privacy tools on top of an open ledger, it integrates privacy directly into the protocol. The network uses zero knowledge cryptography to prove that transactions and smart contracts are valid without exposing sensitive details. This allows financial activity to remain confidential while still being verifiable

This becomes especially important with smart contracts. On many blockchains, contract logic and transaction data are fully visible, which is unacceptable for regulated finance. Dusk introduces private smart contracts through its Hedger system, allowing contracts to execute privately while remaining auditable when required. In simple terms: data stays hidden during normal operation, but can be revealed to regulators if necessary

Another area where Dusk quietly stands apart is settlement. In traditional finance, settlement finality is non negotiable. Trades must be final, not “probably final after a few confirmations.” Dusk’s consensus design emphasizes strong, deterministic finality, aligning more closely with how financial infrastructure actually functions. This may not sound exciting, but for institutions, it’s critical

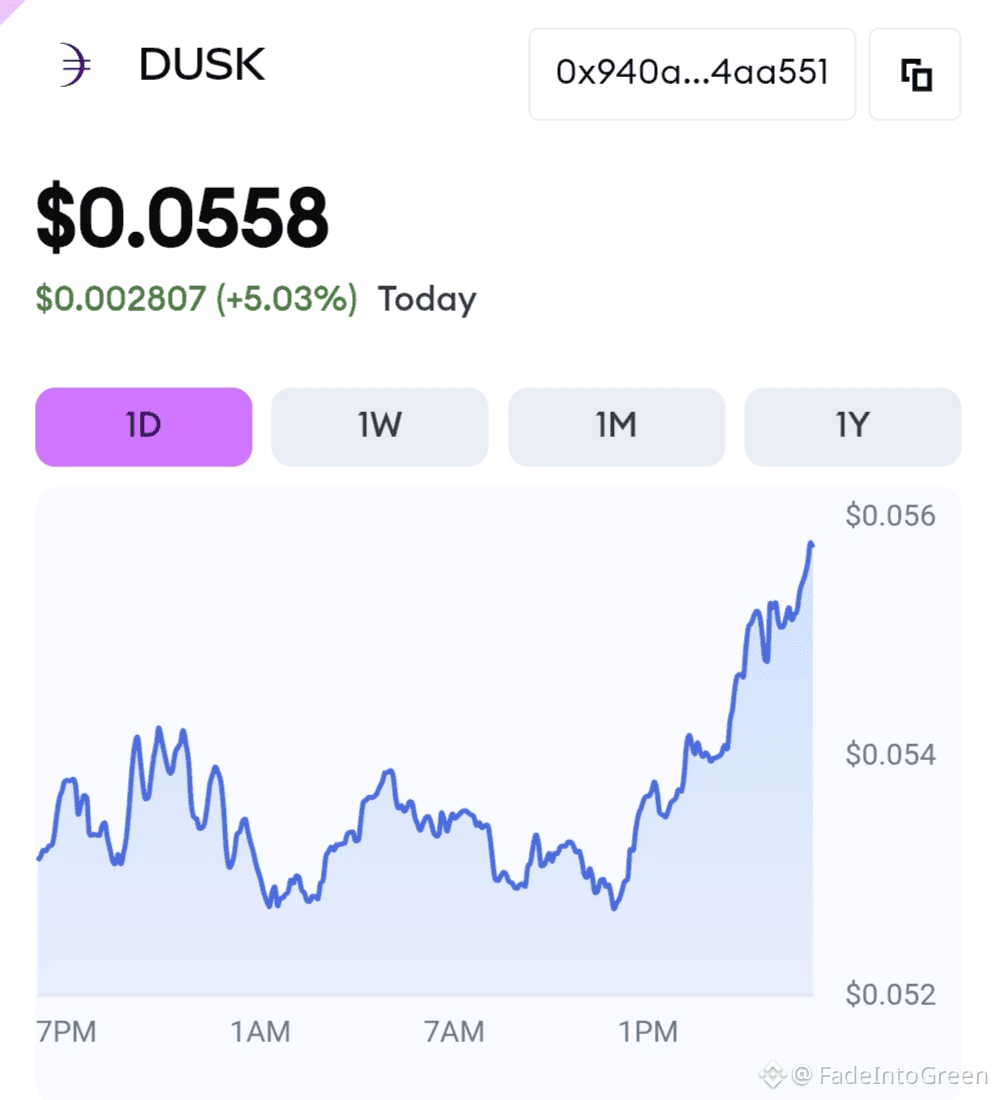

The DUSK token exists to support this system, not to distract from it. It’s used for transaction fees, smart contract execution, and staking, which secures the network. Validators stake DUSK to participate, and rewards flow from real network usage. As more regulated applications run on Dusk, the token’s utility grows naturally

What makes Dusk particularly interesting is its attitude toward regulation. Many crypto projects treat regulation as an obstacle. Dusk treats it as a design constraint. This mindset aligns with where global finance is heading. Regulators are not trying to kill digital assets they’re trying to integrate them safely. Blockchains that ignore this reality will struggle to scale beyond niche use cases

Dusk’s recent focus on interoperability, trusted data feeds and user facing applications shows an effort to move from theory to practice. Products like Dusk Trade hint at how compliant, privacy preserving blockchain finance could look in the real world, rather than in demos and testnets $DUSK

That said, the road ahead isn’t easy. Institutional adoption is slow, compliance varies across regions and privacy technology is complex to implement at scale. Competition in the RWA space is also growing. Dusk’s success will depend on real assets, real issuers, and real activity not announcements @Dusk

Still, Dusk represents a rare thing in crypto: a realistic vision. Not maximalist. Not rebellious. Just practical. If the future of blockchain finance is institutional, private, and regulated, Dusk is building for that future quietly and deliberately